Dec, 23, 2025

By Lawrence G. McMillanMany traders are drawn to buying calls and puts because of the leverage options provide. Unfortunately, that same leverage is the reason so many option buyers struggle, even...

Dec, 22, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on December 22, 2025.

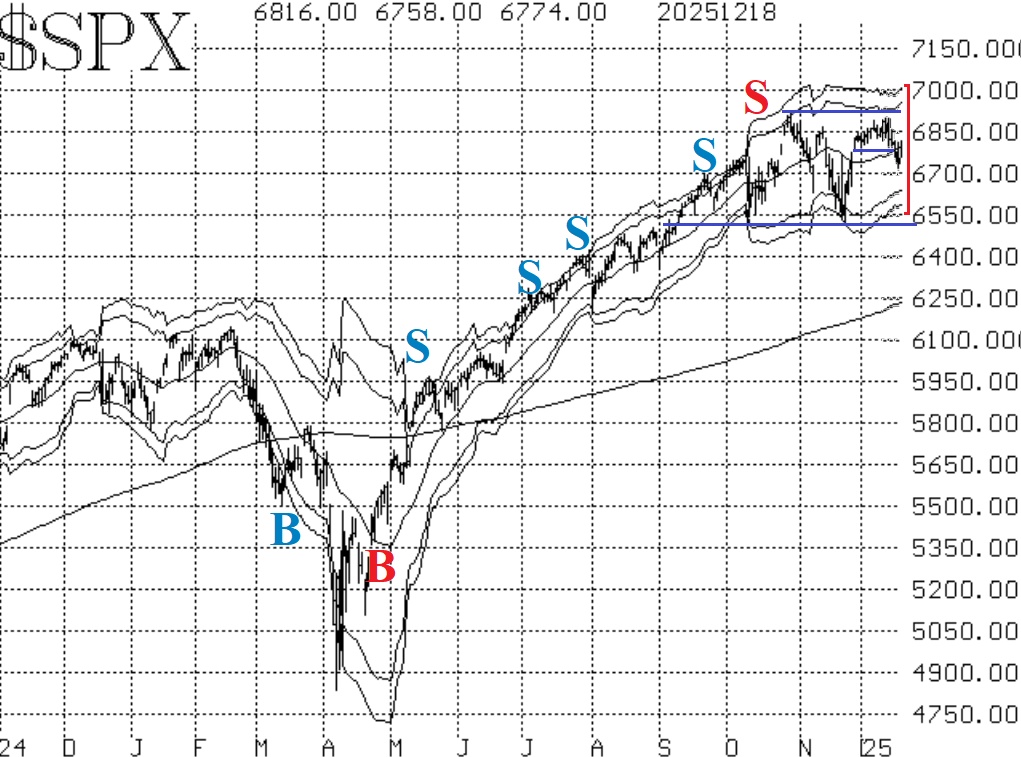

Dec, 19, 2025

By Lawrence G. McMillan$SPX couldn't break out on the upside, so then it decided to test the downside, breaking down below support at 6800 for two days. But that move had no follow-through either....

Dec, 16, 2025

By Lawrence G. McMillanSince its launch in June 2020, The Daily Put-Writer has maintained consistent subscription pricing. During that time, the service has expanded significantly — with daily trade...

Dec, 15, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on December 15, 2025.

Dec, 15, 2025

By Lawrence G. McMillanNaked option writing is one of the most powerful strategies available to experienced options traders — and also one of the most misunderstood. While time decay can work...

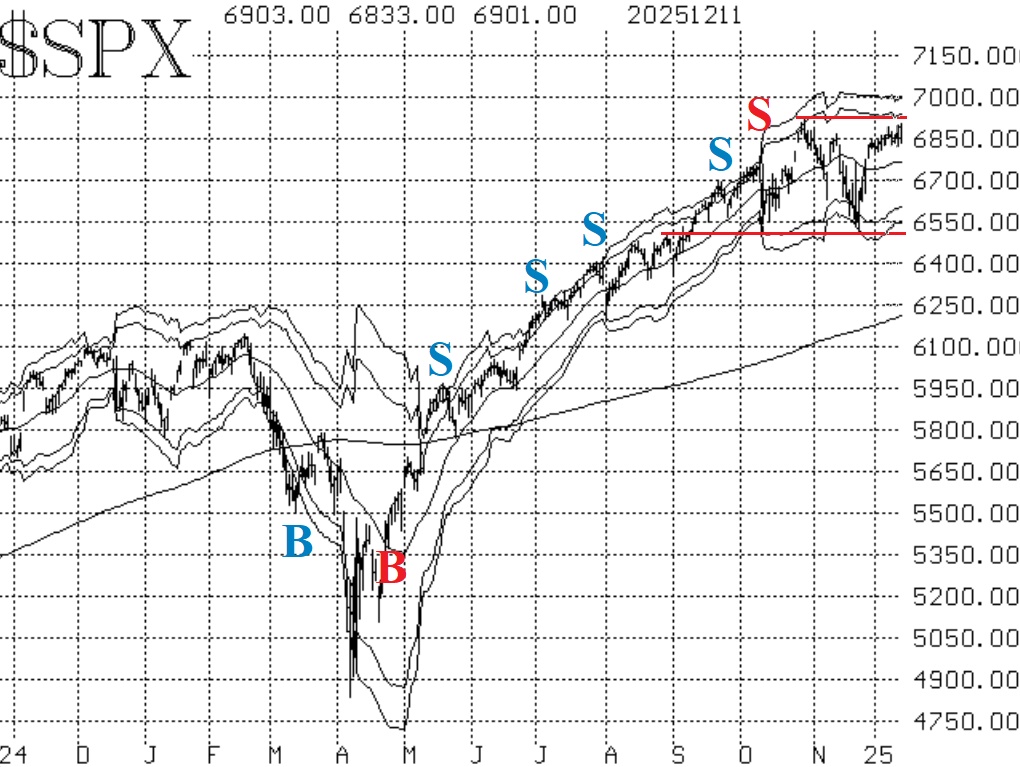

Dec, 12, 2025

By Lawrence G. McMillanIt seems that everything is quite bullish, and we are merely awaiting confirmation from the $SPX chart. That is, we need to see $SPX trade solidly at a new all-time high in...

Dec, 11, 2025

By Lawrence G. McMillanWe recently upgraded our Free Probability Calculator, making it an even more useful tool for traders who want a deeper understanding of market expectations. The calculator...

Dec, 11, 2025

By Lawrence G. McMillanWe’ve just published a detailed Substack post walking through the core principles of covered call writing—a strategy many traders use for income, but one that carries important...

Dec, 08, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on December 8, 2025.

Pages

© 2023 The Option Strategist | McMillan Analysis Corporation