Option Evaluation Software

Determine theoretical option prices with this advanced Black-Scholes Calculator

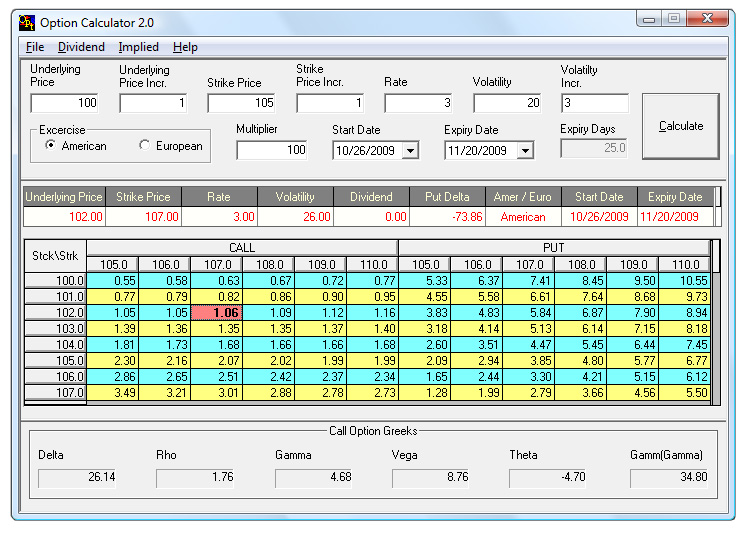

Larry McMillan stresses in his seminars and books that option traders must always trade with a model. The Option Evaluation Software is that model. Using the Black-Scholes model, The Option Evaluation Software calculates option values and related statistics, such as implied volatility and "the Greeks,” and displays them in a clean, easy-to-read grid-like display. It is a necessary piece of software for any serious option trader.

What is the Black-Scholes model?

The Black-Scholes model, introduced in 1973 by Fischer Black and Myron Scholes, is an option valuation model that is the standard method of pricing options.

Why use the Option Evaluation Software?

- It can help you determine what your option position would be worth at any stock and volatility

level at any time. - It can help you determine which option to buy, and how many contracts.

- The Option Evaluation Software can save you money over time by helping you determine what

options are over / underpriced.

How to use the Option Evaluation Software

The Option Evaluation Software is actually quite easy to use. Simply enter the underlying price, price increment, strike price, strike price increment, current T-Bill interest rate, and historical volatility and press “calculate.” The software will then display a matrix of put and call values for six strike prices and eight underlying prices. Click on any particular option value and the Delta, Rho, Gamma, Vega, Theta, and Gamma of Gamma value will be displayed in the “Call Option Greeks” window.

More about the Option Evaluation Software:

- Dividend payouts and implied volatility of options can either be automatically calculated or

manually entered. - Option Greeks are given for each option (Delta, Rho, Gamma, Vega, Theta, and Gamma of Gamma).

- The grid of option values displays option prices at multiple strike and stock prices simultaneously.

- Choose either American-style or European-style exercise.

- Extensive User Manual included.

System Requirements

PC-Operating System Compatible: Windows® 2000, XP Home, XP Pro, 2003 Server, Vista, Windows 7* (download only), Windows 8* (download only), Windows 10* (download only).

*NOTE: Software will not run on any MAC OS. The CD-Rom will not work on Windows 7, Windows 8, and Windows 10. To install on Windows 7, Windows 8, or Windows 10 choose the DOWNLOAD option.

© 2026 The Option Strategist | McMillan Analysis Corporation