Apr, 28, 2025

By Lawrence G. McMillanA new setup has occurred in Tesla (TSLA) using the weekly McMillan Volatility Bands (MVB). TSLA closed back above its +3σ (three sigma) band, indicating a potential shift in...

Apr, 28, 2025

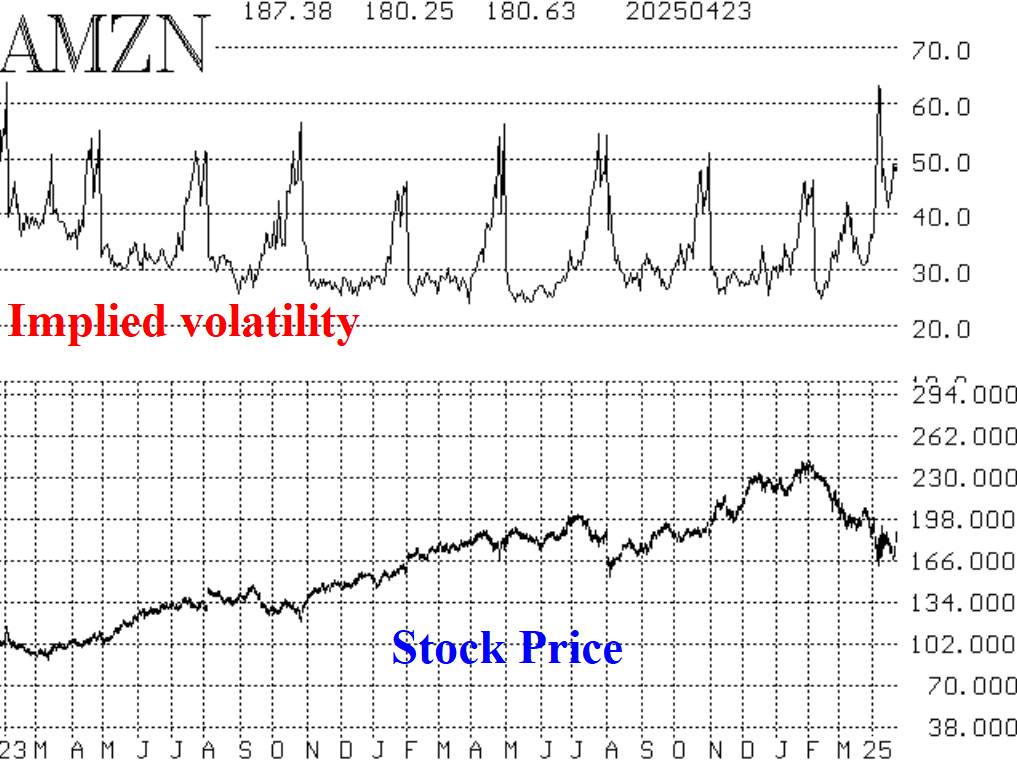

By Lawrence G. McMillanThis week’s earnings calendar is even heavier than last week’s, setting up plenty of potential opportunities for pre-earnings straddle buys. Many stocks are showing the classic...

Apr, 25, 2025

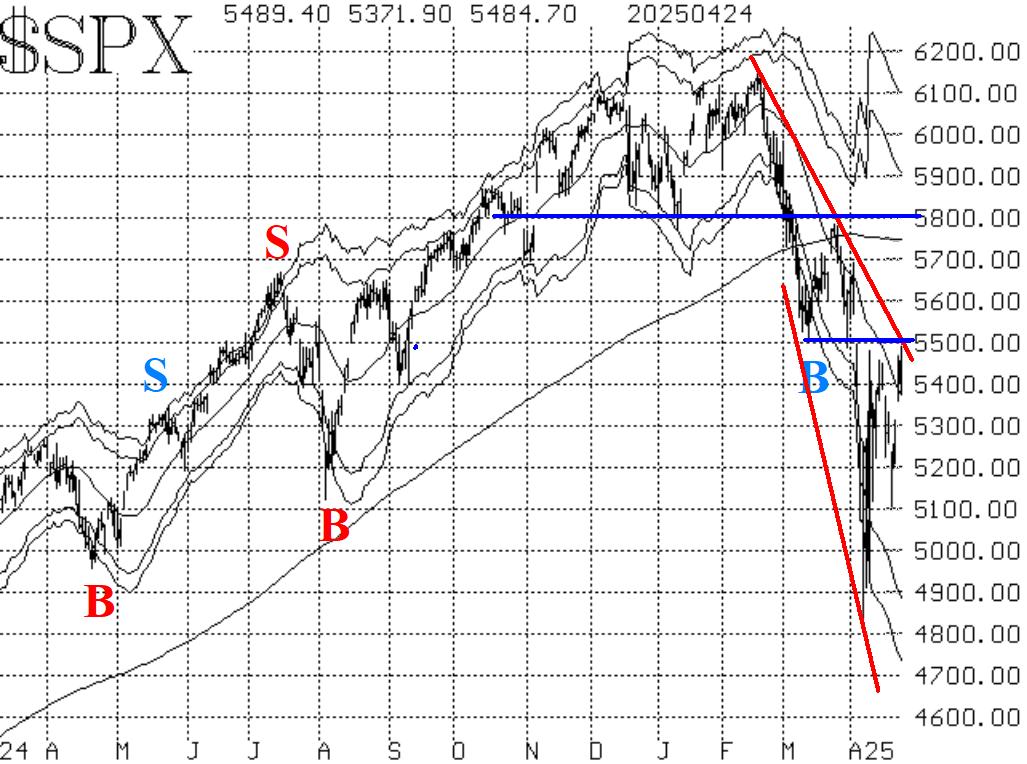

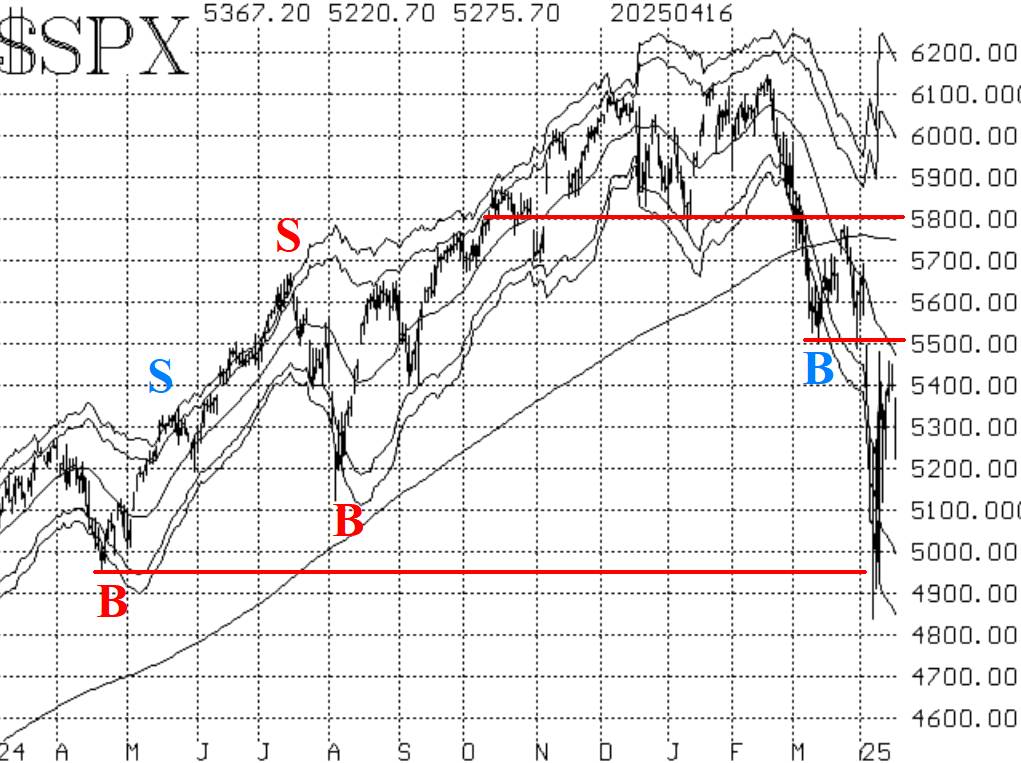

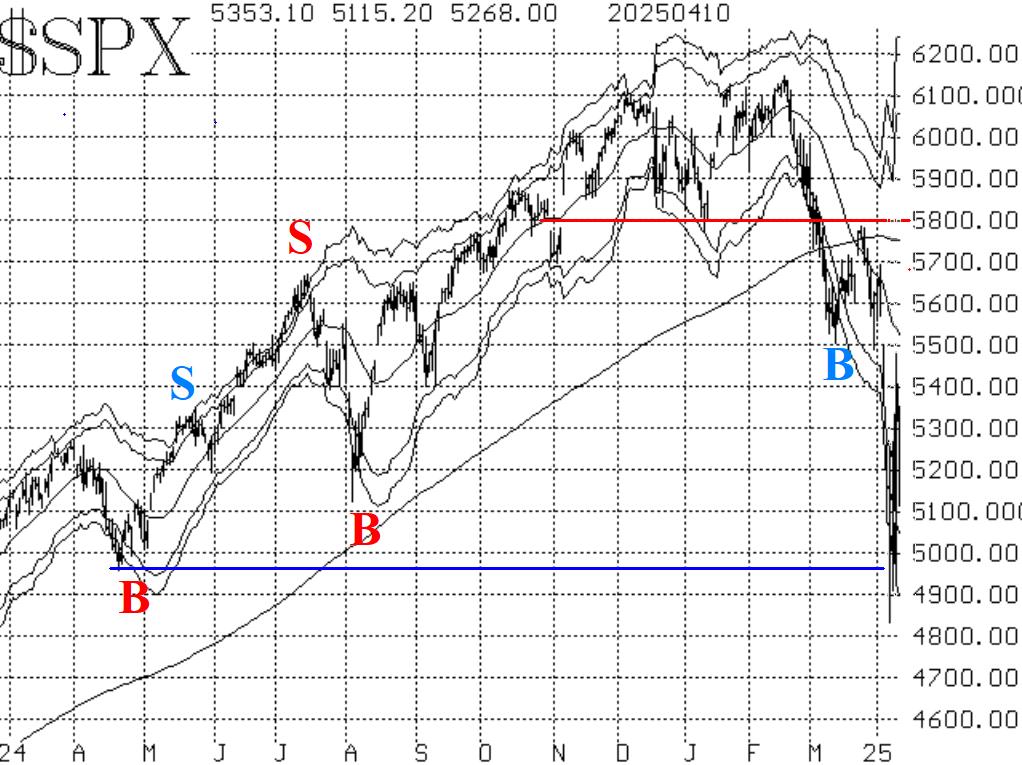

By Lawrence G. McMillanIt really feels like the market is rallying strongly, and perhaps the bottom is in. But the evidence is not clear on that. Even though $SPX has rallied nearly 400 points from...

Apr, 21, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on April 21, 2025.

Apr, 18, 2025

By Lawrence G. McMillanStocks are trying to rally but so far, rallies have merely been of the oversold variety short-term affairs which only carry back to about the declining 20-day moving average....

Apr, 17, 2025

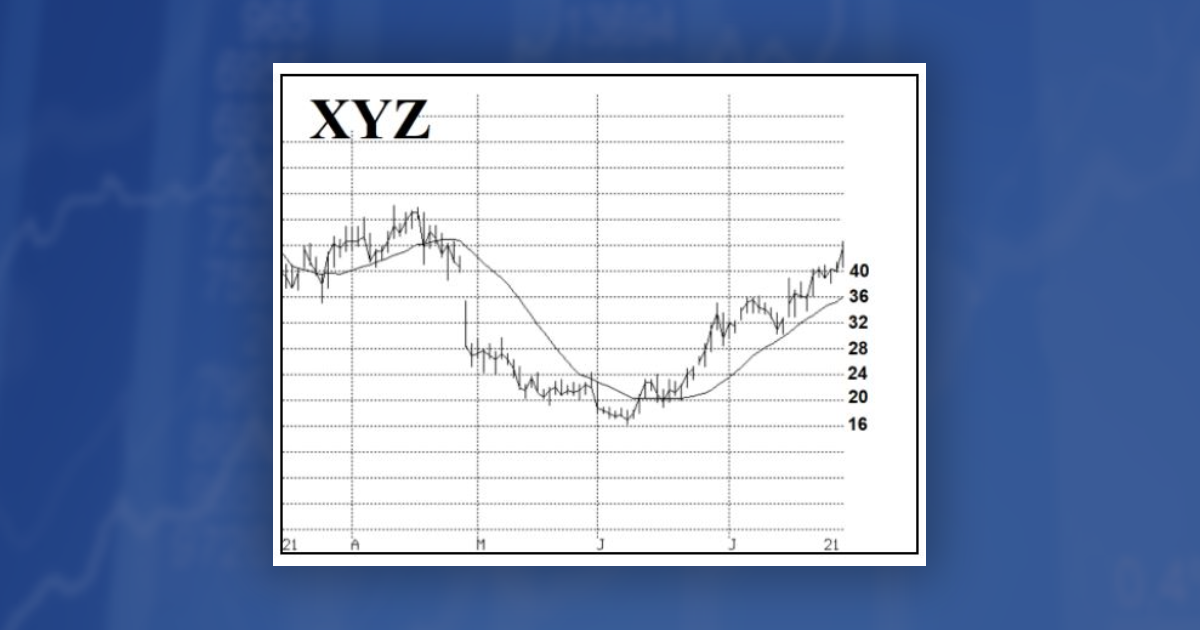

By Lawrence G. McMillanThis article was originally published in The Option Strategist Newsletter on 7/30/2021.One of the tougher choices an option trader faces is what to do with a profitable...

Apr, 16, 2025

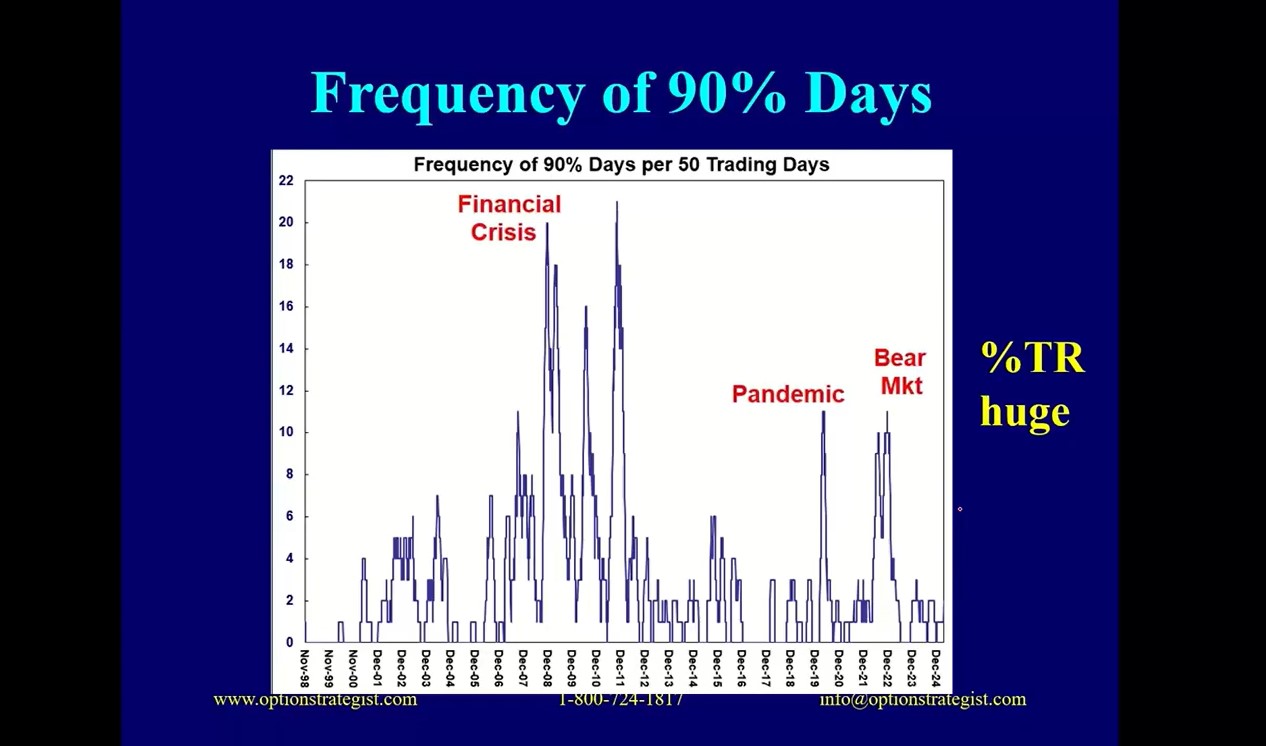

By Lawrence G. McMillanLast week, the market experienced both a 90% down day and a 90% up day—an uncommon and potentially concerning combination. These “90% days,” defined by extreme imbalances in...

Apr, 15, 2025

By Lawrence G. McMillanVolatility has returned to the market in full force. With major indices swinging sharply and investor sentiment shifting rapidly, it's more important than ever to rely on...

Apr, 14, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on April 14, 2025.

Apr, 11, 2025

By Lawrence G. McMillanWildly volatile markets have dominated the scene since last Friday. These are interesting times, but filled with traps. $SPX traded all the way down to 4900, eventually...

Pages

© 2023 The Option Strategist | McMillan Analysis Corporation