Aug, 16, 2012

By Lawrence G. McMillanThe stock market, as measured by the Standard and Poor’s 500 Index continues to rise (albeit very slowly of late). Even though the rise is slow, the fact that there has...

Aug, 13, 2012

By Lawrence G. McMillan(Barron's) - This bull market is rather unpopular—and that's good.Since the rally began in early June, most investors and traders have doubted the advance because...

Aug, 10, 2012

By Lawrence G. McMillanIn a continuation of the irregular series, explaining our analytical techniques, we are going to discuss how we interpret put-call ratio charts. This series began two...

Aug, 10, 2012

By Lawrence G. McMillanStocks have rallied to the top of the bullish $SPX channel (see chart, Figure 1). The top of the channel is at about 1410 currently, and the yearly highs are at 1420....

Aug, 09, 2012

By Lawrence G. McMillanBears are having trouble understanding why the stock market continues to rise, but in reality it’s due in part to the fact that there are still too many bears. Many of...

Aug, 07, 2012

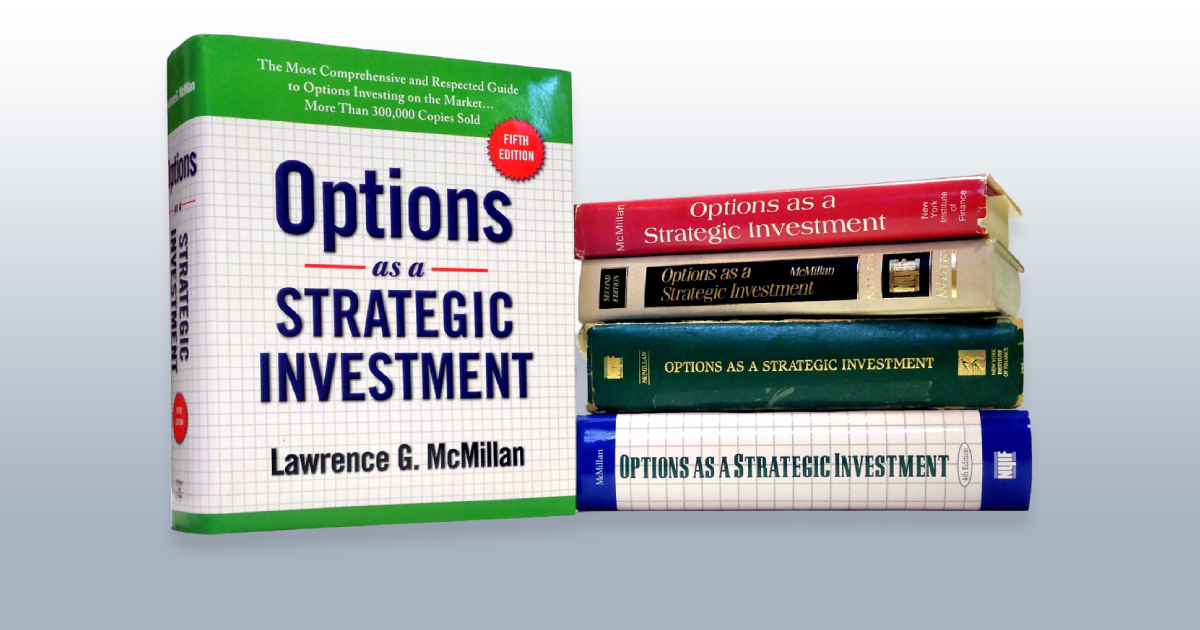

By Lawrence G. McMillanThe fifth edition of the best-selling book, Options As A Strategic Investment was released today, August 7th. An updated version of the Study Guide has also been...

Aug, 03, 2012

By Lawrence G. McMillanAlmost like clockwork, the pendulum of this market swings back and forth within the bullish trading range that $SPX occupies. As long as $SPX stays within this range, the...

Jul, 31, 2012

By Lawrence G. McMillanMORRISTOWN, N.J. (MarketWatch) — Since the broad stock market, as measured by the Standard & Poor’s 500 Index, bottomed in early June, the ensuing rise has been...

Jul, 27, 2012

By Lawrence G. McMillanThis week's selling drove $SPX down to the lower end of its bullish trading channel (see Figure 1). The selling managed to dissipate right near the lower channel, and so...

Jul, 26, 2012

By Lawrence G. McMillanThe recent sharp, 3-day decline in stocks produced very divergent readings in the breadth oscillators that we follow. Such divergences are rare – occurring...

Pages

© 2023 The Option Strategist | McMillan Analysis Corporation