By Lawrence G. McMillan

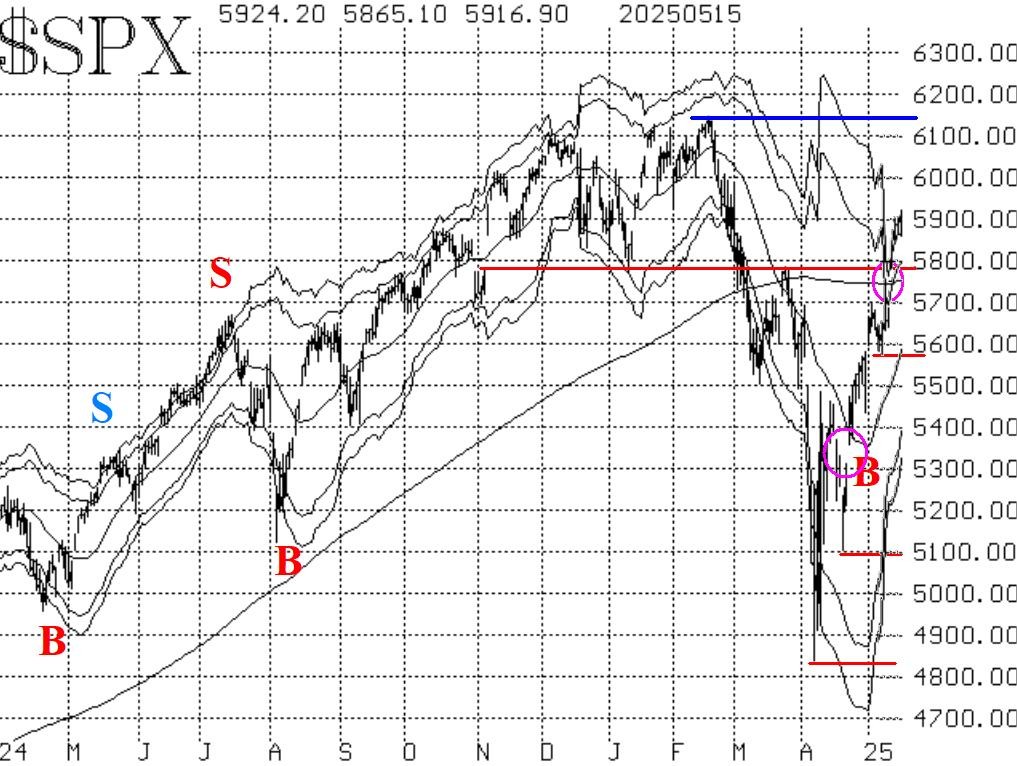

Stocks have continued to rally, after last weekend's positive tariff meeting between the U.S. and China. $SPX gapped higher on Monday, blasting right through former resistance at 5700 and 5800, and thus establishing a new bullish pattern on its chart.

The next resistance area is at the all-time highs of 6150. Yes, it is possible that the Index could falter before reaching 6150, and if it did that, there is still the possibility of a pattern of lower highs on the chart. But we will deal with that if it comes to pass.

There are various support levels below here. They are marked with horizontal red lines on the chart in Figure 1.

For now, this breakout appears to be real and is being accompanied by some buy signals from our internal indicators although not all are on buy signals yet.

Equity-only put-call ratios continue to drop, and that is bullish for stocks. These ratios will only generate sell signals for stocks when they roll over and begin to trend higher.

Breadth continues to be a strength of this market. The breadth oscillators issued buy signals fairly early on (April 23rd) and have remained bullish since then. These oscillators have been in overbought territory for much of that time, but that is a positive thing when $SPX is beginning a new leg upward. It is going to take at least two consecutive days of negative breadth in order to cancel out these buy signals.

$VIX has continued to fall -- although I wouldn't say it has collapsed. Both of the signals that we derive from the $VIX chart have been closed out, so there is no signal associated with $VIX at the current time.

In summary, we had some short-term buy signals a couple of weeks ago ($VIX crossover and "oscillator differential"), and now those have progressed to longer-term buy signals from equity-only, breadth, "$VIX minus HV20," and a more positive $SPX chart. We will follow any new signals that are generated, and we will continue to roll deeply in-the-money options.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation