Feb, 23, 2026

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on February 23, 2026.

Feb, 20, 2026

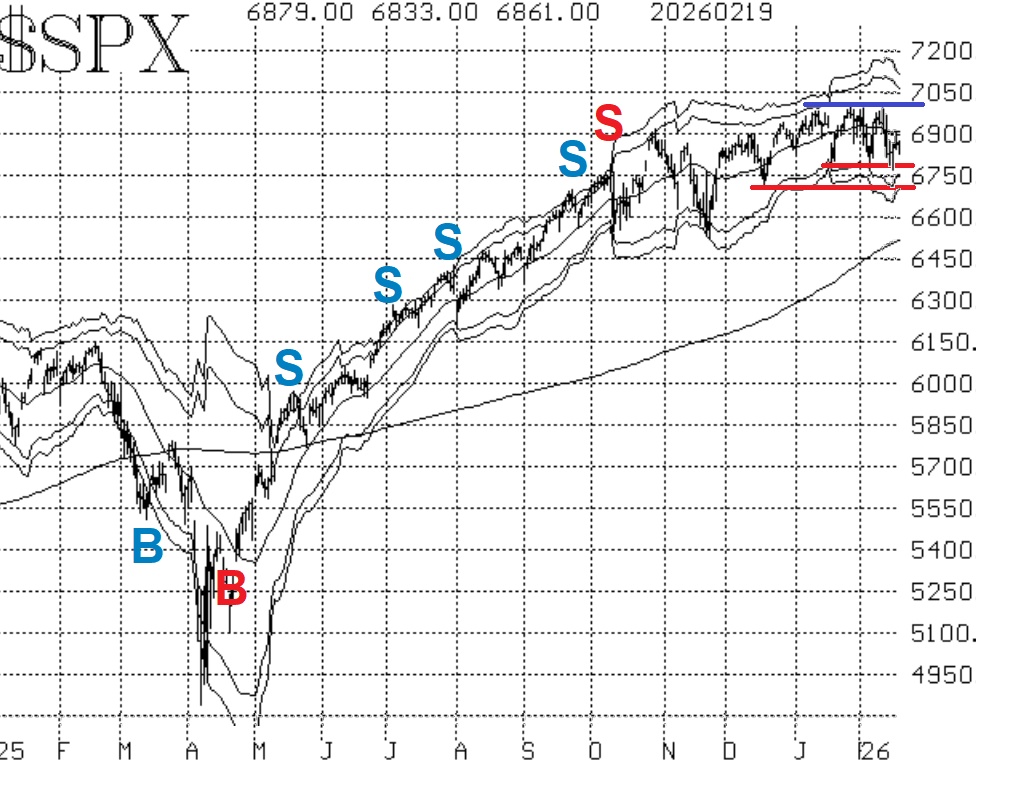

By Lawrence G. McMillanStocks continue to trade in a tight range, with a ceiling near 7000 and strong support in the 6720-6800 range. Eventually a breakout will occur, but until it does, expect more...

Feb, 19, 2026

By Lawrence G. McMillanMost traders talk about delta, gamma, theta, and vega — but far fewer truly understand how they are derived, how they interact, and how they shape real portfolio risk. In this...

Feb, 17, 2026

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on February 17, 2026.

Feb, 13, 2026

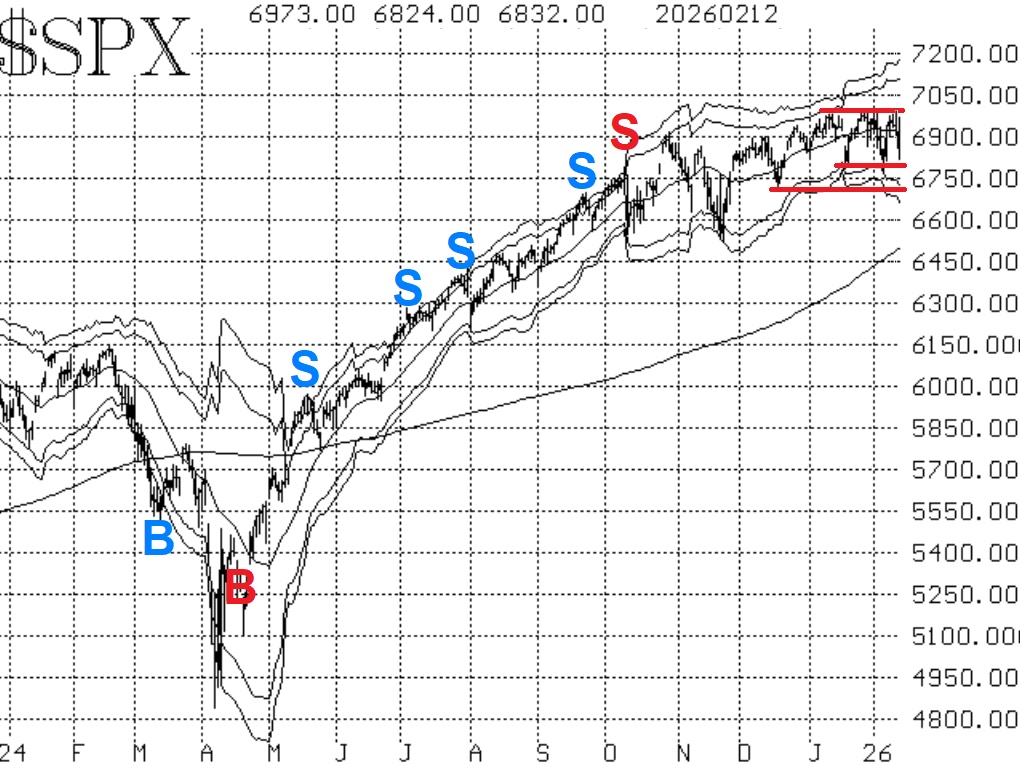

By Lawrence G. McMillanThe schizophrenia of this market is really something else. On bad days, it looks like the world is imploding, but then it bounces right back. Meanwhile, it has been unable to...

Feb, 12, 2026

By Lawrence G. McMillanHow should you properly insure a stock portfolio?Most investors default to buying puts — but the reality is that portfolio insurance is far more nuanced. The cost, structure,...

Feb, 09, 2026

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on February 9, 2026.

Feb, 06, 2026

By Lawrence G. McMillanVolatility has increased with the failure once again of $SPX to clearly break out to new all-time highs. It last made a marginal new all-time intraday high on January 28th. SPX...

Feb, 04, 2026

By Lawrence G. McMillanWe’ve begun publishing our full catalogue of recorded webinars on The Option Strategist Substack — and we’ll be adding more in the coming weeks.These are complete, in-depth...

Feb, 03, 2026

By Lawrence G. McMillanWe’ve added another full-length educational webinar to The Option Strategist Substack library: Intermarket Spreads.In this session, Larry McMillan explains how some of the...

Pages

© 2023 The Option Strategist | McMillan Analysis Corporation