By Lawrence G. McMillan

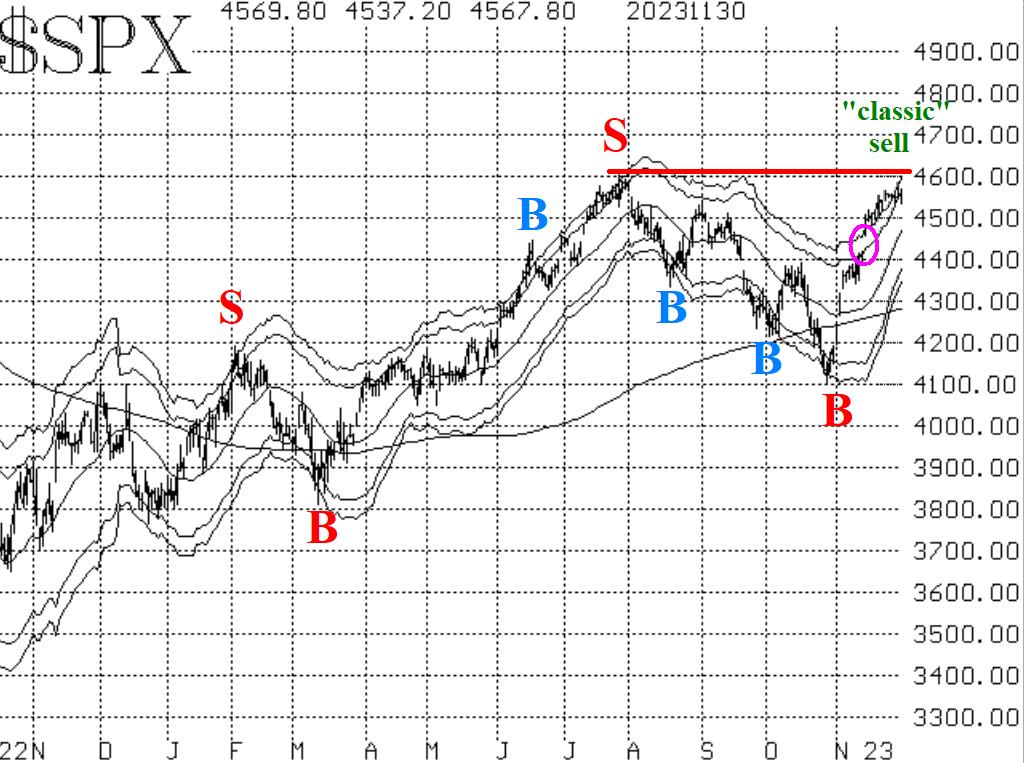

The massive rally of November has slowed a bit, but $SPX continues to move higher. The Index is now approaching the 2023 highs near 4600, which may offer some resistance. If that is overcome, then sights will be set on the all-time highs at 4800 (from early 2022). If there is a pullback, it is likely to come sooner rather than later, since there is bullish year-end seasonality (although there is a general positive influence for most of December in any case). Any pullback will likely be minor perhaps closing the gap down to 4420 on the $SPX but not much more. It would be a game-changer, though, if $SPX were to fall below 4400.

As we walk through the various indicators, one will see that many are overbought. But remember that "overbought does not mean sell." Sell signals always require necessary confirmation, but especially before venturing in against this strong market trend.

Equity-only put-call ratios are plunging now, as call buying has increased. The weighted ratio is already reaching the lower regions of its chart, meaning that it is in overbought territory. These won't give sell signals until they roll over and begin to rise.

Market breadth has improved, but is still not stellar. In any case, the breadth oscillators are on buy signals and are in modestly overbought territory. It would only take one or two days of negative breadth to generate sell signals from these oscillators, but they have been subject to whipsaws recently, so we are relying more on other indicators at this time.

$VIX is quite subdued and traded at a new 2023 low this week. In fact, that was the lowest level since January 2020 only slightly prior to the pandemic "crash." Fear-mongers are already citing that fact, but the real thing one needs to pay attention to with $VIX is its trend. Currently the trend of $VIX is downward, and that is a bullish signal for stocks.

Overall, we are maintaining a "core" bullish position, based on the strong $SPX chart. We will trade other confirmed signals around that "core."

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation