By Lawrence G. McMillan

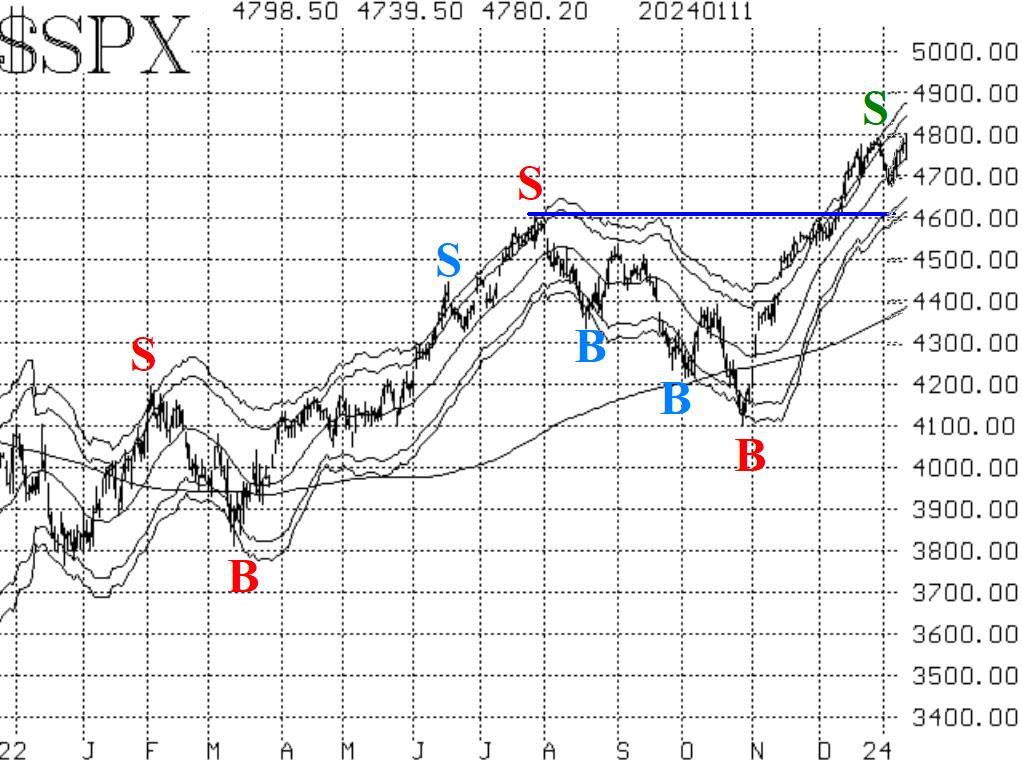

New 2024 highs have been registered this week for $SPX. The all-time highs for $SPX were set in January 2022. The intraday high was 4818, and the closing high was 4796. Most recently, $SPX has not bettered either of those numbers, but it's not far away. A two-day close above 4800 would be enough confirmation that the next leg of the bull market is ready to take place.

There is support just below 4700 (last week's lows), and there is stronger support near 4600. The important area is 4550 the December lows. If $SPX closes below there, then a much more bearish scenario is likely to play out. There is an old rule of thumb (citing Trader's Almanac), that if $SPX violates the December lows during the ensuing first quarter of the next year, a bear market is in place.

Equity-only put-call ratios are shown in Figures 2 and 3. They have both rolled over and begun to rise. The rise is more pronounced on the standard ratio chart (Figure 2), but as long as these ratios are rising, it is a bearish signal for stocks. The computer analysis programs that we utilize agree that these are on sell signal. These signals are emanating from very low levels on the charts meaning that they are starting from very overbought conditions.

Breadth has not been good. Since just before the end of 2023, there have been a lot of days with strongly negative breadth, and only one day with strongly positive breadth. As a result, the breadth oscillators are on sell signals, and those signals have been confirmed.

$VIX has remained low, and that is a bullish sign for stocks. A low $VIX may be an overbought condition, but it is not a sell signal. The sell signals will come from $VIX when it begins to rise (sharply). Currently, the trend of $VIX buy signal remains in place. It would be stopped out if $VIX were to rise and close above its declining 200-day Moving Average (currently at 15.70).

We continue to maintain a "core" bullish position because of the positive nature of the $SPX chart. We are trading other confirmed signals around that "core."

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation