Oct, 06, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on October 6, 2025.

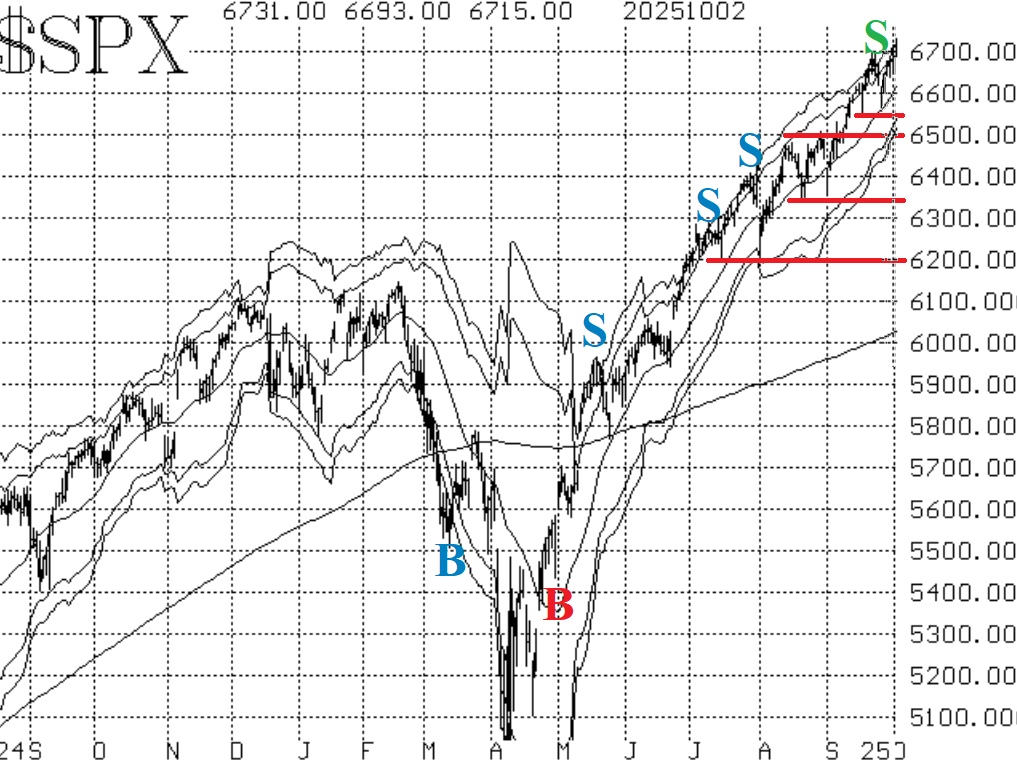

Oct, 03, 2025

By Lawrence G. McMillanThe stock market didn't seem to care much about the government shutdown at all. This is a government spending shutdown and is not nearly as negative for stocks as would be a...

Sep, 29, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on September 29, 2025.

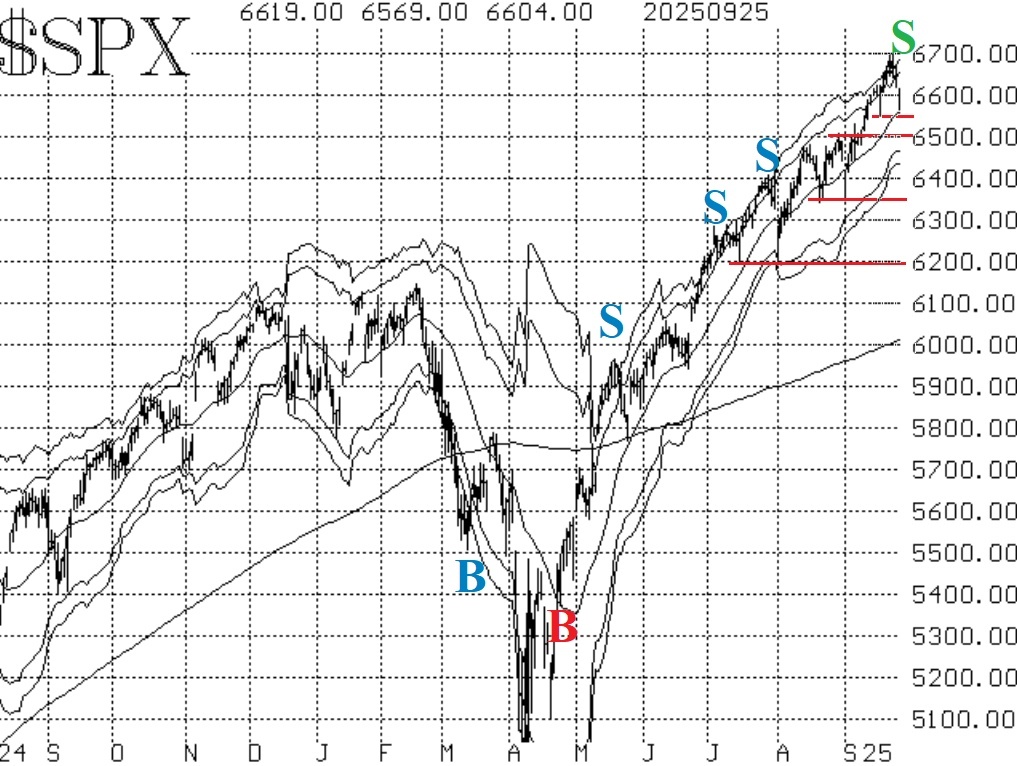

Sep, 26, 2025

By Lawrence G. McMillanStocks made new all-time highs again this past week, but early in the week. Even then, breadth wasn't good. Now $SPX has pulled back slightly from those intraday all-time highs...

Sep, 23, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on September 23, 2025.

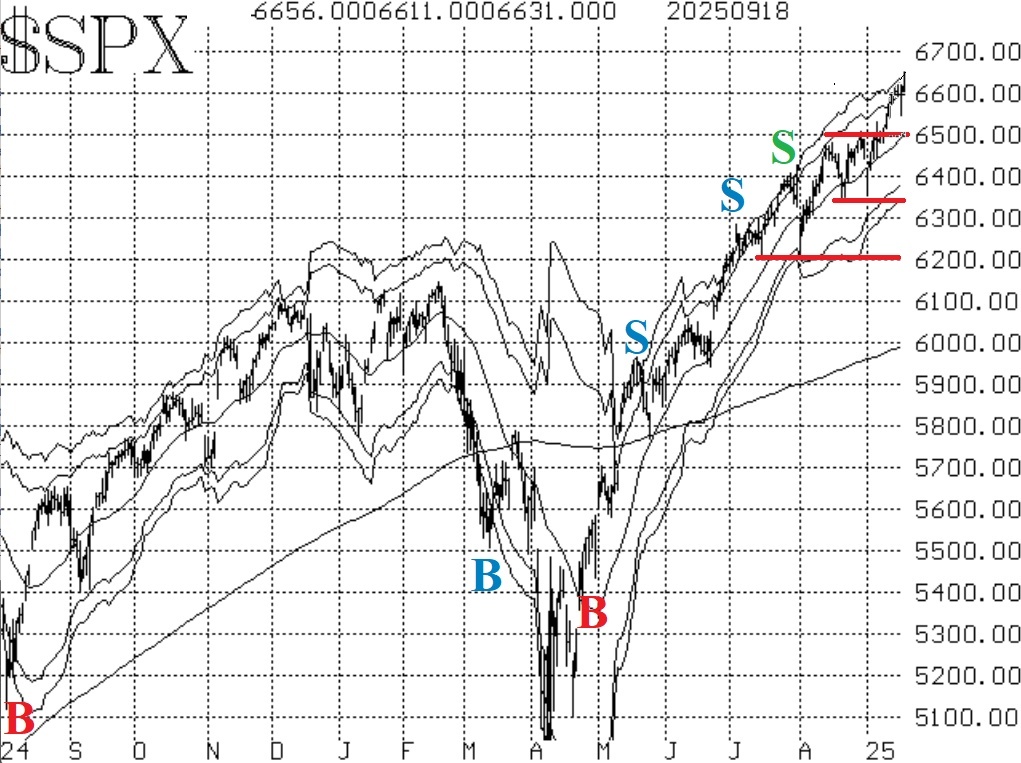

Sep, 19, 2025

By Lawrence G. McMillanThe Fed lowered rates by a quarter of a percent on Wednesday, and the market liked it. Many people had been expecting a "sell on the news" after that, but instead $SPX has...

Sep, 15, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on September 15, 2025.

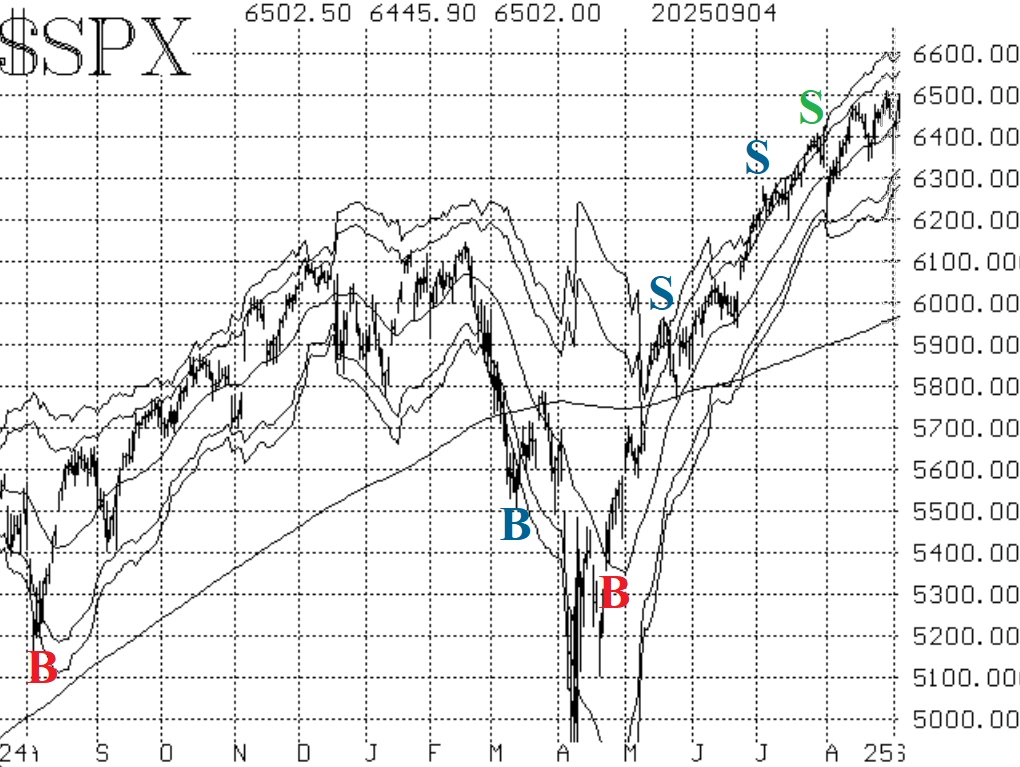

Sep, 12, 2025

By Lawrence G. McMillanThe market continues to plow through worries galore and continues to register new all-time highs. This is true for $SPX, $NDX (the NASDAQ-100; QQQ), and the Dow ($DJX; DIA),...

Sep, 11, 2025

By Lawrence G. McMillanIntuit ($INTU) has been flashing some notable signals recently. A weighted put-call ratio buy signal was issued, although the ratio chart itself has not yet visibly turned over...

Sep, 08, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on September 8, 2025.

Pages

© 2023 The Option Strategist | McMillan Analysis Corporation