Jun, 02, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on June 2, 2025.

May, 30, 2025

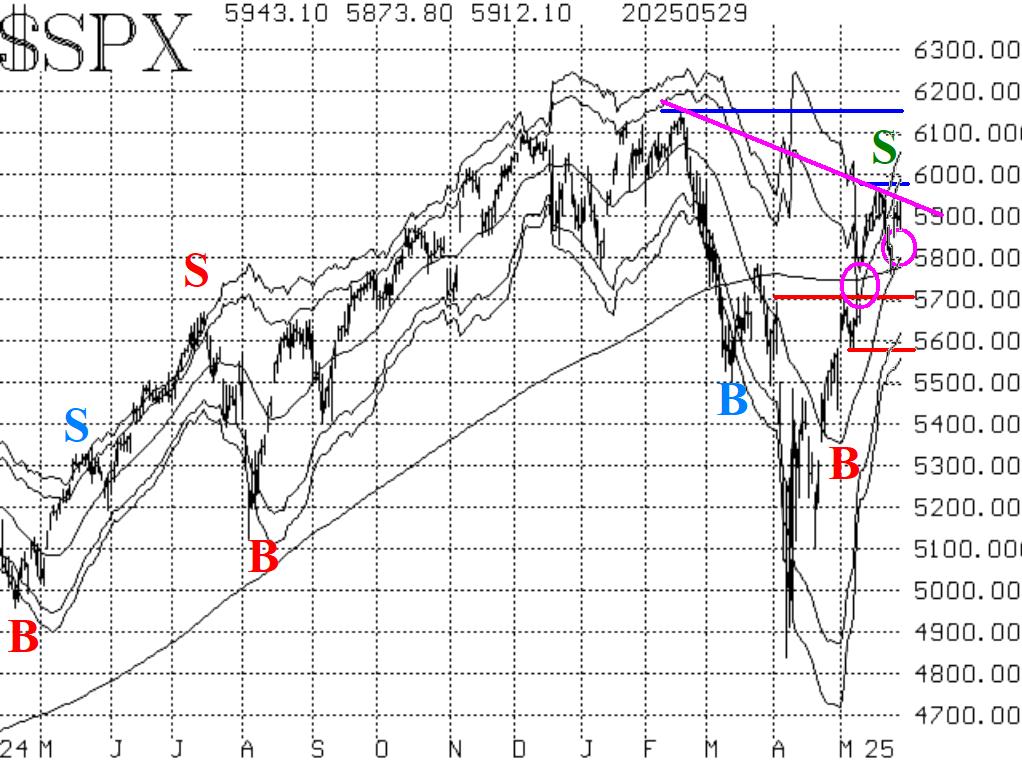

By Lawrence G. McMillanLast weekend, tariffs against Europe were postponed, and the stock market took that as a very favorable sign. When traders returned after the Memorial Day weekend, $SPX gapped...

May, 29, 2025

By Lawrence G. McMillanAt McMillan Analysis, our approach to selling naked puts is grounded in data, probability, and risk management—not gut feelings or "favorite" stocks. Each trading day, we apply...

May, 28, 2025

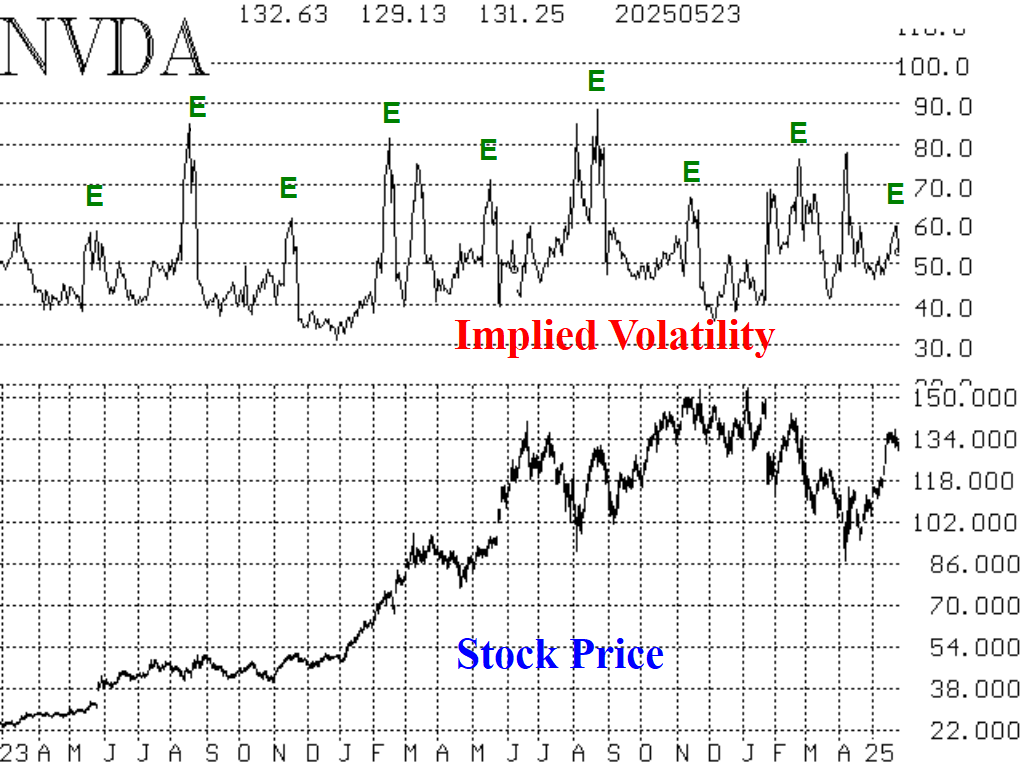

By Lawrence G. McMillanSome companies typically make a large gap move after earnings are reported. Large post-earnings moves are caused by the fact that – for some companies – it is difficult for...

May, 27, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on May 27, 2025.

May, 23, 2025

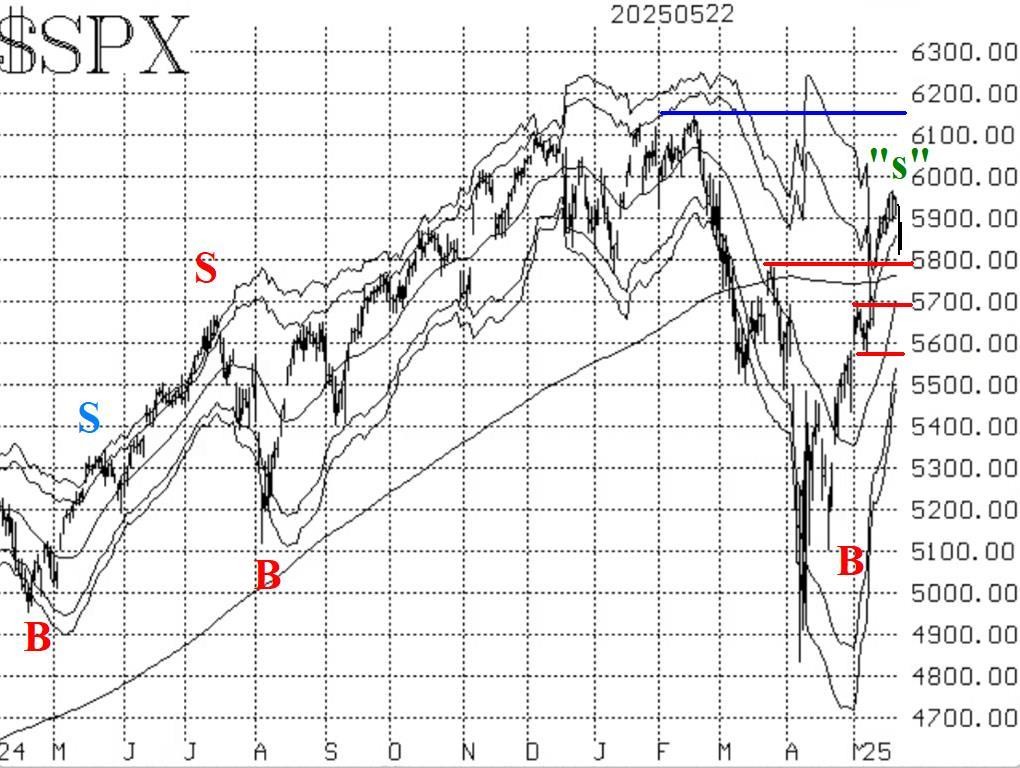

By Lawrence G. McMillanThe broad market continued to rally through May 20th -- even shrugging off a downgrade of US debt over the weekend. But on Wednesday (May 21st), a poorly received US Bond...

May, 19, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on May 19, 2025.

May, 16, 2025

By Lawrence G. McMillanWe have run a couple of articles about the various covered writing ETFs, most of them listed at Yieldmax.com. We reviewed CONY, MSTY, NVDY, and TSLY, which are covered...

May, 16, 2025

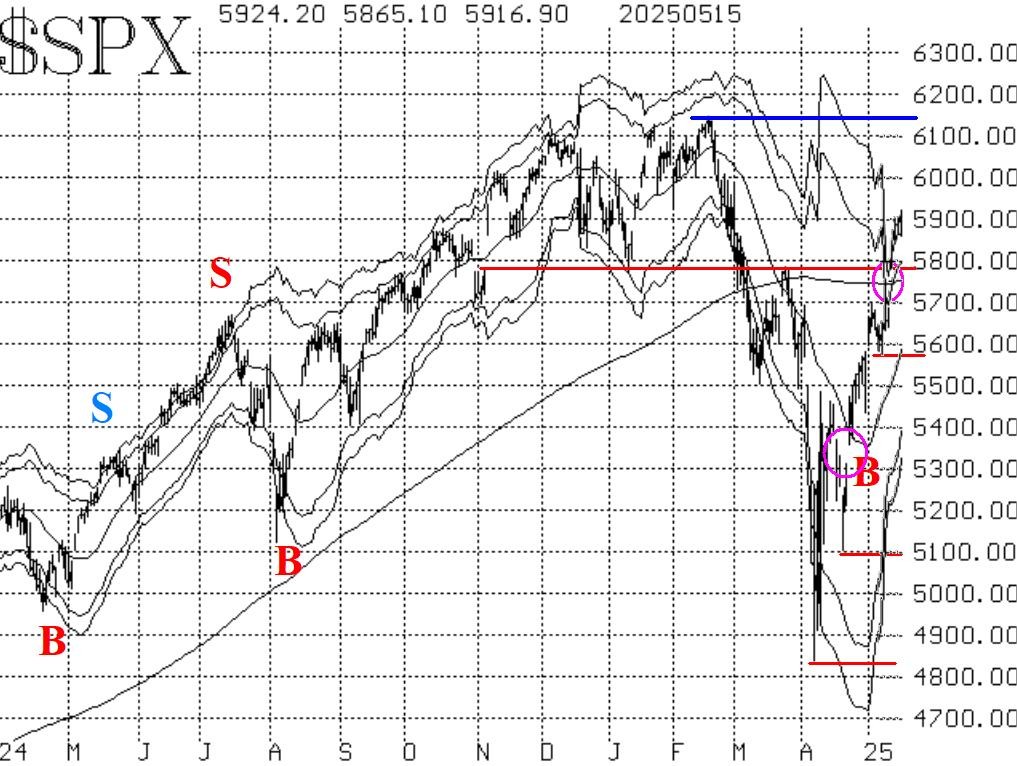

By Lawrence G. McMillanStocks have continued to rally, after last weekend's positive tariff meeting between the U.S. and China. $SPX gapped higher on Monday, blasting right through former resistance...

May, 13, 2025

By Lawrence G. McMillanThe market has shown impressive strength recently, with $SPX closing above the key 5800 level. That move alone adds to the bullish tone, but the real question now is: Could...

Pages

© 2023 The Option Strategist | McMillan Analysis Corporation