By Lawrence G. McMillan

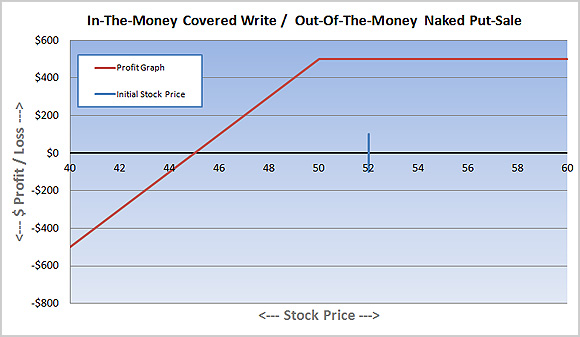

With the recent market sell-off, some traders have been shifting from selling puts to writing covered calls. The argument is that selling puts in a declining market is riskier, while covered calls provide a safer way to generate income. However, this belief misunderstands the fundamental equivalence of the two strategies.

The Covered Call & Naked Put Equivalence

At their core, a covered call and a cash-secured put (also known as a naked put) are two sides of the same coin. Both strategies have:

- Limited upside potential – Both have fixed, limited upside profit potential above the striking price of the written option.

- Downside risk – Both strategies suffer if the underlying stock declines below the strike price of the written option.

Why Selling Puts Might Be More Efficient

In my article Covered Call Writing: Why Cash-Based Put Selling is Superior, I outline why put selling often has advantages over covered call writing:

- Lower Commissions – A covered call requires two trades (buying stock and selling a call), while selling a put is a single transaction. If the stock is called away in a covered call position, another commission is incurred when selling the stock. Put selling avoids this extra cost.

- Easier Adjustments – If a trader wants to exit a position early, it’s often easier to close out a short put than a covered call. Out-of-the-money puts tend to have tighter bid-ask spreads than deep-in-the-money calls, making them more liquid and easier to trade.

- Cash Efficiency in Certain Accounts – Many traders use covered calls in retirement or cash accounts because they believe they cannot sell puts. However, most brokers allow cash-secured put writing, where the trader holds enough cash to purchase the stock if assigned. This achieves the same risk/reward profile as a covered call but avoids the inefficiencies of stock ownership. An added bonus is that one can earn interest on the cash while it is set aside as collateral.

Managing Risk: The Role of Leverage

One reason put selling is sometimes perceived as riskier is because traders often use leverage. Since only ~25% of the strike price is required as collateral to sell naked puts, traders may sell more contracts than they would if they were purchasing the stock outright when establishing a covered write. This increased leverage amplifies potential losses in a downturn. However, if one is concerned about downside risk, they could simply sell fewer put contracts, maintaining the same overall exposure as a covered call strategy without taking on additional leverage.

Conclusion

Whether you sell puts or write covered calls, you are effectively making the same trade. The choice between the two should be based on factors like commissions, liquidity, and account flexibility—not a mistaken belief that one is safer than the other.

For put-selling candidates and recommendations on a daily basis, subscribe to The Daily Put-Writer.

© 2023 The Option Strategist | McMillan Analysis Corporation