Jun, 13, 2025

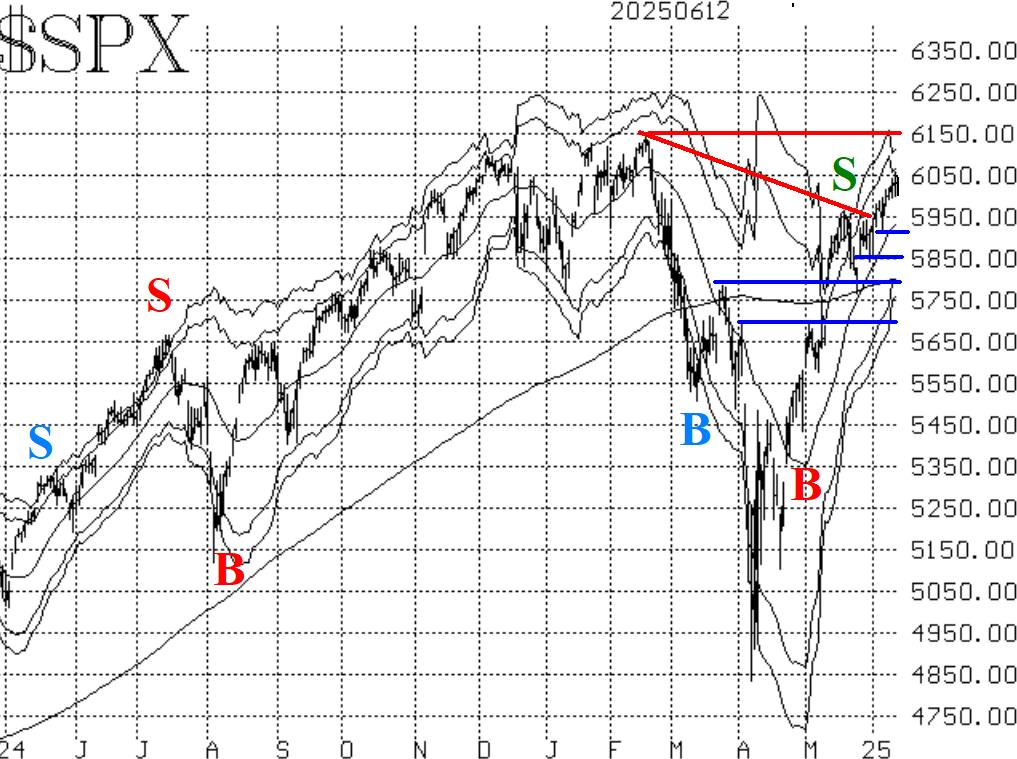

By Lawrence G. McMillanThe broad market continues to inch higher, and has so far remained above the previous downtrend line that connected the February and May highs. The only overhead resistance is...

Jun, 13, 2025

By Lawrence G. McMillanA number of years ago, we introduced a $VIX futures premium indicator, which we called VOLFUTA. It is a composite of the premium on the front-month and second-month $VIX...

Jun, 09, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on June 9, 2025.

Jun, 09, 2025

By Lawrence G. McMillanYieldMax has a number of ETFs, in which they are generally long synthetic stock (long call, short put with the same terms) and then they sell call credit spreads, out-of-the-...

Jun, 06, 2025

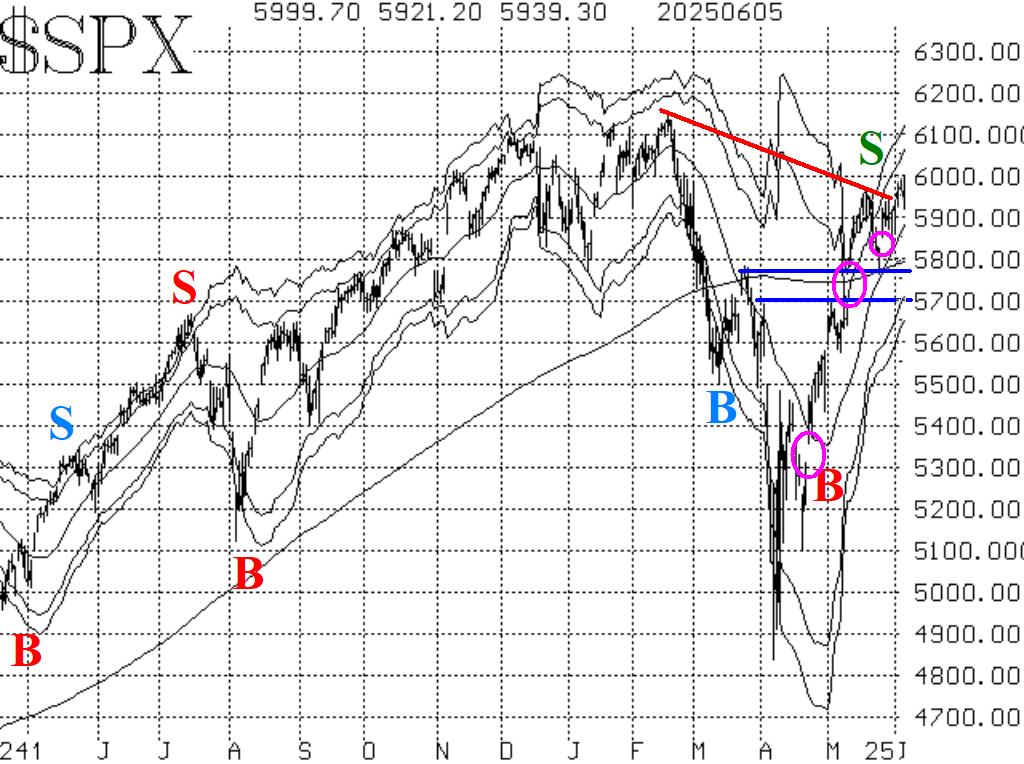

By Lawrence G. McMillanThe downtrend line connecting the February and May highs was a major impediment on the upside, and now $SPX has overcome that. For the previous three days, $SPX has traded...

Jun, 03, 2025

By Lawrence G. McMillanA few weeks ago, I had the pleasure of speaking to students in the UCLA MQE program on the topic of Understanding and Trading Volatility Derivatives. It was a data-driven,...

Jun, 02, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on June 2, 2025.

May, 30, 2025

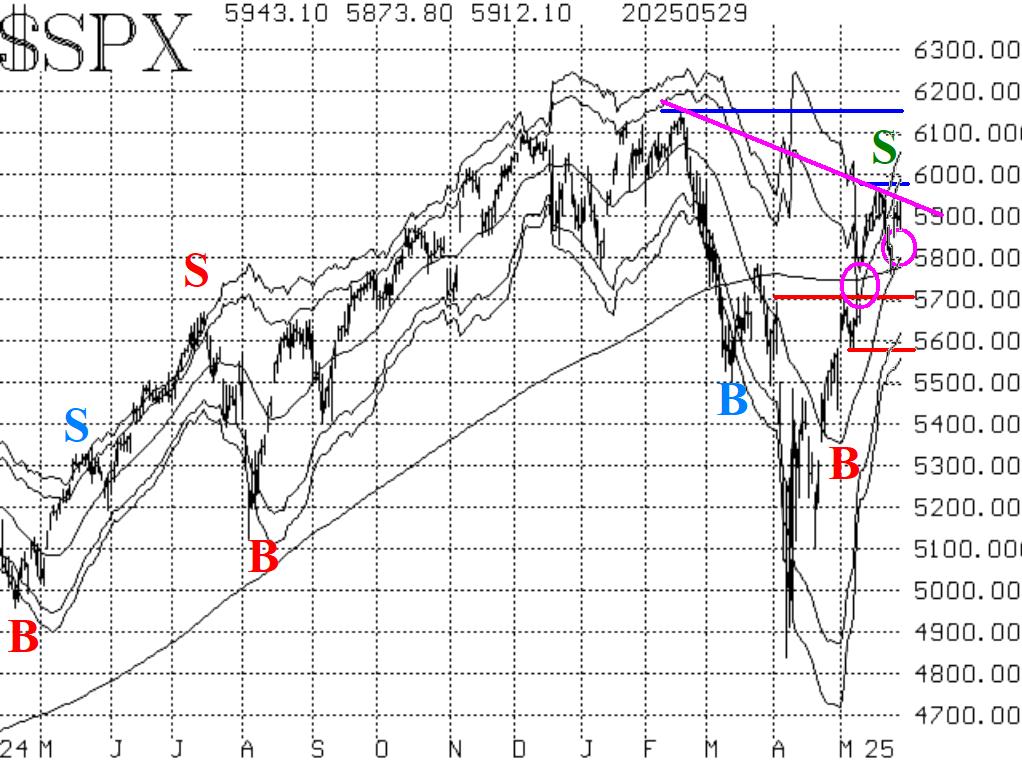

By Lawrence G. McMillanLast weekend, tariffs against Europe were postponed, and the stock market took that as a very favorable sign. When traders returned after the Memorial Day weekend, $SPX gapped...

May, 29, 2025

By Lawrence G. McMillanAt McMillan Analysis, our approach to selling naked puts is grounded in data, probability, and risk management—not gut feelings or "favorite" stocks. Each trading day, we apply...

May, 28, 2025

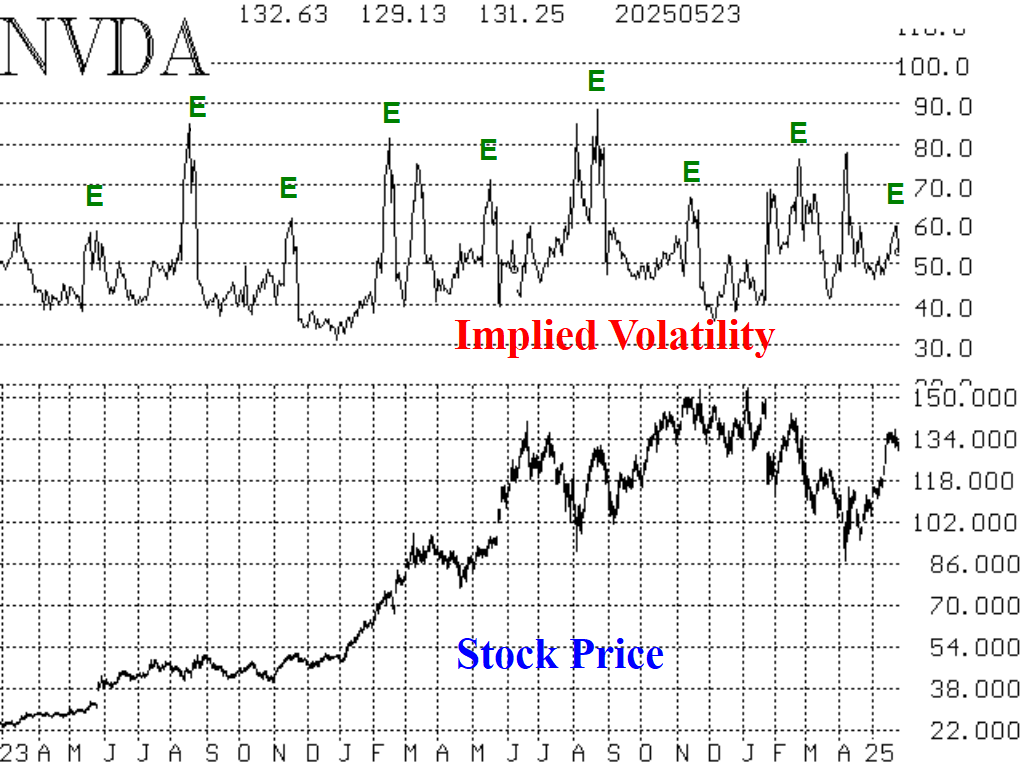

By Lawrence G. McMillanSome companies typically make a large gap move after earnings are reported. Large post-earnings moves are caused by the fact that – for some companies – it is difficult for...

Pages

© 2023 The Option Strategist | McMillan Analysis Corporation