By Lawrence G. McMillan

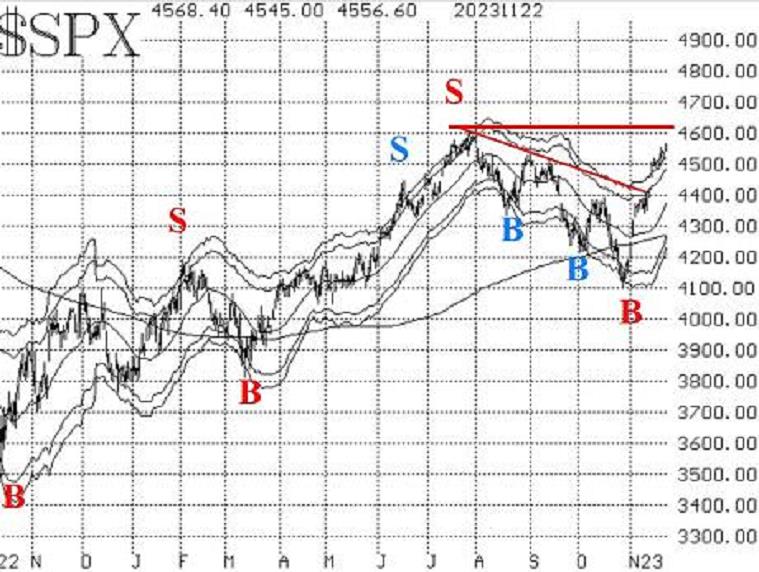

The broad stock market continues to plow ahead, building on the recent upside breakout over 4400. Even though there are some signs of an overbought market, we are not seeing any confirmed sell signals yet. $SPX has overcome two small resistance levels, leaving the 2023 highs near 4610 as the next area to overcome. Above there, the all-time highs at 4800 might be challenged.

As for downside possibilities, there is still an obvious gap on the $SPX chart down to 4420 or so that could easily be filled. Even if that were filled, it would still leave the bullish scenario intact. As long as $SPX doesn't close below 4400, the $SPX chart is bullish.

Equity-only put-call ratios remain on buy signals as both are declining. There is once again some distortion from equity put arbitrage, especially noticeable on the CBOE, where Tuesday's CBOE Equity-only put-call ratio was 1.10. But that is just "noise" as far as the predictive capability of the equity-only put-call ratios are concerned. They will remain on buy signals for stocks until they roll over and begin to rise.

Market breadth has not been strong. In fact, for a brief moment a week ago, the breadth oscillators rolled over to sell signals, but they have since recovered. At the current time, they are on buy signals, and they are in modestly overbought territory. So, breadth has been disappointing, and even one day of negative breadth could throw the oscillators back onto sell signals.

$VIX has edged lower, although it doesn't seem to want to break below the yearly lows near 13. This has kept both the "spike peak" and Trend of $VIX buy signals intact. The "spike peak" buy signal, however, is about to "expire" on its own. The trend of $VIX buy signal would only be terminated if $VIX closes above its 200-day Moving Average.

There is a new seasonally bullish period about to begin, after Thanksgiving. In summary, we are maintaining a "core" bullish position as long as $SPX is above 4400, and we will trade other confirmed signals around that "core" position.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation