By Lawrence G. McMillan

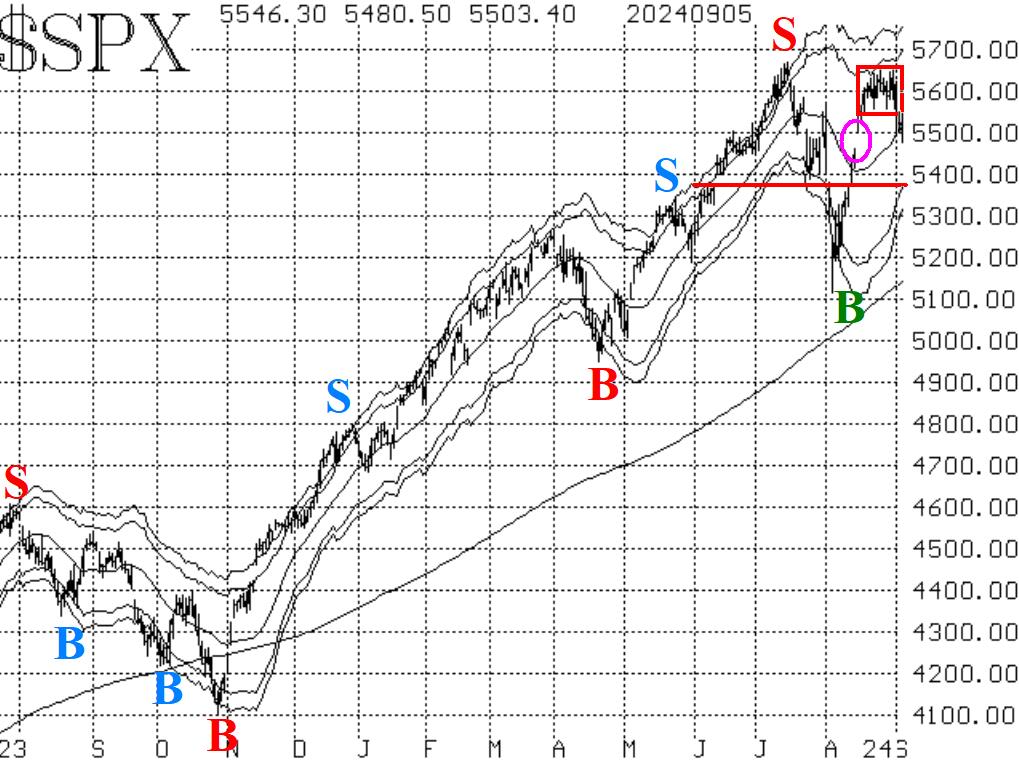

The broad market traded in a fairly tight range between 5560 and 5650 for eleven trading days. Eventually, after the Labor Day holiday, $SPX broke down sharply, losing 120 points intraday in one day. That breakdown now leaves heavy overhead resistance not only in the 5560-5650 range, but at the all-time highs (5670) as well.

There should be some support near 5460, the point at which the gap on the $SPX chart would be closed (circled in Figure 1). Furthermore, there is support at 5370. So, $SPX could pull back to 5370 and it would still be within the confines of an overall neutral- to-bullish market. However, a breakdown below 5370 would be very negative.

At the current time, there are mixed signals, although buy signals still outnumber sell signals.

The equity-only put-call ratios have continued to fall, despite the market's selloff. That is mainly due to the fact that put buying has not been all that heavy this week, and there have been some fairly large numbers coming off the 21-day moving averages in recent days.

Breadth has deteriorated rapidly over the last two weeks, especially after the breakdown on Tuesday. So, the "stocks only" breadth oscillators are now on sell signals.

There has been some change in the $VIX indicators, because $VIX re-entered "spiking mode" this past Tuesday, when $SPX sold off so sharply. That re-entry to "spiking mode" stops out the previous "spike peak" buy signal from $VIX, but it sets up another one, eventually.

Meanwhile, the trend of $VIX sell signal remains in place. $VIX has not been able to close below its 200-day Moving Average. If it did, it would stop out this sell signal. That 200-day MA is at 14.50 and moving sideways.

In summary, the indicators are somewhat mixed, but the breakdown on the $SPX chart is bearish for now. We will continue to trade any confirmed signals, while rolling deeply in-the-money options in existing positions.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation