By Lawrence G. McMillan

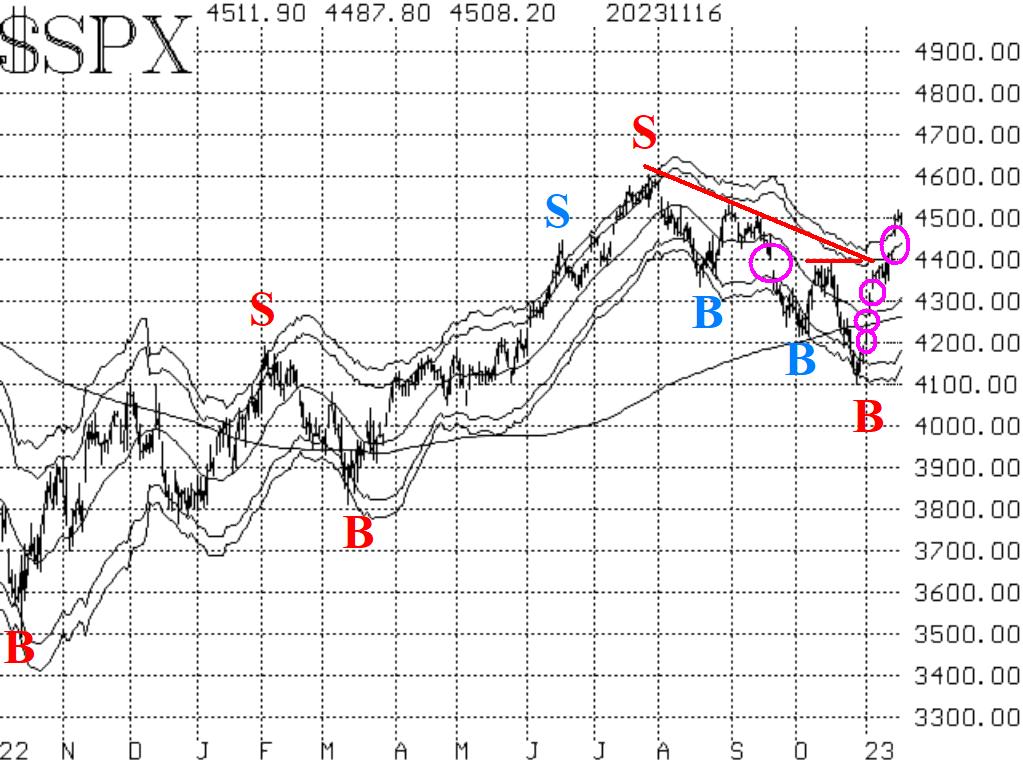

On November 13th, $SPX closed above 4402 for the second of two consecutive days, which was enough to dictate a bullish stance since it was an upside breakout over resistance and over the downtrend line, as well as closing the gap from the September breakdown. Then another huge upside gap was formed on November 14th, when there was favorable CPI data.

The next upside targets would be resistance at 4510 (which has already been reached), 4540, and the 2023 highs at 4610. Beyond there, bulls can dream of an assault on the all-time highs above 4800.

On the negative side, breadth hasn't been all that great. But perhaps the biggest problem I see is that there are just too many gaps on the SPX chart. The latest one is the fourth one. It would be filled on a pullback to 4421. That is certainly possible, as the market often retests a breakout level before resuming its uptrend.

Equity-only put-call ratios are finally back on the same page: both are on buy signals now. The standard ratio moved to a buy signal over a month ago -- prematurely, to be sure. The weighted ratio was reluctant to confirm that buy signal, but finally did over the past week.

Breadth hasn't been great. If $SPX is breaking out to new relative highs, one wants to see breadth get very overbought and stay in that condition. But that has not been the case here.

$VIX has generally been staying flat with the stock market rising. The "spike peak" buy signal is still in place. Meanwhile, the trend of $VIX is now on the verge of a new buy signal of its own.

In summary, we are holding a "core" bullish position now, after the breakout over 4400. We will continue to hold that position unless $SPX were to fall back below 4370, which would indicate this whole move was a false upside breakout. That seems unlikely to happen. Meanwhile, we will trade other confirmed signals around this "core" bullish position.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation