Sep, 27, 2024

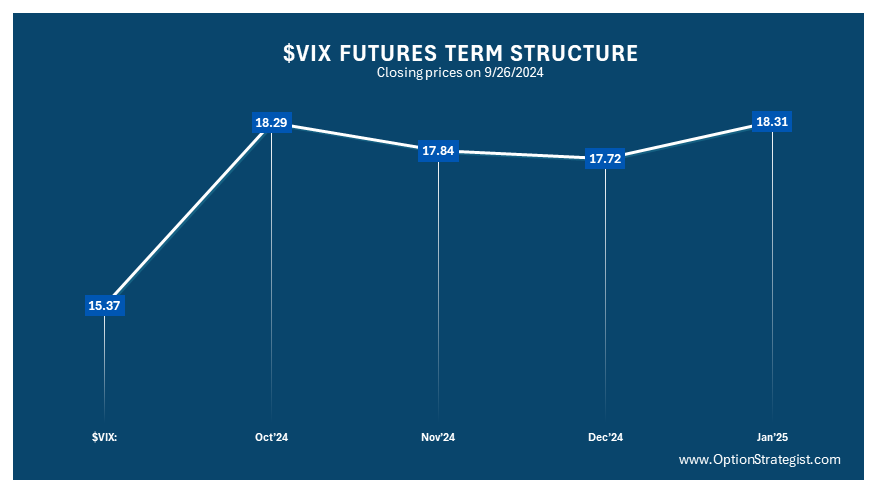

By Lawrence G. McMillanThe “election bump” is the term that I have given to the distortion in the term structure of the $VIX futures prices. Specifically the October $VIX futures continue to...

Jul, 30, 2024

By Lawrence G. McMillanAs we head into another Presidential election, understanding how the stock market behaves during these periods can be invaluable for investors. Over the years, we have compiled...

Oct, 19, 2020

By Lawrence G. McMillanThere has only been one contested election since listed options have been trading – the 2000 election between George W. Bush (43) and Al Gore. Election day was November 7th,...

Oct, 13, 2020

By Lawrence G. McMillanWe have previously seen that $VIX has a slightly different pattern in election years than in most years. We wrote about this in the September 4th issue, so please refer to that...

Oct, 09, 2020

By Lawrence G. McMillan$SPX In Election YearsWe have $SPX data going back to 1950, so it wasn’t too difficult to construct the following Table, which shows the performance of the market (as measured...

Sep, 09, 2020

By Lawrence G. McMillanThis year has been a wild and crazy year in many respects – probably nowhere more than in volatility. That has manifested itself in the trading of $VIX. Over the...

Aug, 19, 2020

By Lawrence G. McMillanThis article was originally published in The Option Strategist Newsletter Volume 21, No. 20 on October 26, 2012. I’m always a bit dubious of analyses of how a...

Nov, 09, 2016

By Lawrence G. McMillanTrump has won, but the world is not coming to an end. Futures plunged overnight – at one point touching limit down = 107 points! But prices have completely...

Sep, 27, 2016

By Lawrence G. McMillan This article was originally published in The Option Strategist Newsletter Volume 21, No. 20 on October 26, 2012.We occasionally publish charts showing the seasonal...

Nov, 06, 2012

By Lawrence G. McMillanWe occasionally publish charts showing the seasonal pattern of $VIX. Figure 2 below shows the composite price of $VIX for a 23-year history (1989 through 2011). This...

Pages

© 2023 The Option Strategist | McMillan Analysis Corporation