Dec, 04, 2023

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on December 4, 2023.

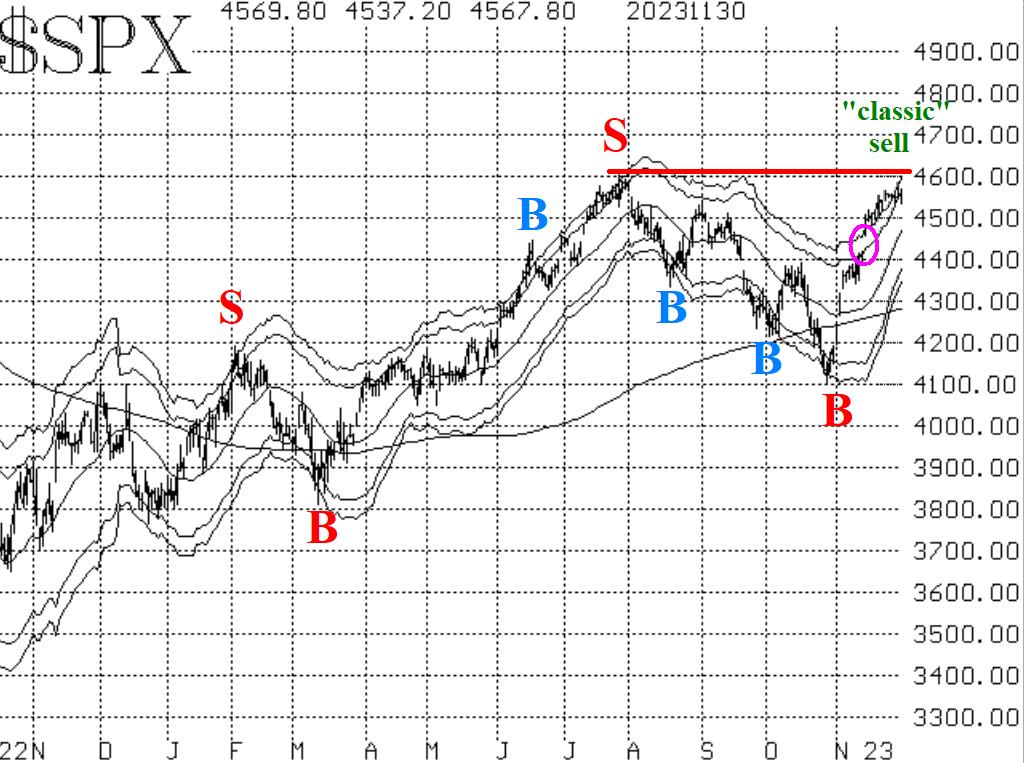

Dec, 01, 2023

By Lawrence G. McMillanThe massive rally of November has slowed a bit, but $SPX continues to move higher. The Index is now approaching the 2023 highs near 4600, which may offer some resistance. If...

Nov, 28, 2023

By Lawrence G. McMillanWe have been trading this seasonal spread annually every year since 1994, except for 1995. Last year, we were stopped out, but still with a gain.In its current form, we buy...

Nov, 27, 2023

By Lawrence G. McMillanThere are actually three different positive (bullish) seasonal systems that occur between Thanksgiving and the start of the new year. In short, they are 1) the post-...

Nov, 27, 2023

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on November 27, 2023.

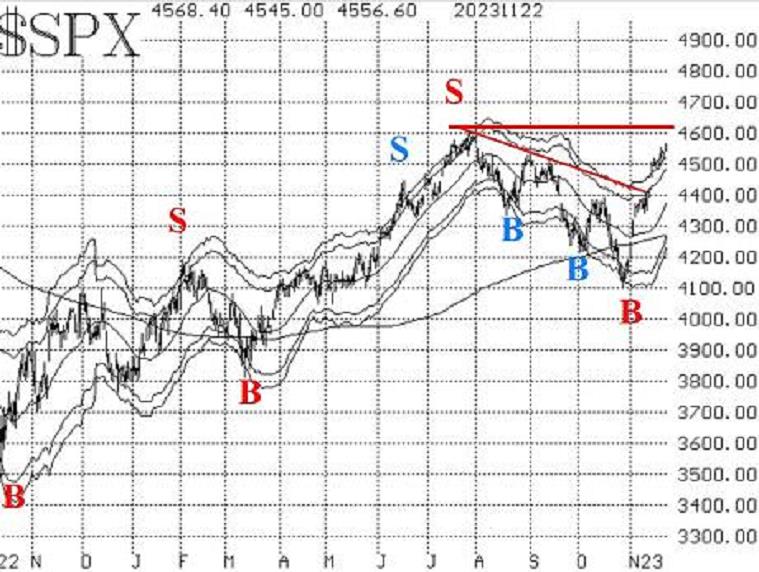

Nov, 24, 2023

By Lawrence G. McMillanThe broad stock market continues to plow ahead, building on the recent upside breakout over 4400. Even though there are some signs of an overbought market, we are not seeing...

Nov, 20, 2023

By Lawrence G. McMillanThis article was originally published in The Option Strategist Newsletter Volume 13, No. 2 on January 22, 2004. In our last issue, we summarized our trading...

Nov, 20, 2023

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on November 20, 2023.

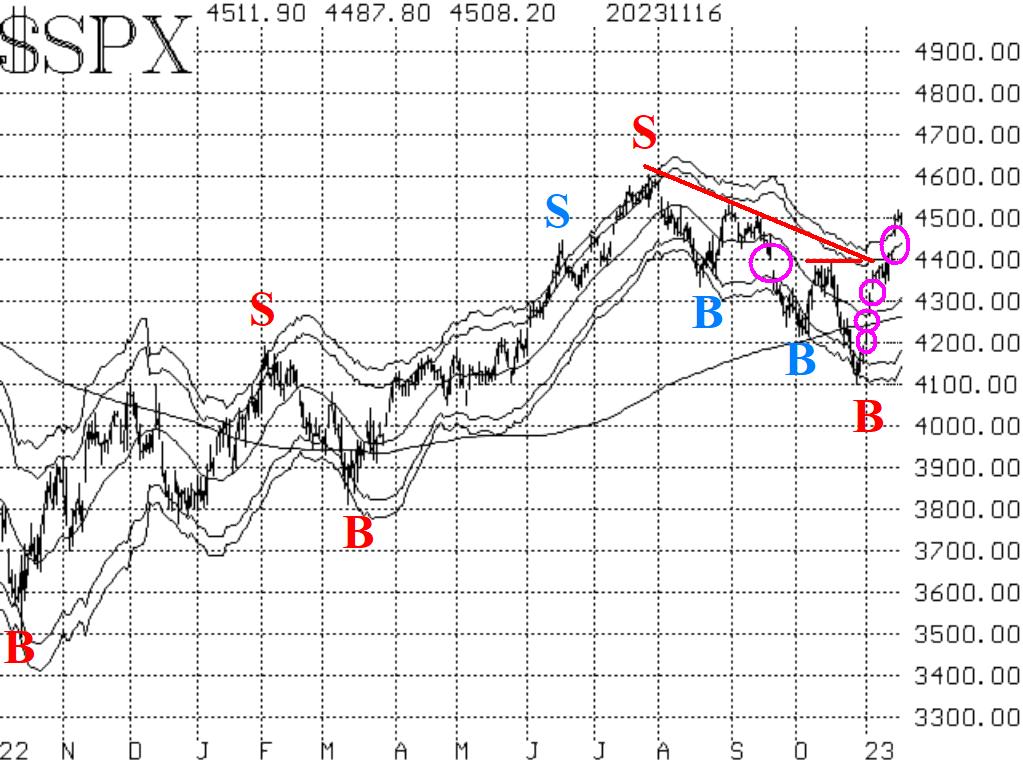

Nov, 17, 2023

By Lawrence G. McMillanOn November 13th, $SPX closed above 4402 for the second of two consecutive days, which was enough to dictate a bullish stance since it was an upside breakout over resistance...

Nov, 13, 2023

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on November 13, 2023.

Pages

© 2023 The Option Strategist | McMillan Analysis Corporation