By Lawrence G. McMillan

New all-time highs (both intraday and closing) were registered on Friday, January 19th, by $SPX. Since then, $SPX has added onto those gains every day, setting new all-time closing highs each day. It seems that a large chunk of the buying impetus came from short covering and "chasing" by longs who weren't fully invested. But there isn't the euphoria that one might normally expect to see, since many stocks are in far worse shape than the major indices.

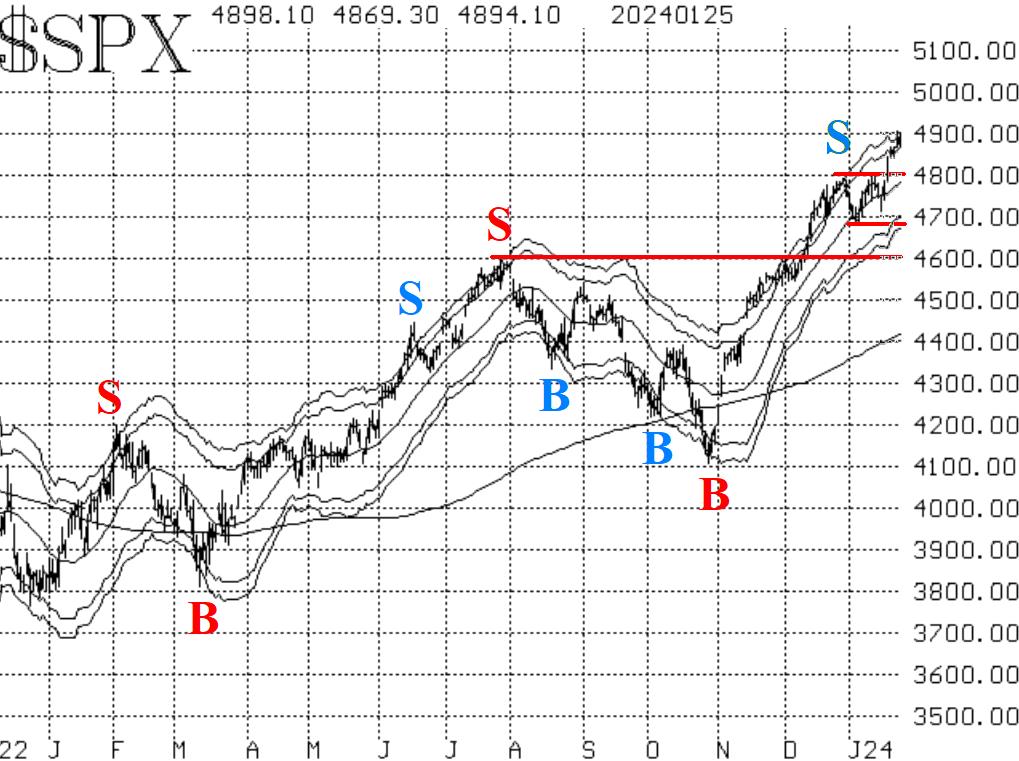

Since $SPX had spent nearly a month building a base while trading in the 4680 4800 trading range, there should be strong support in that area. A close below 4680 would be very negative, but that doesn't seem likely to happen anytime soon. As for resistance, there is none in the technical sense, since $SPX is at all- time highs.

Equity-only put-call ratios remain on sell signals (for stocks). Even though they've both curled downward over the past few days, the computer analysis programs are still grading them as bearish. As long as they are rising, that's a bad sign for stocks.

Breadth improved just as $SPX was breaking out to new all- time highs, and the breadth oscillators rolled over to buy signals at that time. They remain on those buy signals, and now they have just reached the beginning of overbought territory. It is a positive thing to see these oscillators get overbought when $SPX is breaking

Meanwhile, $VIX has remained subdued and that is also bullish for stocks. Yes, $VIX is low, but that is not a problem for the stock market. The problem would come if $VIX were to rise sharply. It has not done that yet. So, the trend of $VIX buy signal remains in place and will continue to do so until $VIX closes above its declining 200-day Moving Average (which is currently at 15.30).

So, we continue to maintain our "core" bullish position because of the positive nature of the $SPX chart. We are trading other confirmed signals around that, and we are rolling long call options higher as they become deeply in-the-money. One might have figured that a number of sell signals would be appearing by now, but the few that did are all stopped out, so the bulls have it their way right now. Even so, we expect to see more sell signals appear if the market begins to top out. February has been an ugly month a few times in recent memory: 2018 and 2020, especially, but the last two years saw declining Februaries as well.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation