By Lawrence G. McMillan

The wheels came off the wagon after the Fed meeting on Wednesday. It appears that the Fed's decision to drop rates by 25 basis points, plus their announcement that they might not cut much next year, triggered the selling. But it was probably more of a "sell the news" kind of thing. In the old adage, it's the Fed taking away the punchbowl.

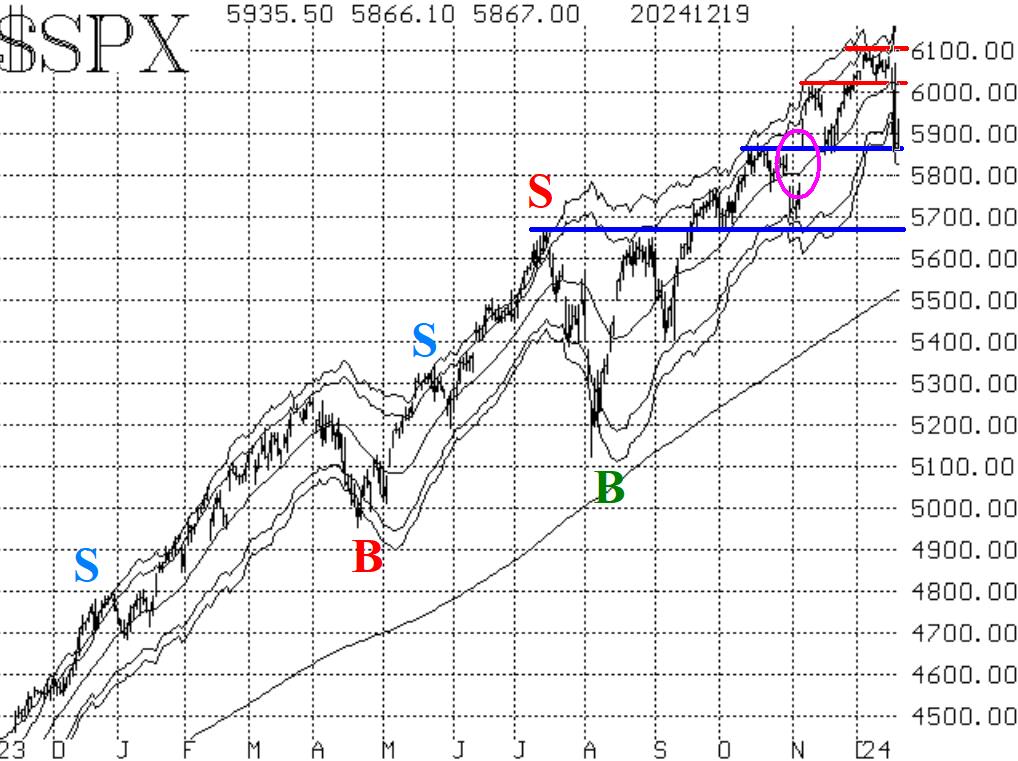

Ironically, though, the $SPX support at 5870 seems to be holding. Yes, $SPX probed below there and even closed three points below that level one day, but we have been stating that unless there were a two-consecutive-day close below 5870, the bullish case could still be made. And thus it can. We will still be holding a "core" position if $SPX closes above 5870 today.

Equity-only put-call ratios have finally begun to rise. The weighted is more obvious (Figure 3) than the standard (Figure 2), but both jumped higher on this recent bout of selling. Both are now on sell signals, to the naked eye as well as the computer analysis programs. However, we have seen previous times this year where sell signals appeared obvious (late October, for example), but then the ratios rolled back over. So, they need to keep rising in order to remain on sell signals for stocks.

Breadth has been horrific. The breadth oscillators have been on sell signals since early December, and now they are in deeply oversold territory. They will eventually generate buy signals, but the stock market can decline quite sharply even while these oscillators are in oversold territory.

$VIX jumped up after the Fed meeting, and closed above its 200-day Moving Average for two consecutive days. That stopped out the recent trend of $VIX buy signal. However, $VIX went into "spiking" mode when it made that leap upwards, and now there is a new "spike peak" buy signal. It's interesting to note that the $SPX chart -- while having taken a hit -- is not bearish yet. It's the most important indicator always.

In summary, we are still clinging to a "core" bullish outlook, as long as $SPX doesn't close below 5870 for two consecutive days. We are trading other confirmed signals as well, though, and -- quite importantly -- we are rolling options that become deeply in-the- money.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation