Jul, 17, 2025

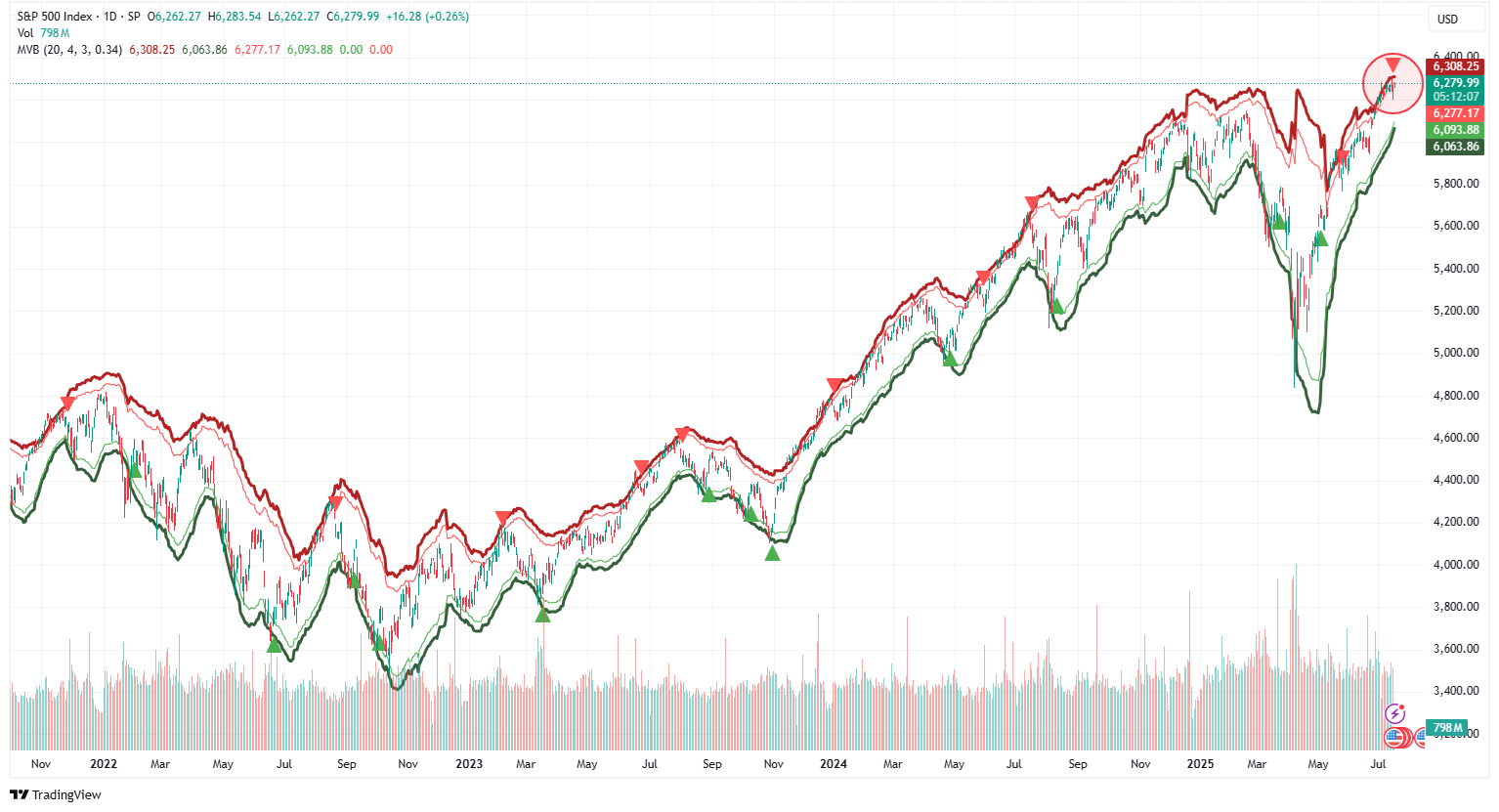

By Lawrence G. McMillanThe S&P 500 ($SPX) remains in a solid uptrend, but yesterday marked a notable shift: a confirmed McMillan Volatility Band (MVB) sell signal was triggered. This is the first...

Jul, 14, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on July 14, 2025.

Jul, 11, 2025

By Lawrence G. McMillanWe rarely buy out-of-the-money calls, because when you do, there is a chance that you could be right about the direction of the underlying stock (up), but still lose money....

Jul, 11, 2025

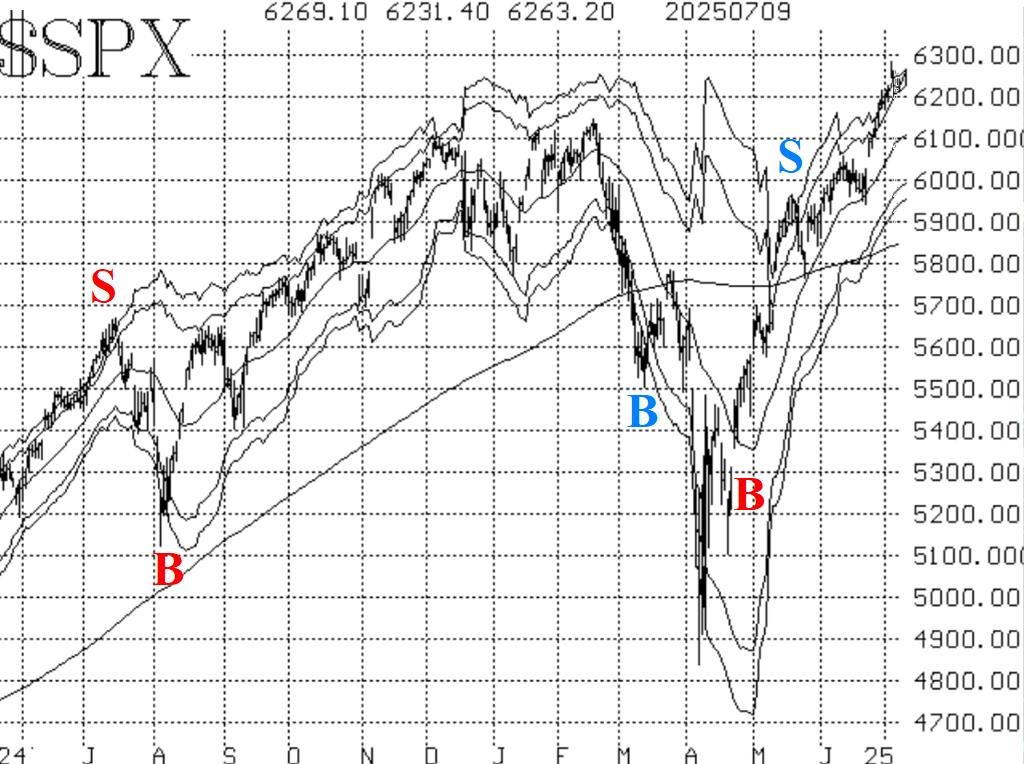

By Lawrence G. McMillanThe stock market has continued to make new all-time highs, accompanied by strong internal indicators. Eventually, overbought conditions may become confirmed sell signals, but...

Jul, 07, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on July 7, 2025.

Jul, 03, 2025

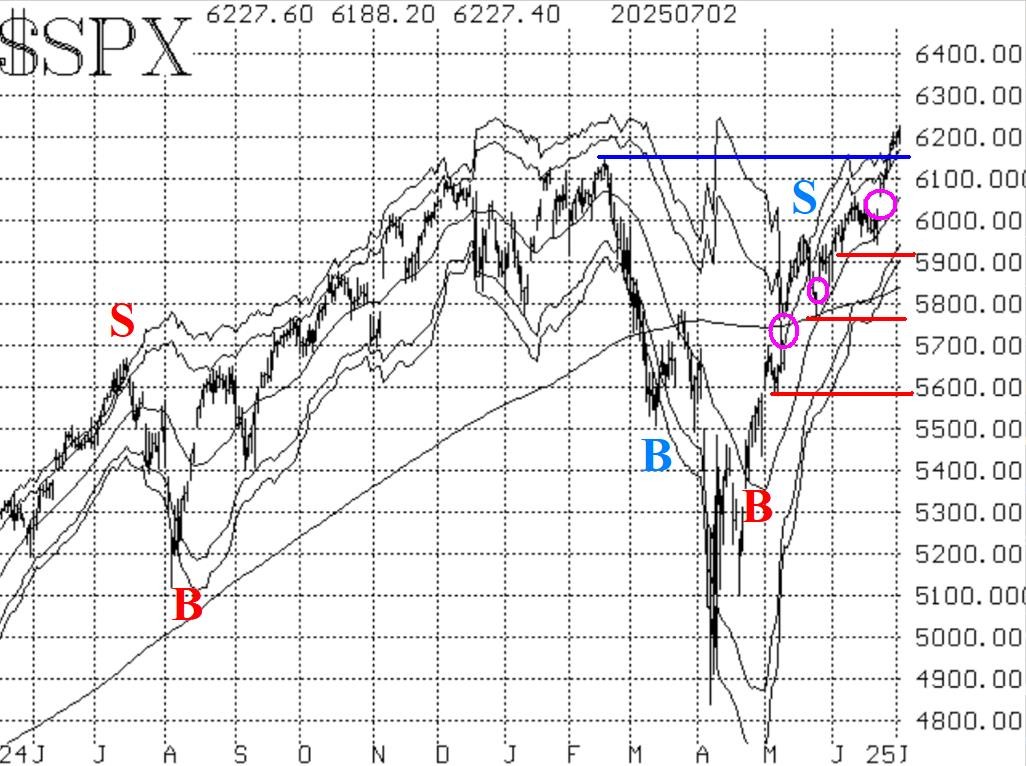

The stock market, has continued to rise, registering new all-time highs repeatedly. It appears that the current breakout to new all-time highs is stronger than the failed one of last February. There...

Jul, 01, 2025

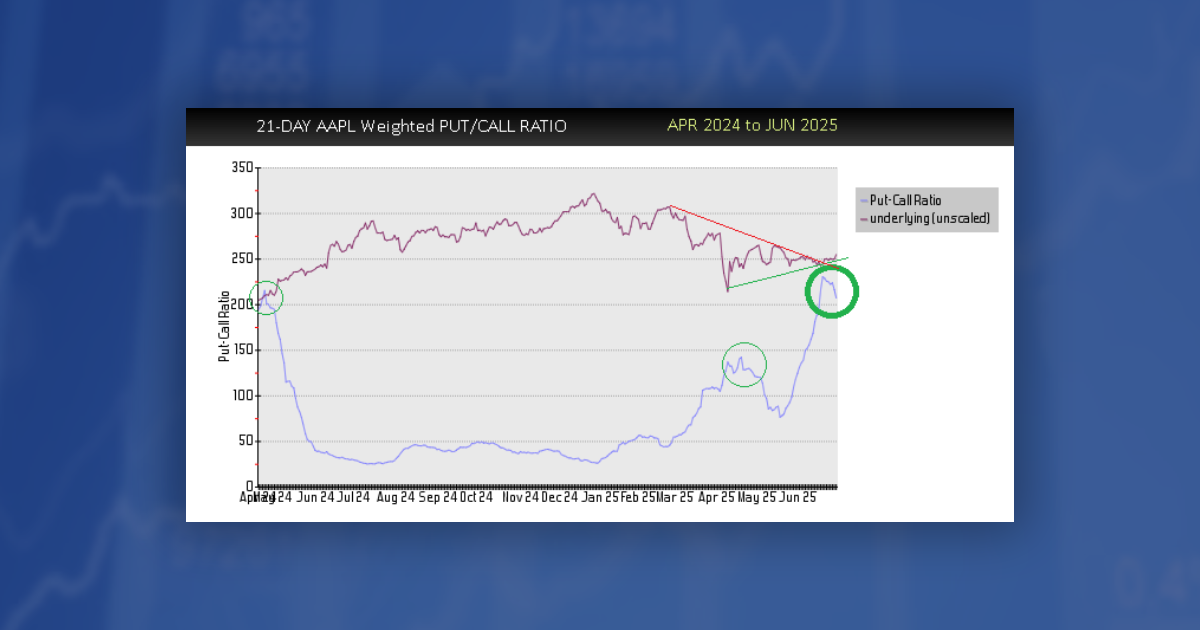

By Lawrence G. McMillanApple ($AAPL) has just triggered a buy signal based on our weighted put-call ratio, one of our more reliable sentiment-based indicators for this stock. Historically, these...

Jun, 30, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on June 3, 2025.

Jun, 30, 2025

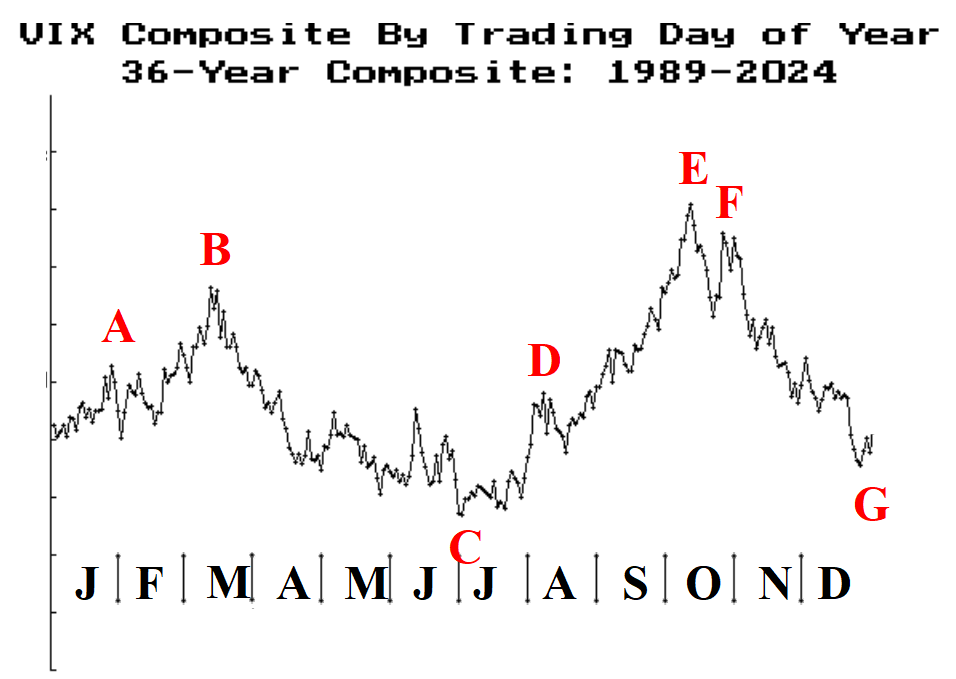

By Lawrence G. McMillanPeriodically we publish the chart below, which shows the $VIX composite from 1989 through some more current date – 12/31/24 in this case. We usually update this chart annually...

Jun, 27, 2025

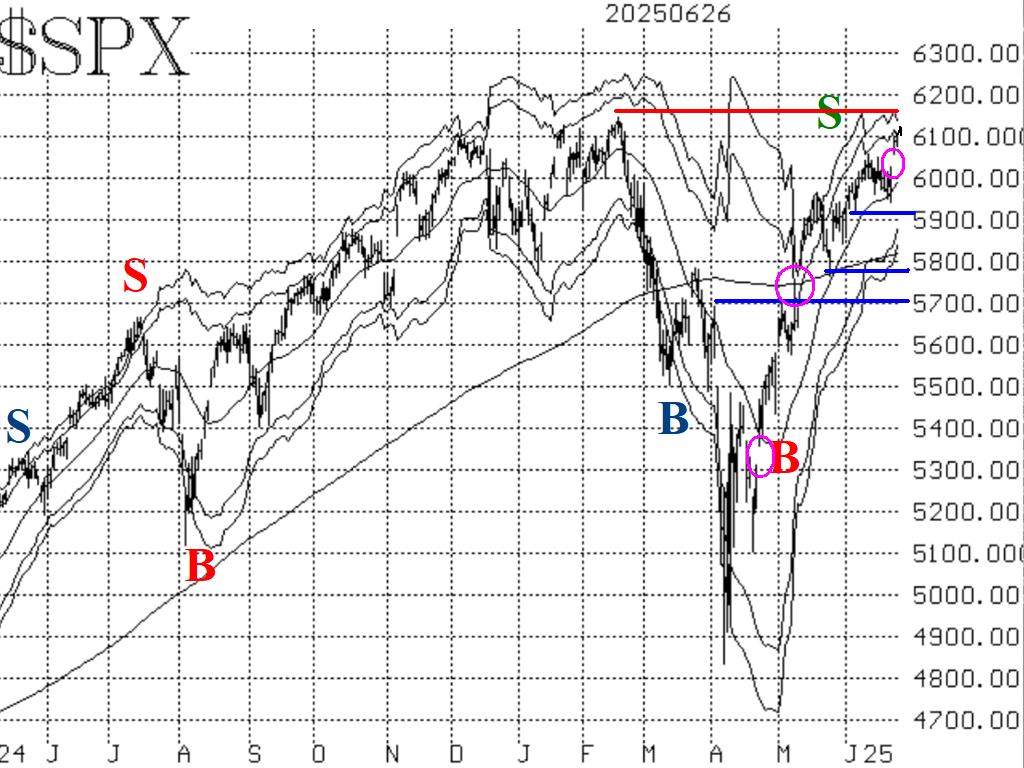

By Lawrence G. McMillanStocks are making new all-time highs this morning, as this is being written. This includes $SPX and $NDX, but not $RUT (Russell 2000) and $DJX (The Dow). The $SPX chart remains...

Pages

© 2023 The Option Strategist | McMillan Analysis Corporation