By Lawrence G. McMillan

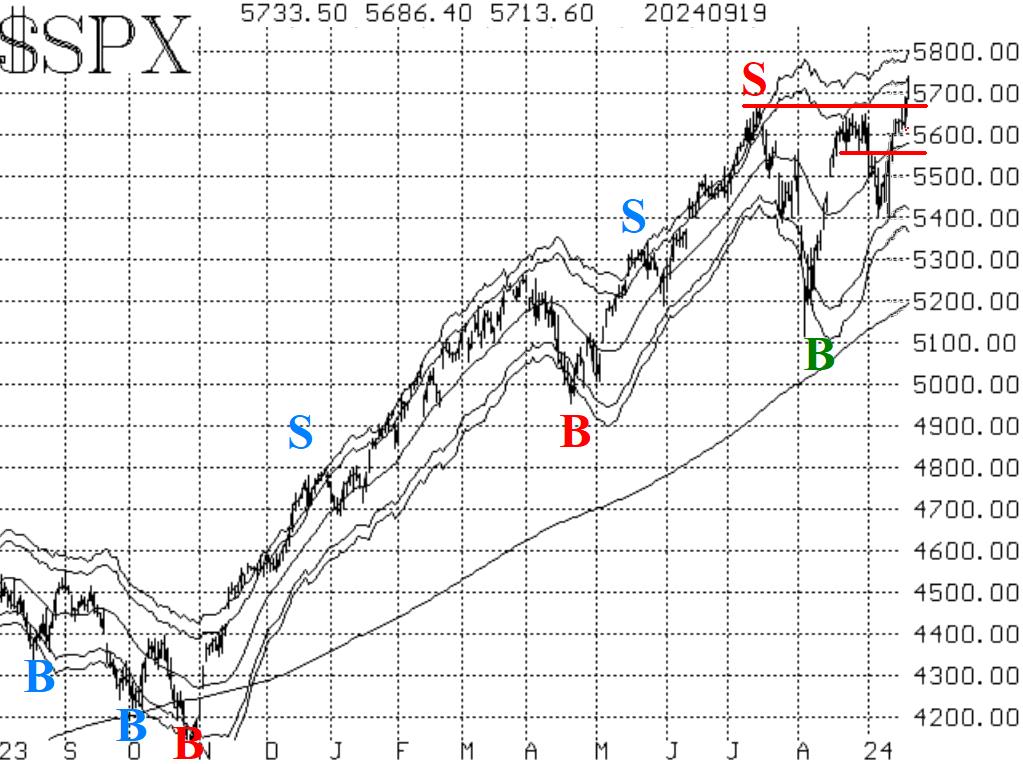

After bumping up against resistance once again in the 5670 area, $SPX finally exploded on through, one day after the Fed lowered rates by 50 basis points. A second day's close above 5670 will confirm the breakout and will warrant a "core" bullish position in the Index.

There should now be support throughout the former trading range, 5560 5670. If $SPX falls back below 5670, then it would have to be considered a false upside breakout, though.

Oddly enough, the equity-only put-call ratios are rolling over to sell signals as $SPX is breaking out to new all-time highs. I wouldn't say that's never happened, but it is certainly rare. The computer analysis programs that we use on these put-call ratio charts is in agreement that sell signals are in place for both the standard and weighted ratio.

Breadth has been tremendously strong over the past two weeks, and the breadth oscillators remain on buy signals in overbought territory. It is a good thing when the breadth oscillators are overbought as $SPX is breaking out to a new all-time high.

The $VIX signals continue to remain split. The "spike peak" buy signal is still in place, and it lasts for 22 trading days or another 12 trading days. It would be stopped out if $VIX were to return to "spiking" mode that is, an increase of at least 3.00 points over any 3-day or shorter time period, using closing prices. On the other hand, the trend of $VIX sell signal is still in place as well, since $VIX remains above its 200-day Moving Average.

Finally, we will respect the new upside breakout if it confirms today. We will also trade any new signals that emerge. However, we are quite diligent in rolling profitable, deeply-in-the-money options higher.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation