Jul, 03, 2025

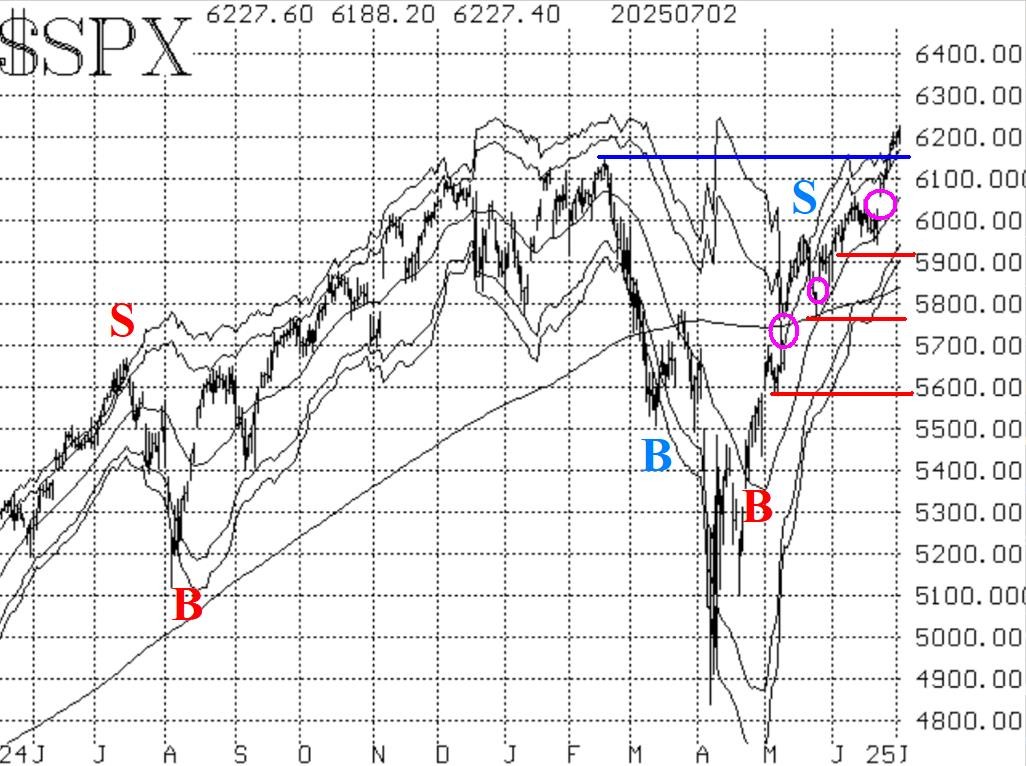

The stock market, has continued to rise, registering new all-time highs repeatedly. It appears that the current breakout to new all-time highs is stronger than the failed one of last February. There...

Jul, 01, 2025

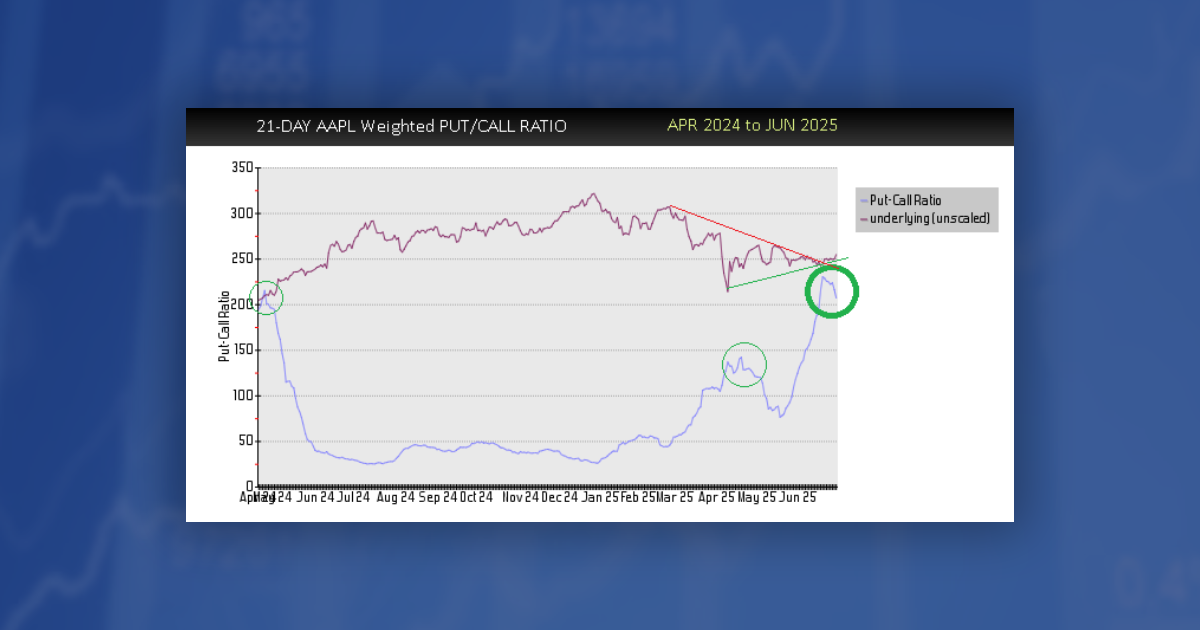

By Lawrence G. McMillanApple ($AAPL) has just triggered a buy signal based on our weighted put-call ratio, one of our more reliable sentiment-based indicators for this stock. Historically, these...

Jun, 30, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on June 3, 2025.

Jun, 30, 2025

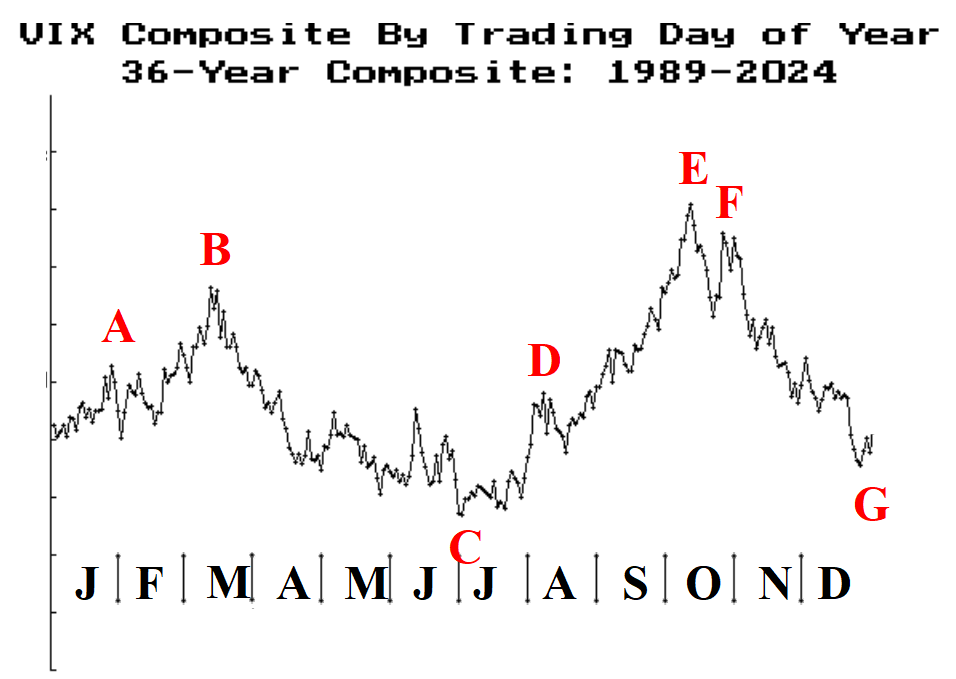

By Lawrence G. McMillanPeriodically we publish the chart below, which shows the $VIX composite from 1989 through some more current date – 12/31/24 in this case. We usually update this chart annually...

Jun, 27, 2025

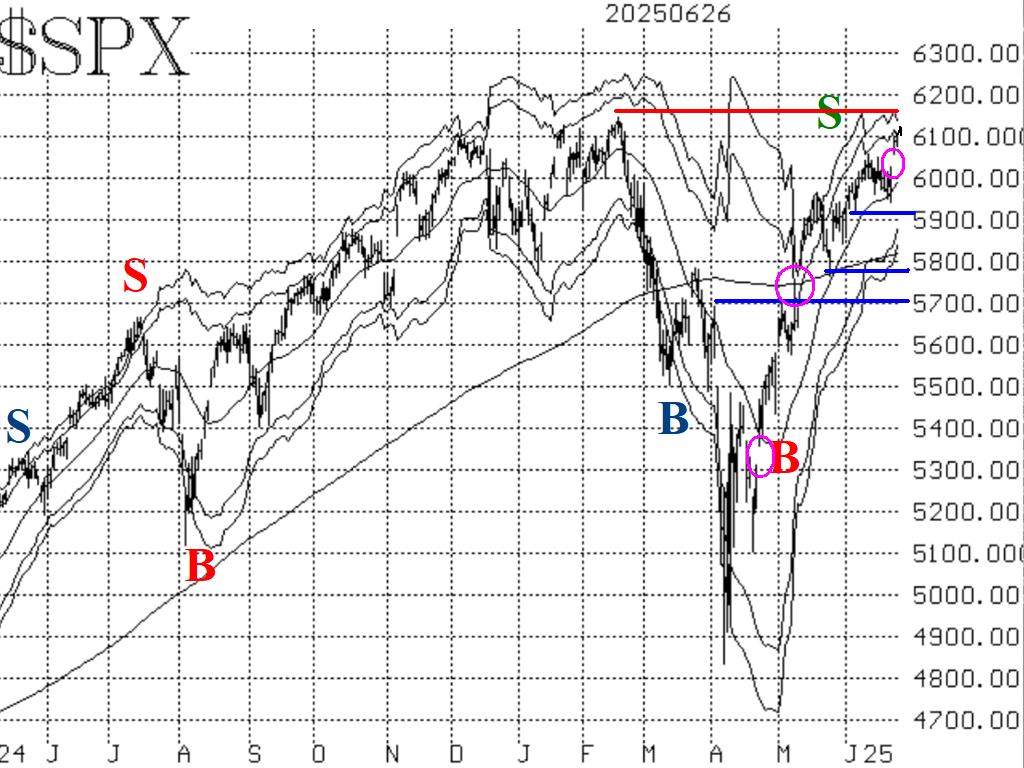

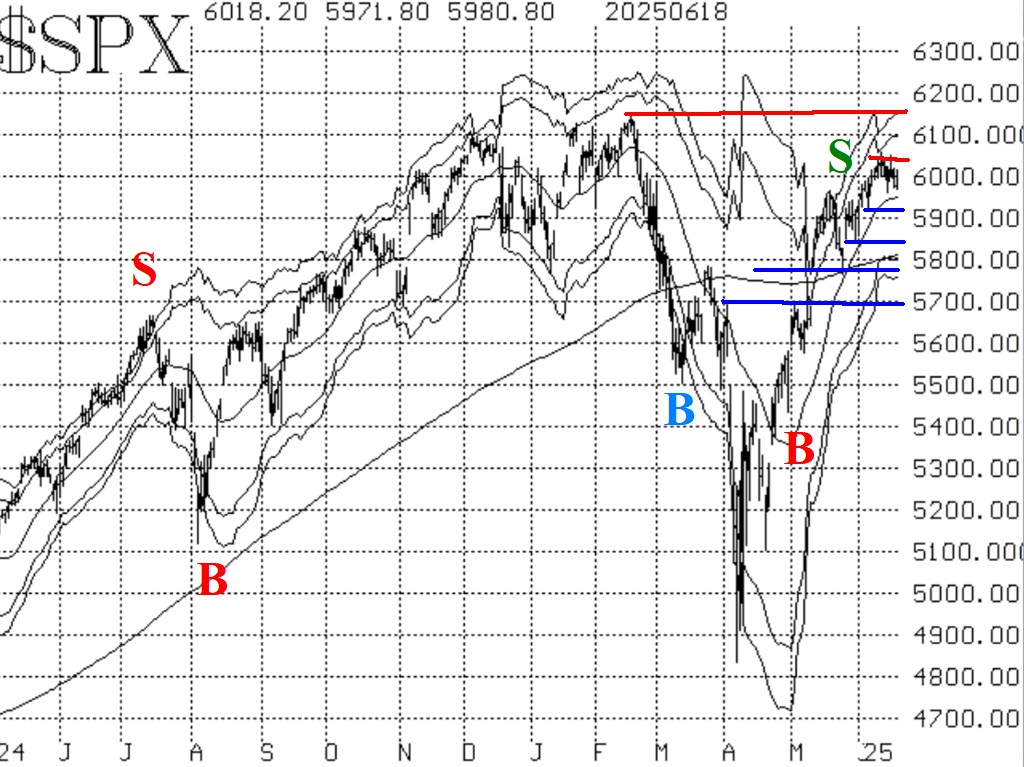

By Lawrence G. McMillanStocks are making new all-time highs this morning, as this is being written. This includes $SPX and $NDX, but not $RUT (Russell 2000) and $DJX (The Dow). The $SPX chart remains...

Jun, 24, 2025

By Lawrence G. McMillan$LYFT has been a classic underperformer since its IPO, trending steadily lower for years. But recently, it gave bulls a reason to pay attention: a weekly MVB Buy signal.While...

Jun, 23, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on June 23, 2025.

Jun, 20, 2025

By Lawrence G. McMillan$RDDT issued its first weekly McMillan Volatility Band (MVB) Buy signal (chart above) this week since being listed—an encouraging development for bullish traders watching the...

Jun, 20, 2025

By Lawrence G. McMillanStocks sold off on the Israel-Iran conflict, but only modestly as it appeared that traders were most worried about the U.S. directly entering the conflict which hasn't happened...

Jun, 16, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on June 16, 2025.

Pages

© 2023 The Option Strategist | McMillan Analysis Corporation