Mar, 29, 2023

By Lawrence G. McMillanThis article was originally published in The Option Strategist Newsletter Volume 9, No. 17 on September 14, 2000. Covered call writing is not a subject that we...

Mar, 27, 2023

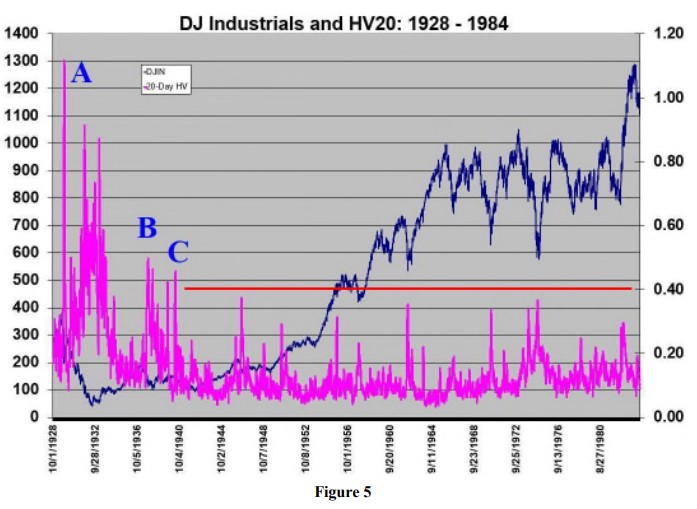

By Lawrence G. McMillanOne of the questions that traders – both retail and professional – have been asking all throughout the bear market that began in January 2022 is “What Is Wrong With $VIX?”...

Mar, 27, 2023

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on March 27, 2023.Click here to view this week's charts »This Market Commentary is an abbreviated...

Mar, 24, 2023

By Lawrence G. McMillanAs for the $SPX chart, it once again shows a lower high and lower low, since that February top. Moreover, the latest rally attempt, which began on March 13th, appears to merely...

Mar, 21, 2023

By Lawrence G. McMillanThis article was originally published in The Option Strategist Newsletter Volume 12, No. 9 on May 8, 2003. The 30th anniversary of the Chicago Board Option...

Mar, 20, 2023

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on March 20, 2023.Click here to view this week's charts »This Market Commentary is an abbreviated...

Mar, 17, 2023

By Lawrence G. McMillanStocks broke down early this past week, but found support in the same area as the late-December trading range. Specifically, $SPX broke down below 3930 and traded down into the...

Mar, 15, 2023

By Lawrence G. McMillanThis article was originally published in The Option Strategist Newsletter Volume 1, No. 22 on November 12, 1992. In the last issue, we looked at some of the...

Mar, 13, 2023

By Lawrence G. McMillanJustin Mamis was a famous stock market technician (he died in 2019). I particularly recall that he and James Dines were the only newsletter writers that seemed to be...

Mar, 13, 2023

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on March 13, 2023.Click here to view this week's charts »This Market Commentary is an abbreviated...

Pages

© 2023 The Option Strategist | McMillan Analysis Corporation