By Lawrence G. McMillan

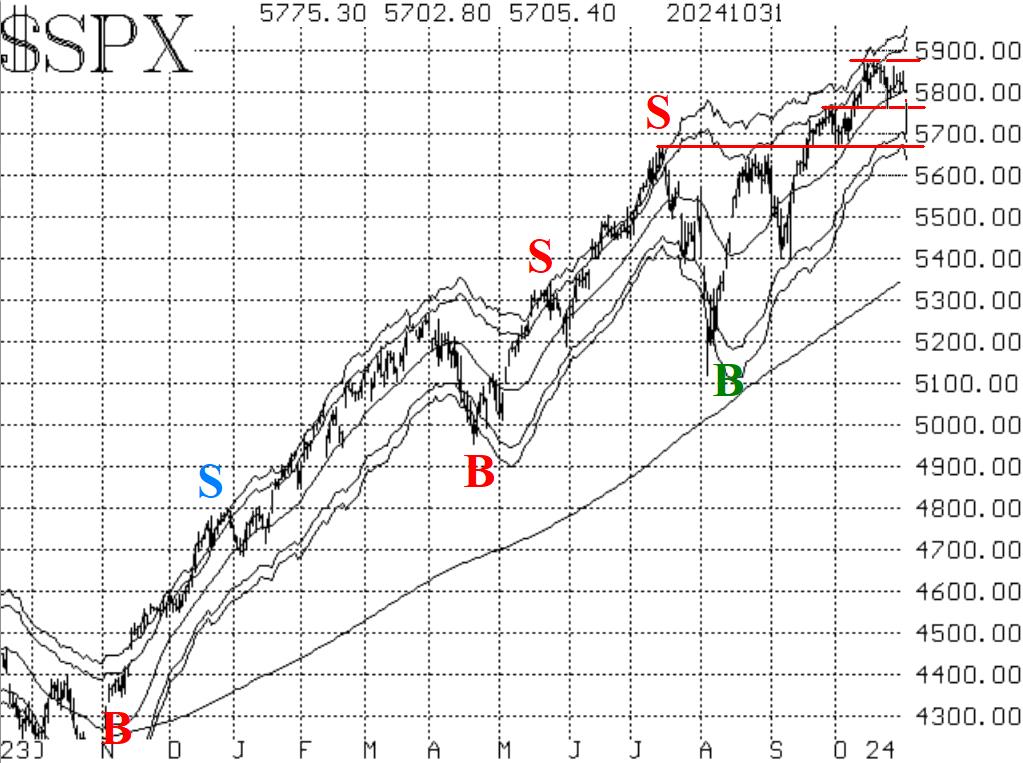

The broad market has stalled out at about 5870 and has pulled back from there. So, that is short-term resistance. The sharp pullback on October 31st didn't quite reach the support level at 5670, but it came close. So there is a trading range between 5670 and 5870 in effect now, but it is highly likely that the range will not be able to contain a post-election market.

A move above 5870 would be to new all-time highs and that would be quite bullish. However, a close below 5670 would violate not only the support from early October, but the previous highs in July and September. That would bring in a good deal of selling I would think.

Equity-only put-call ratios have started to move more sharply higher, and that confirms their tentative sell signals from a week ago. Earlier this week, the ratios were more or less moving sideways, but now that they have begun to accelerate upward, that is the sell signal confirmation.

Breadth has been poor this week, and the breadth oscillator sell signals that were in place from a week ago have proven to be correct. Both oscillators are now in oversold territory, but won't generate buy signals until they reverse from these levels.

$VIX and its tradeable products are where the nervousness about the election shows up. $VIX itself rose sharply yesterday, and closed at its highest level since August. That stopped out the "spike peak" buy signal that was in place, but eventually a new "spike peak" buy signal will take place since $VIX is already back into "spiking" mode. Meanwhile, the trend of $VIX sell signal is still intact, because $VIX is well above its 200-day Moving Average (currently at 15.70 and rising).

In summary, we are still holding a "core" bullish position as long as $SPX closes above 5670. We will add other positions along the way, as signals are confirmed, and we will take partial profits on any deeply in-the-money options.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation