By Lawrence G. McMillan

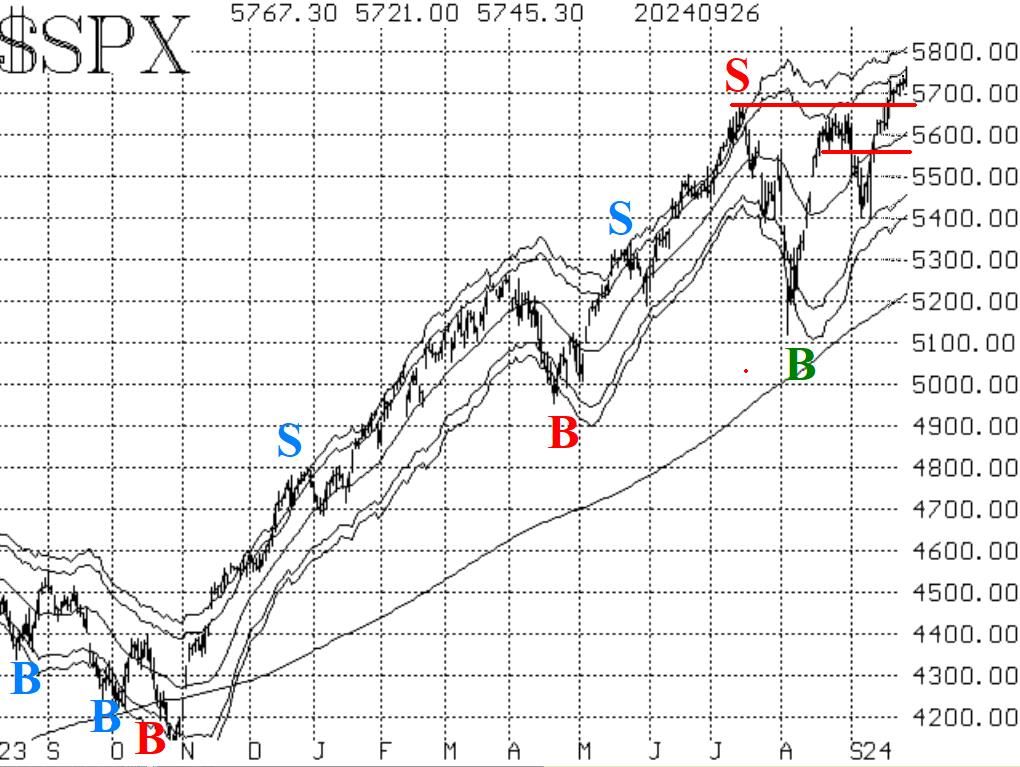

After breaking out to new highs at the end of the previous week, there was only one minor pullback this week, and it was a successful retest of the 5670 breakout level for $SPX. New all-time highs continue to be registered both on an intraday and a closing basis daily. So, the upside breakout to new all-time highs has been confirmed with supportive price action.

The 5670 level is support now, and one could probably make a case that the support extends down to 5560 although a move back below 5670 would certainly be somewhat problematic. A decline below 5560 which I do not expect to see anytime soon would be a full-fledged bearish move and would mean that the recent upside breakout was a false one.

There is no classic upside resistance with $SPX trading at new all-time highs, but we often use the +4Σ "modified Bollinger Band" (mBB) as a target in that case. That Band is currently at 5810 and slowly rising.

Equity-only put-call ratios are toying with sell signals, but not very successfully. The standard ratio (Figure 2) has moved to a new relative low over the past couple of days, and that keeps this ratio on a buy signal. The weighted ratio is just moving sideways (Figure 3), and so the local minimum of last week is still in place (barely). This is technically a sell signal, but it is not actionable unless the ratios starts to move swiftly higher.

Breadth has been reasonably good, and both breadth oscillators remain on buy signals. They are in overbought territory, but that's fine when $SPX is breaking out to new all-time highs.

$VIX continues to give diverging signals. On one hand, the "spike peak" buy signal of September 9th remains in place and has been a good trade. On the other hand, the trend of $VIX sell signal remains in place as well, since $VIX still has not fallen below its 200-day Moving Average. That MA is currently at 14.90 and rising, but $VIX has remained above 15.

In summary, the majority of our indicators are bullish, and with $SPX having confirmed its upside breakout, we are holding a "core" bullish position. We will trade any confirmed signals, though, and we will continue to take partial profits on deeply in-the- money positions

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation