By Lawrence G. McMillan

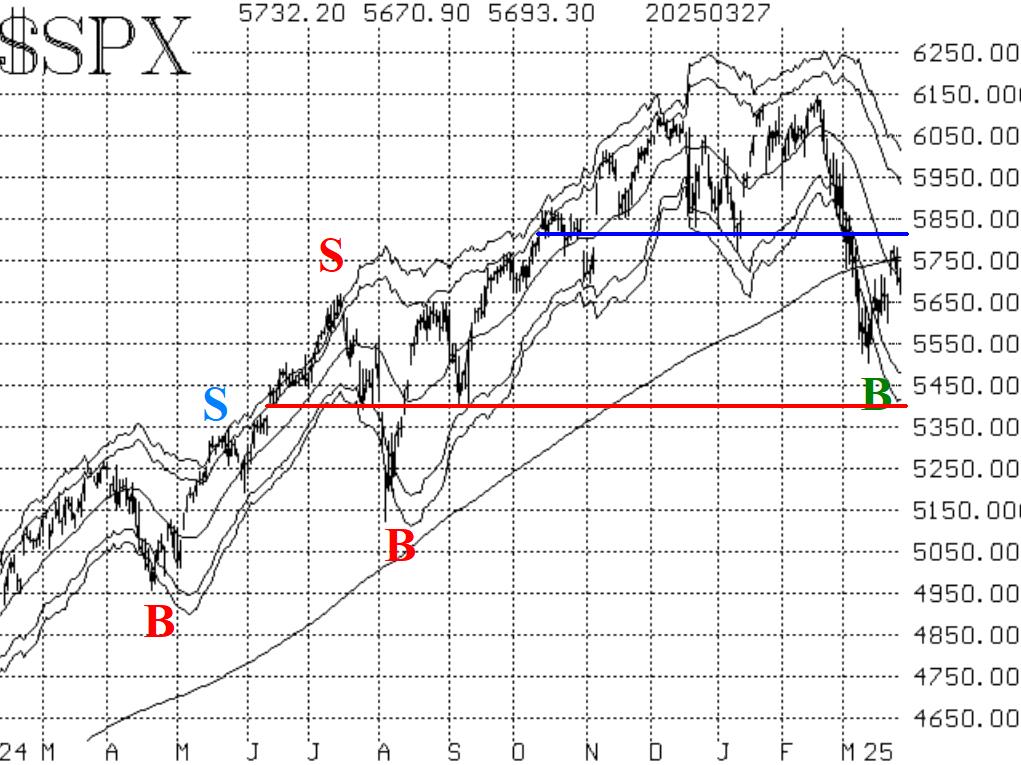

The current rally in $SPX is behaving very much likely a typical oversold rally and not something stronger. $SPX rallied up to its declining 20-day Moving Average, and overshot it slightly. Then it backed off again. That is classic action for an oversold rally. In this particular case, $SPX also ran into its 200-day Moving Average, at the same level. The highs of this week are just below 5800, so that is resistance.

The gap at 5650 has been filled this morning, and that has not provided any support yet. The next support area is the 5500-5540 zone, which comprised the lows earlier this month. Below that, there should be support at 5400 last September's lows.

Frankly, given the level of the oversold conditions that existed a couple of weeks ago, and the market's predilection for buying the dips, I would have expected the oversold rally to be much stronger. As we noted last week, the first oversold rally in the 2022 bear market carried so high that it almost reached the highs once again. Not this time.

Equity-only put-call ratios are presenting a mixed picture. The weighted ratio reached highs last seen in late 2023 (at the end of that year's 10% correction). Then it retreated a little. That was enough for the computer analysis programs to declare a buy signal, and that signal is marked on the chart in Figure 3. Meanwhile, the standard ratio (Figure 2) is not getting the all-clear buy signal.

Market breadth has slipped again this week, but not enough to cancel out the buy signals from the breadth oscillators. NYSE breadth remains considerably stronger than "stocks only" breadth. If they slip back into oversold territory, that would stop out the buy signal, but so far that hasn't happened.

$VIX has been giving mixed signals. The "spike peak" buy signal of March 12th remains in place, and we are adjusting the stop. Meanwhile, the trend of $VIX sell signal remains in place.

Overall, this is still a bearish market (not necessarily a confirmed bear market -- we would need the pattern of lower lows and lower highs for that, meaning that $SPX would have to trade below 5500). The oversold rally was a big disappointment to the bulls, and now buy signals need to be regenerated. Meanwhile, we will trade confirmed signals as they occur. But sure to roll deeply in-the-money positions in order to lock in some partial profits and reduce price risk if the underlying reverses direction.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation