By Lawrence G. McMillan

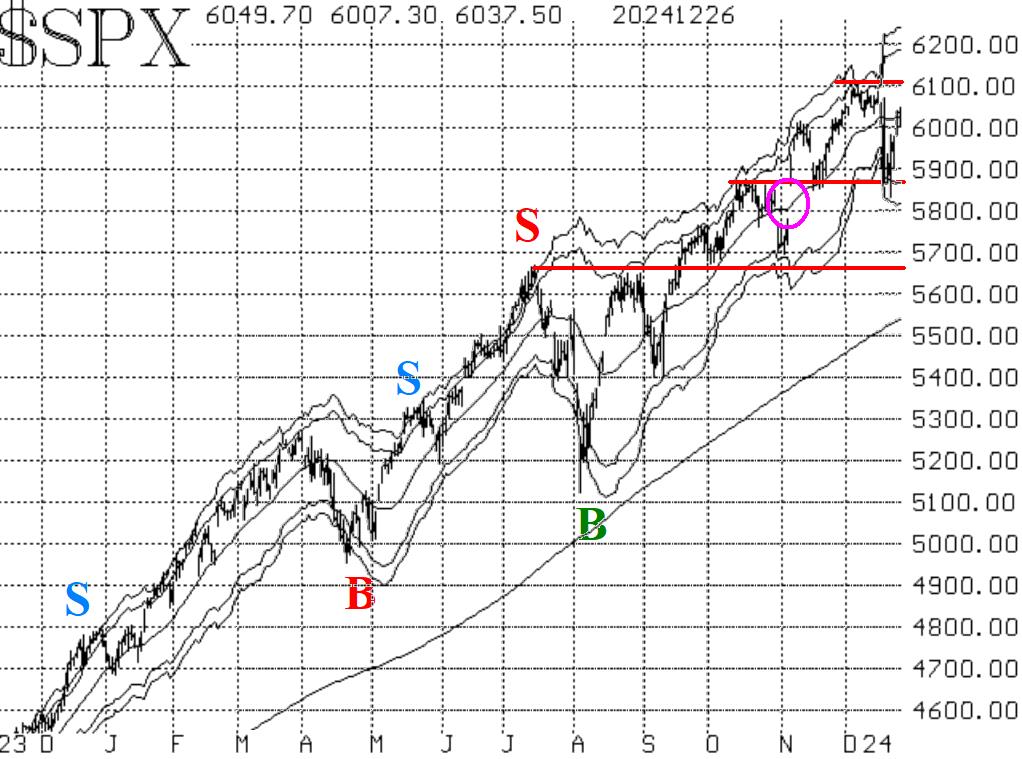

Stocks rallied sharply off the 5870 level exactly a week ago. While $SPX had probed below there intraday, it was above 5870 by the close of trading. So, there is strong support at 5870 on a closing price basis, and it has been tested several times. The rally was sharp, but it seems to have died out after reaching the 20-day Moving Average of $SPX, which is near a previous resistance level, at 6010. There is further resistance at the all-time highs, 6100. So, for now $SPX is in a range between 5870 and 6100, and it is volatile. A breakout from that range in either direction should produce a sustainable momentum-based move.

Equity-only put-call ratios remain on sell signals, although they spent a great deal of time this past week going sideways, before edging a bit higher on Thursday (December 26th). A rising put-call ratio is bearish for the stock market, but twice in the past year (January and October), we've seen the ratios ostensibly begin to rise, only for them to quickly turn downward again and make new lows. So, for these sell signals to persist, the ratios must continue to rise.

Breadth had been abysmal, and both breadth oscillators have been on sell signals since early December. This week, though, there were four days of positive breadth (see Table, Page 1), and that has brought the breadth oscillators to the brink of buy signals. We require a 2-day confirmation of any change of signal, so that has not yet been confirmed. With today's action being decidedly negative, these breadth oscillators will likely remain on sell signals for now.

$VIX has been volatile in its own right. Last week, it spiked up to 28.32, and then back down again, thereby creating a "spike peak" buy signal (for stocks) which is still in place.

The seasonally bullish Santa Claus rally period encompasses the last five trading days of this year and the first two of next year. It began with the trading of December 24th. It is not looking good right now, and as the late Yale Hirsch the identifier of the Santa Claus rally said: "If Santa Claus should fail to call, bears may come to Broad and Wall." In other words, if this time period produces a loss in the market instead of a gain, that may signal a much more bearish environment going forward.

In summary, $SPX is bouncing around between 5870 and 6100 (or 6010 if you prefer) with a great deal of volatility. A breakout from the range would be important. Meanwhile, we are continuing to hold a "core" bullish position as long as $SPX closes above 5870.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation