By Lawrence G. McMillan

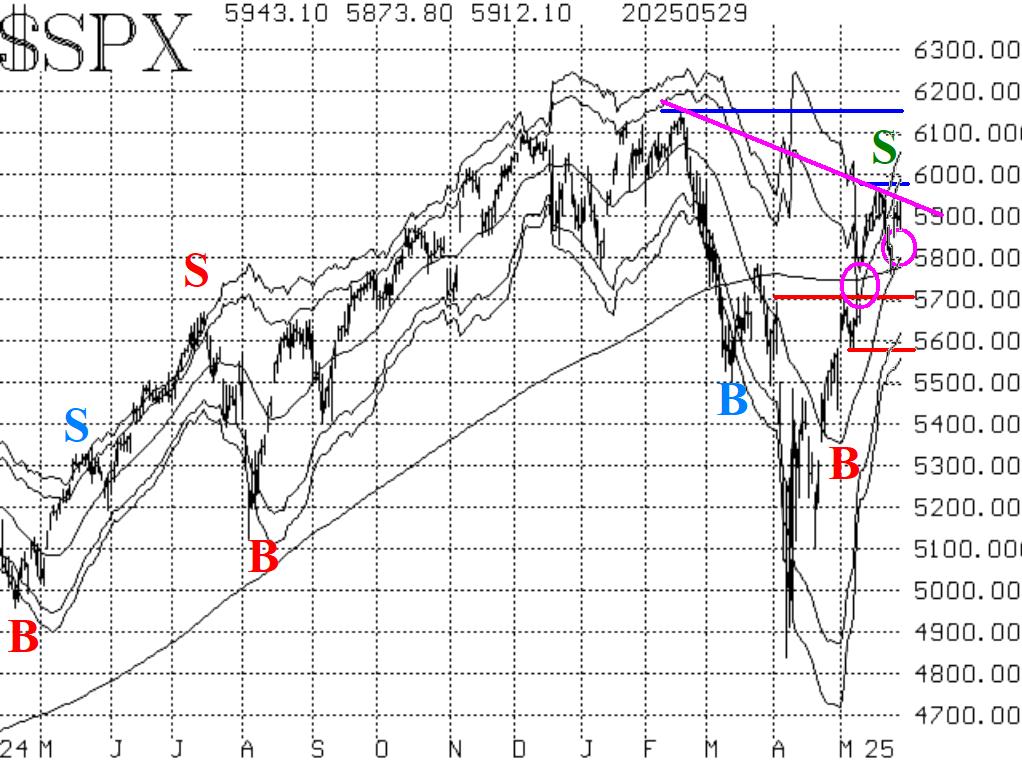

Last weekend, tariffs against Europe were postponed, and the stock market took that as a very favorable sign. When traders returned after the Memorial Day weekend, $SPX gapped higher on what turned out to be a very strong day for the big-cap stocks. The gap from that day extends down to 5830, and it would probably be a positive thing if that were filled. A move below 5700 would be negative. There is resistance at last week's highs near 5970 and also at the all-time highs of 6150.

Equity-only put-call ratios continue to decline, so these remain as bullish signals for the stock market. These ratios are beginning to reach the lower regions of their charts (Figures 2 and 3), but that is only an overbought condition and is by no means a sell signal. Breadth has been in a fairly negative mode for the last couple of weeks. That had produced sell signals from our breadth oscillators, and they remain bearish today.

$VIX shot up to 25.53 last Friday (May 23rd) when the stock market opened sharply lower. $VIX then proceeded to retreat sharply that day, and by the end of the day had closed more than 3.00 points below that high. Thus a new "spike peak" buy signal was registered.

So, we have a generally mixed picture, with a slight weight of the evidence to the bullish side: Regardless, we will continue to trade confirmed signals as they appear. Roll deeply in-the-money positions to take partial profits and reduce risk of a reversal.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation