Special Situation Alerts

A Daily Service Featuring Distressed Stocks, Special Situations and Event-Driven Option Trades.

Special Situation Alerts is McMillan Analysis Corp.'s newsletter service designed for the alpha trader seeking to produce exceptional returns. Delivered each afternoon, the Special Situation Alerts provides option trading recommendations on unique trading opportunities based on our proprietary methodology. Trading recommendations are made when appropriate and are monitored closely throughout the life of the position.

Special Situation Trading and Event-Driven Trading are two of McMillan Analysis Corp.'s powerful trading approaches. The stocks chosen are based on a filter that helps identify special-situation stocks according to potential return relative to the risks, probability, and several other deciding factors. The newsletter features independent, original, and thoughtful research, providing insight into the process of wealth creation.

This newsletter puts the analysis in your hands and enables you to trade using our methodology.

The Special Situation Alerts Subscription Includes:

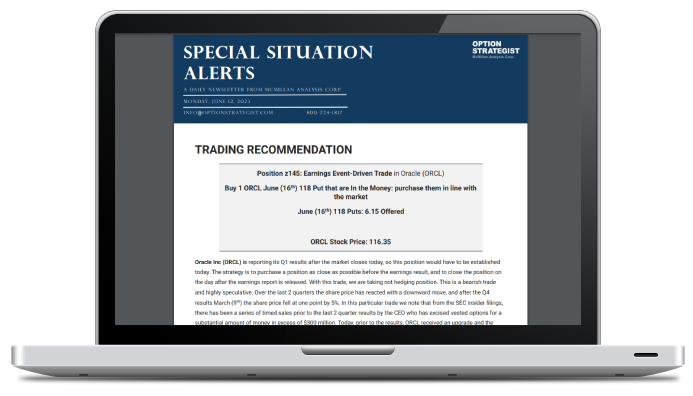

- Specific Trading Recommendations

Trading recommendations based on the most attractive distressed stocks and event-driven opportunities. Includes follow-up action, trading stops, position analysis, and a recap of what happened with previous recommendations (if there were any). - Detailed Analysis

All trading recommendations include an in-depth write-up explaining the rationale behind the trading opportunity.

About Special Situation Trading

There are always companies in the market that look terrible, while others look like they’ll never retreat. The first instinct for the regular trader is to go with the crowd, however, trading in these stocks can be worthwhile when you structure the trade in the correct way.

- Special Situation Trading: This strategy employs a proprietary process that seeks to identify situations where a company’s stock price has the potential to stage a substantial recovery from depressed levels over an intermediate-term holding horizon. Common catalysts driving such stock price recoveries include a rise in valuation, shareholder activism, or M&A activity. A stop-loss discipline is employed in order to manage risk in accordance with strategy risk/reward metrics.

About Event-Driven Trading

Event-Driven Trading is focused on specific criteria in temporary stock mispricings, or consistent recurring patterns which can occur for a number of reasons. Markets can overreact or underreact to particular news and this strategy exploits the tendency of a company’s stock price to suffer during a period of change.

- Event-Driven Trading: This strategy focuses primarily on earnings event-driven trading, where a multi-factor process is employed in an attempt to identify directional trading opportunities with a short-term holding horizon. This approach is designed for the short-term trader seeking an uncorrelated strategy that has the potential to achieve high returns with a defined risk of loss.

- Earnings Event-Driven Trading: While the trading of earnings announcements can be a great source of rewards with a short holding period, the inherent risk element is heightened given the impact of the post-earnings announcement volatility collapse. For this reason, the strategy eschews the use of conventional methods of capturing large event-driven price moves (higher or lower) using a Straddle or a Strangle. Instead, a directional position is preferred, informed by key metrics and proprietary analysis.

Satisfaction Guaranteed

If you are not completely satisfied with your subscription, you may cancel at any time and a prorated refund will be issued based on the remaining unused portion of the subscription.

If you are not completely satisfied with your subscription, you may cancel at any time and a prorated refund will be issued based on the remaining unused portion of the subscription.

Free Trial Subscriptions are not renewed automatically. Paid Trial Subscriptions will renew at the shortest subscription length offered (e.g. monthly / quarterly). Paid auto-renew subscriptions are set to automatically renew monthly, quarterly, or annually for your convenience and to avoid any interruption of service.

© 2026 The Option Strategist | McMillan Analysis Corporation