Jan, 31, 2024

By Lawrence G. McMillanThe full track record, including 2023, is now available on our website. The information for 2023 is going to be presented in this article. 2023 was a profitable year for our...

Jan, 29, 2024

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on January 29, 2024.

Jan, 26, 2024

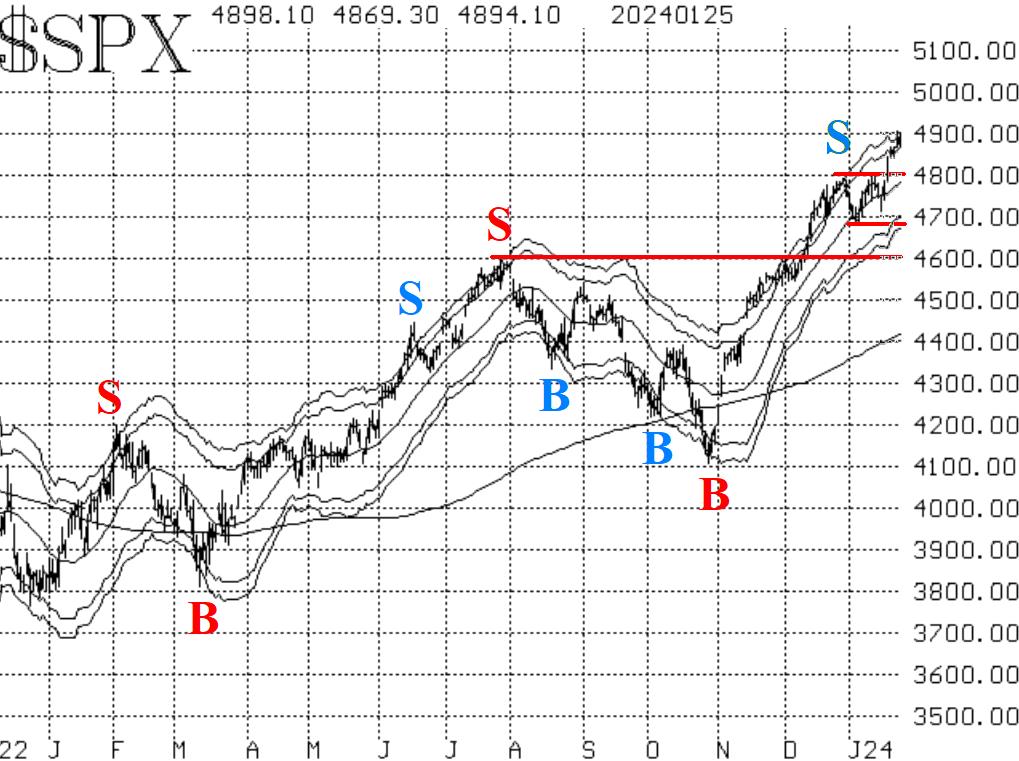

By Lawrence G. McMillanNew all-time highs (both intraday and closing) were registered on Friday, January 19th, by $SPX. Since then, $SPX has added onto those gains every day, setting new all-time...

Jan, 22, 2024

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on January 22, 2024.

Jan, 19, 2024

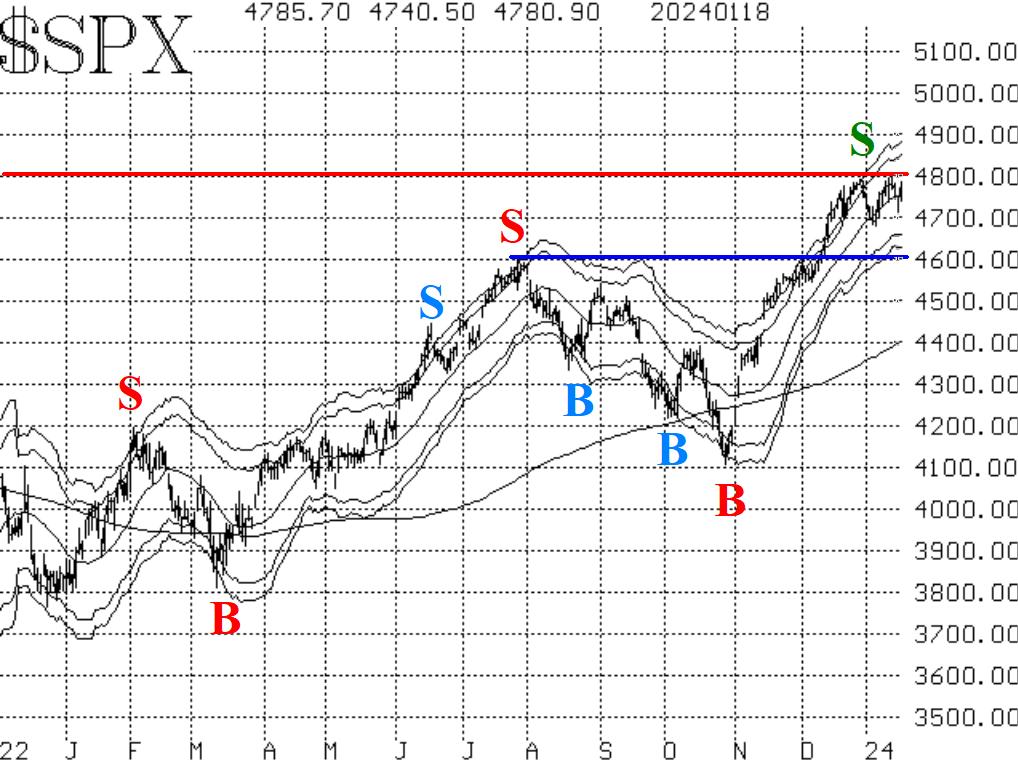

By Lawrence G. McMillanDespite more deterioration in the internal indicators (put-call ratios, breadth, New Highs vs. New Lows), $SPX has not weakened much and remains near all-time highs. Both the...

Jan, 16, 2024

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on January 16, 2024.

Jan, 12, 2024

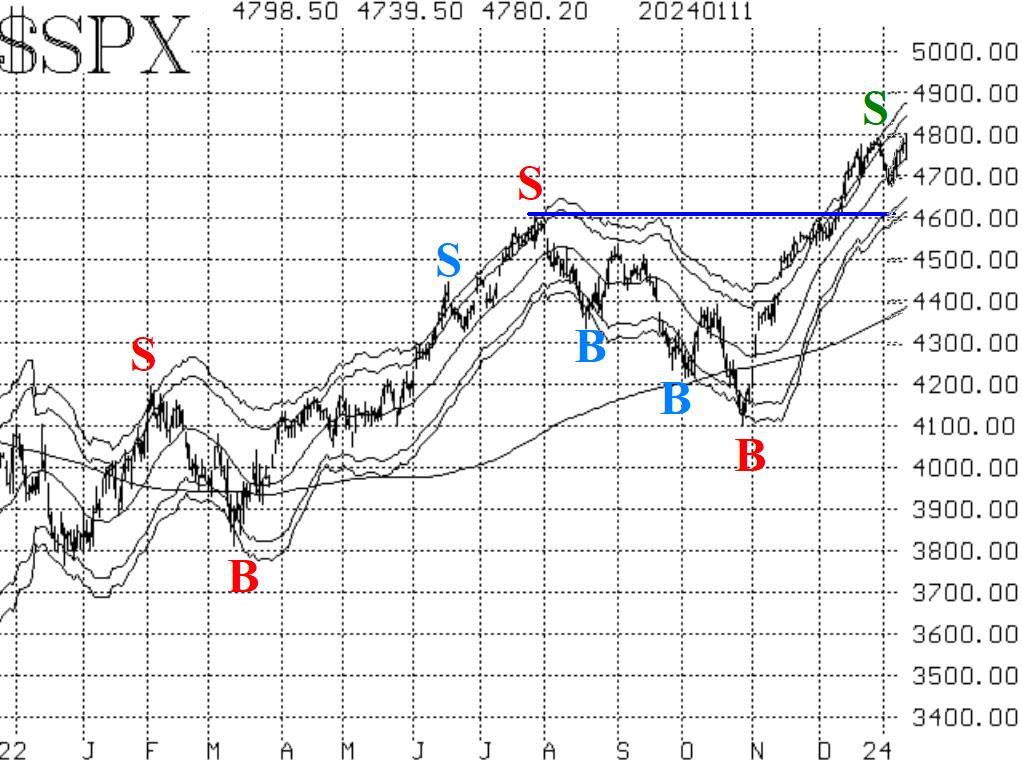

By Lawrence G. McMillanNew 2024 highs have been registered this week for $SPX. The all-time highs for $SPX were set in January 2022. The intraday high was 4818, and the closing high was 4796. Most...

Jan, 11, 2024

By Lawrence G. McMillanThere are two seasonal trading systems that we utilize in January – one bearish and one bullish. The first one is the bearish one. It is called the “January Defect” by some,...

Jan, 08, 2024

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on January 8, 2024.

Jan, 05, 2024

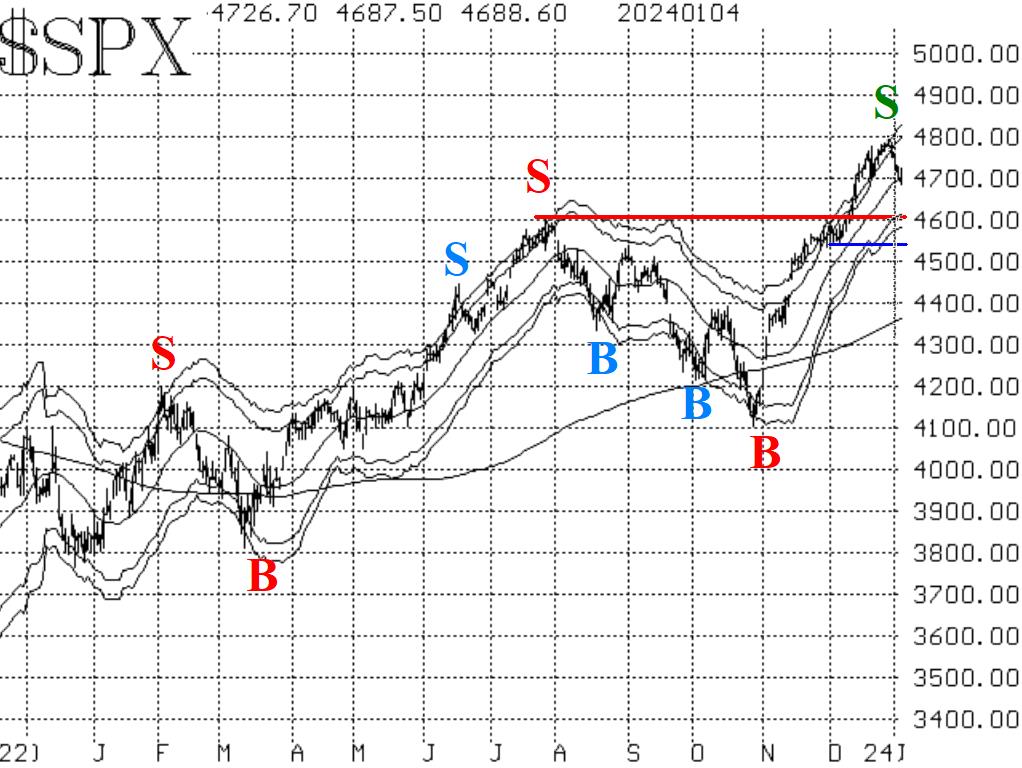

By Lawrence G. McMillanHeavy selling hit the market this week. Part of that was due to the fact that traders didn't want to sell in 2023, because of the taxes that would be owed. So, they sold in...

Pages

© 2023 The Option Strategist | McMillan Analysis Corporation