By Lawrence G. McMillan

Heavy selling hit the market this week. Part of that was due to the fact that traders didn't want to sell in 2023, because of the taxes that would be owed. So, they sold in 2024, deferring the tax bill for a year. But there is more to the story than that, as overbought conditions had built up to the point where sell signals are now appearing in numerous places although not in the implied volatility ($VIX) complex.

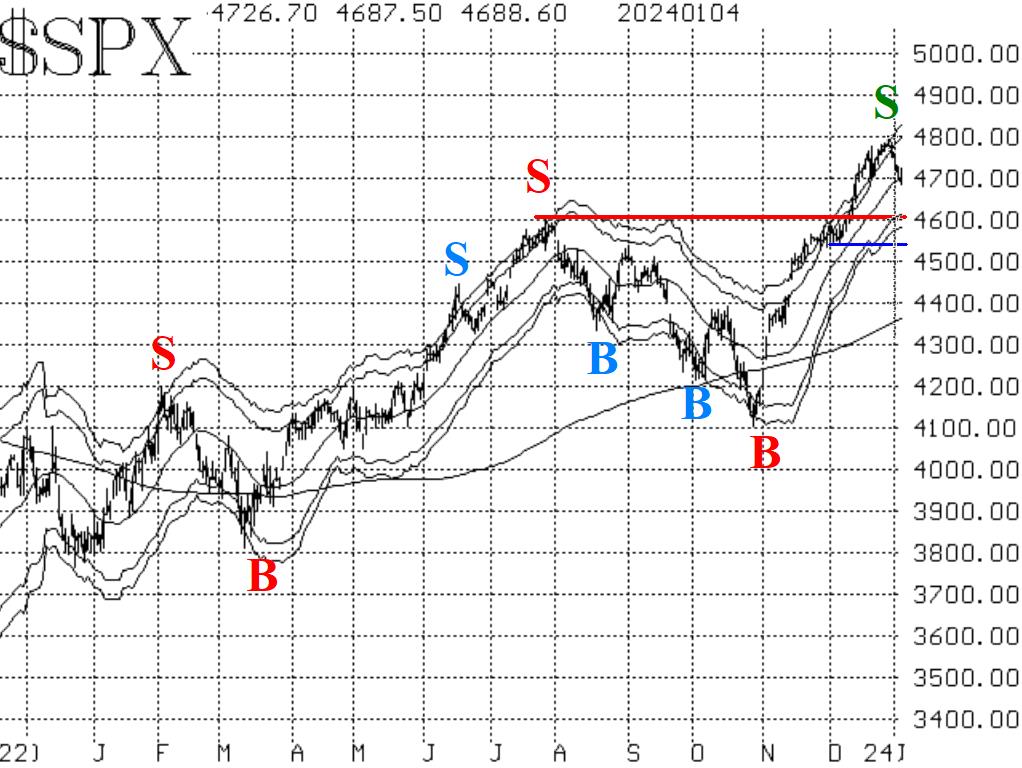

There is now resistance just below 4800 (the December highs). Of course, this is very near to the all-time highs set in January 2022.

There is support on the $SPX chart at 4600 (horizontal red line on the chart in Figure 1). A pullback to there, while not necessarily pleasant, would still keep the chart bullish overall. However, a decline below 4600 and especially a decline below the December lows at 4550 would be a game-changer as to the trend of the $SPX chart. As it is, the chart is still bullish as long as support holds at 4600, and a "core" bullish position can be maintained.

That's the positive news. There is a lot of negative news surrounding the internals of the market.

Equity-only put-call ratios have curled upward, and these are now on confirmed sell signals, according to the computer programs that we use to analyze these charts. These sell signals are coming from the low levels on their charts (i.e., from overbought conditions).

Market breadth had been tremendously strong at the end of 2024, but now it has turned heavily negative. As a result, both breadth oscillators rolled over to sell signals on January 3rd.

The implied volatility complex is much more bullish on the market than just about everything else. Recall that we have often pointed out the fact that a low $VIX is not a sell signal in and of itself; $VIX only generates sell signals for stocks if it starts to rise sharply. That has not happened (yet). $VIX has yawned at the selling that took place this week. It barely rose above 14.

Overall, we are still carrying a "core" bullish position, and we are adding new confirmed sell signals around that. In addition, some of the previous bullish signals have expired or are being stopped out.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation