Aug, 15, 2025

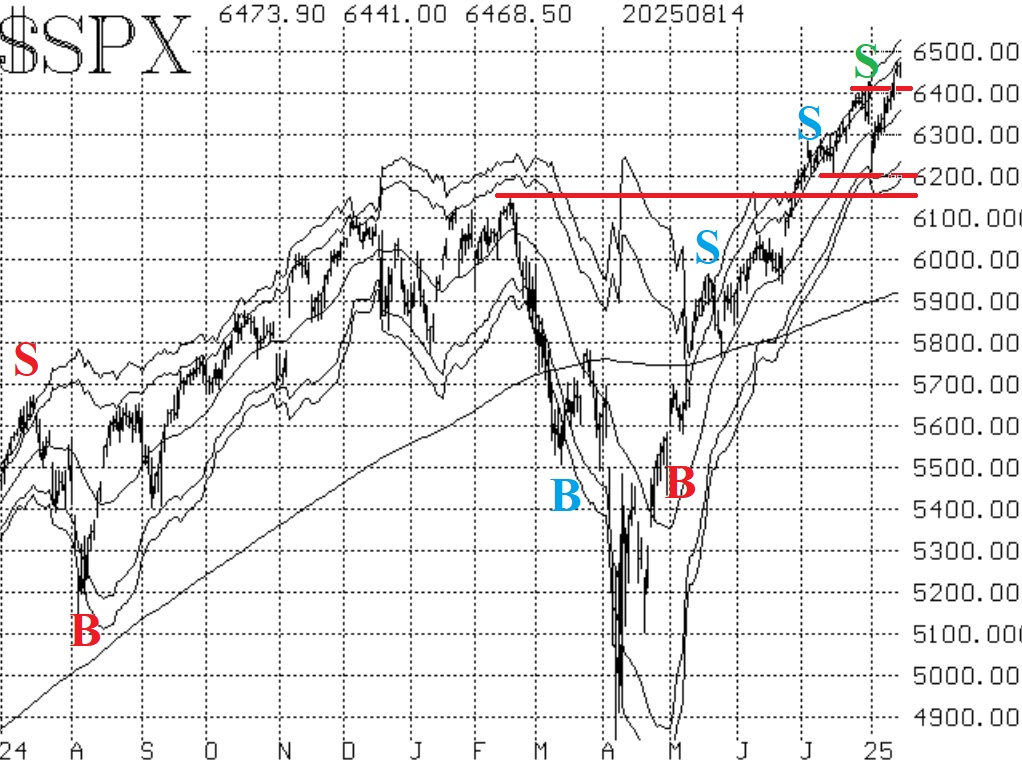

By Lawrence G. McMillanStocks pushed to new all-time closing and intraday highs this past week on two separate days -- August 12th and 13th. Any chart making new all-time highs is, by definition,...

Aug, 11, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on August 11, 2025.

Aug, 11, 2025

By Lawrence G. McMillanTwo of the hardest-hit stocks in the S&P 500 this year — UnitedHealth Group ($UNH) and UPS ($UPS) — both issued daily MVB buy signals today. While this is a notable...

Aug, 08, 2025

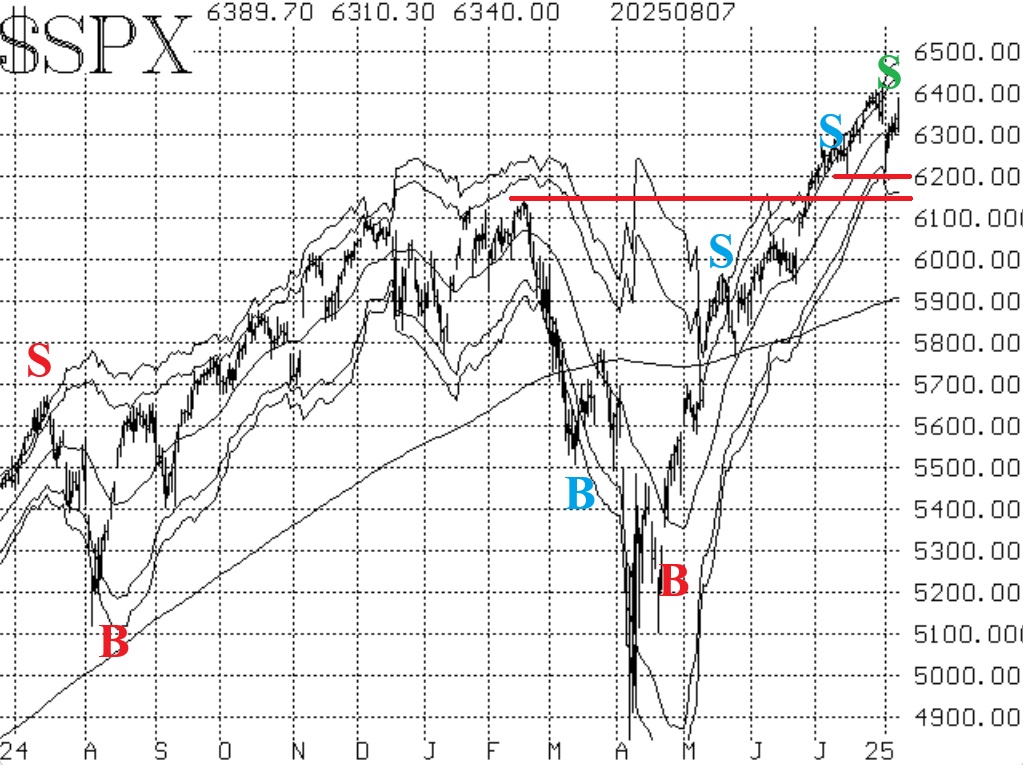

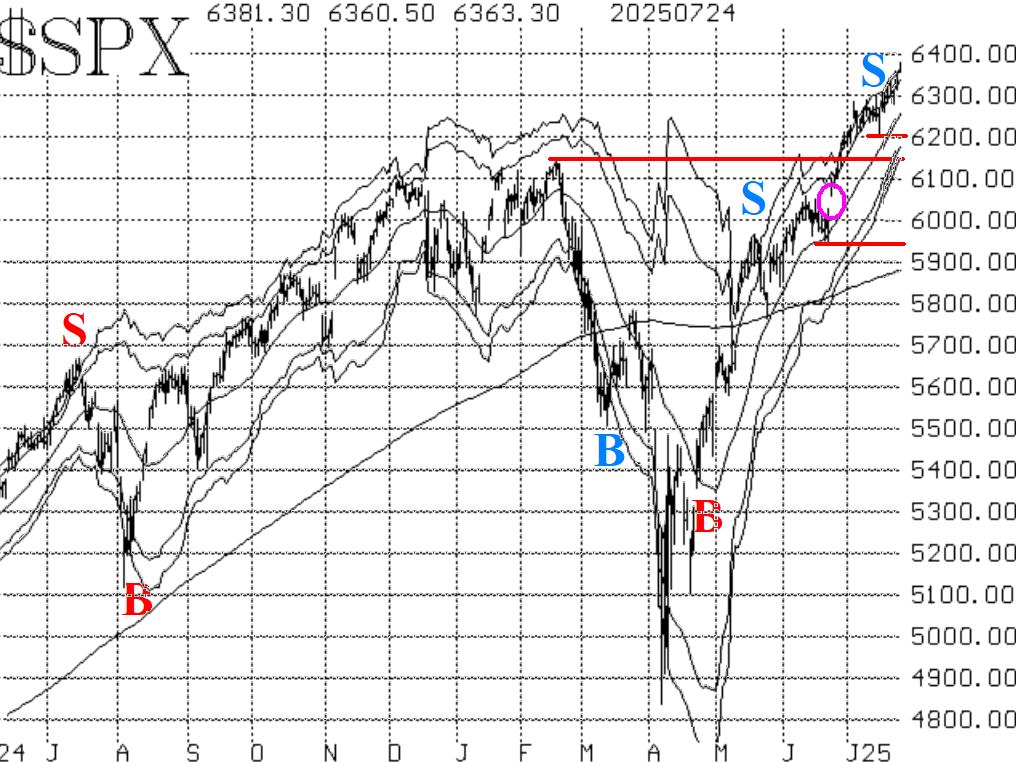

By Lawrence G. McMillanThe chart of $SPX remains bullish. The Index pulled back to almost exactly 6200 last Friday, August 1st, and has bounced from there. It also bounced off that level back in...

Aug, 06, 2025

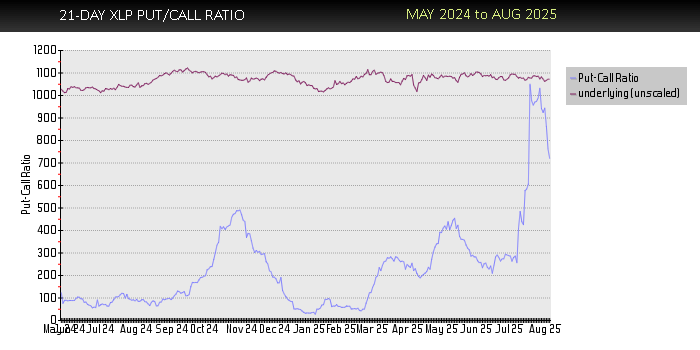

By Lawrence G. McMillan$XLP (Consumer Staples Select Sector SPDR Fund) just triggered a put-call ratio buy signal, as its weighted 21-day put-call ratio peaked at extreme levels and has now begun to...

Aug, 04, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on August 4, 2025.

Aug, 01, 2025

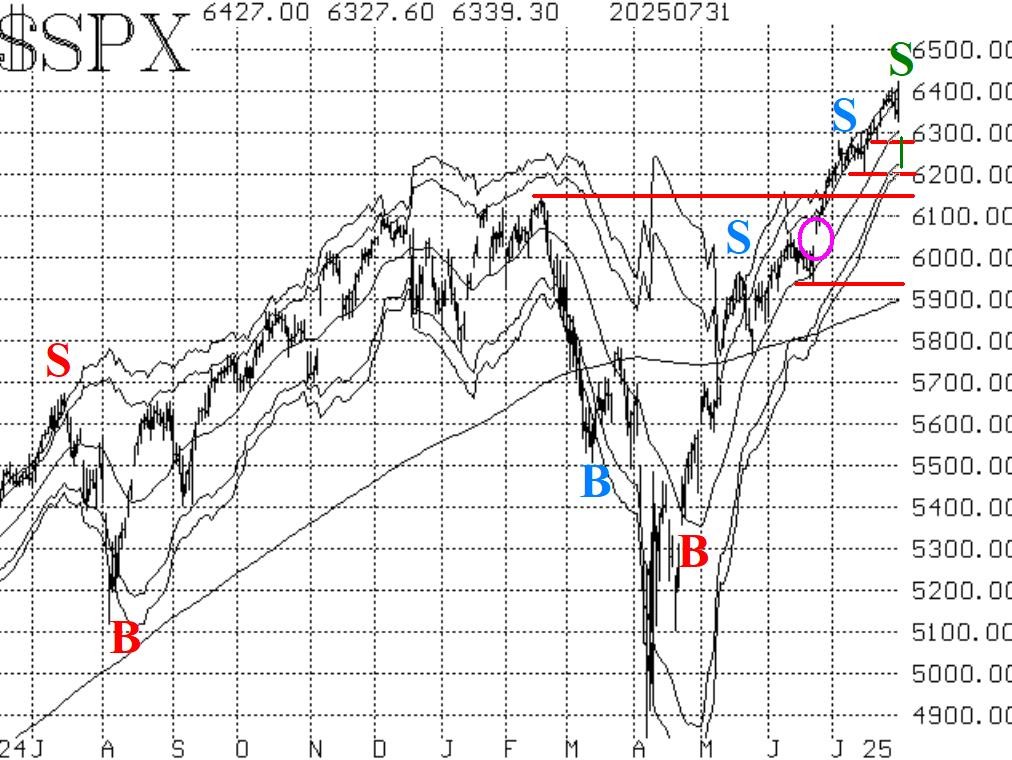

By Lawrence G. McMillanThe buildup of overbought conditions has manifested itself in new confirmed sell signals. However, the $SPX chart is still positive, and will remain so, certainly as long as it...

Jul, 28, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on July 28, 2025.

Jul, 25, 2025

By Lawrence G. McMillanAs we stated many times in this week's Stock Market Commentary, there are overbought conditions but no confirmed sell signals (yet). However, we know volatility is low,...

Jul, 25, 2025

By Lawrence G. McMillanThe rally that began in early April continues to drive higher into new all-time territory. There hasn't been much of a correction, and so far the internals have held up very...

Pages

© 2023 The Option Strategist | McMillan Analysis Corporation