Aug, 29, 2012

By Lawrence G. McMillanMORRISTOWN, N.J. (MarketWatch) — Despite the fact that the news media and fundamentalists can’t seem to find any reason to like this market, it refuses to sell off...

Aug, 27, 2012

By Lawrence G. McMillanFor quite some time now (perhaps since last November), we have been pointing out how the voracious appetite for volatility protection has had the effect of distorting the term...

Aug, 27, 2012

By Lawrence G. McMillanFor most of the last two weeks, the Standard & Poors 500 Index ($SPX) plowed ahead, finally making new post-2008 highs this past Tuesday. Our intermediate-term...

Aug, 17, 2012

By Lawrence G. McMillanThis market is becoming the ultimate in defying bearish opinion. Since June 1st, $SPX has advanced almost exactly 150 points and is nearly back to the yearly highs -- and...

Aug, 16, 2012

By Lawrence G. McMillanThe stock market, as measured by the Standard and Poor’s 500 Index continues to rise (albeit very slowly of late). Even though the rise is slow, the fact that there has...

Aug, 13, 2012

By Lawrence G. McMillan(Barron's) - This bull market is rather unpopular—and that's good.Since the rally began in early June, most investors and traders have doubted the advance because...

Aug, 10, 2012

By Lawrence G. McMillanIn a continuation of the irregular series, explaining our analytical techniques, we are going to discuss how we interpret put-call ratio charts. This series began two...

Aug, 10, 2012

By Lawrence G. McMillanStocks have rallied to the top of the bullish $SPX channel (see chart, Figure 1). The top of the channel is at about 1410 currently, and the yearly highs are at 1420....

Aug, 09, 2012

By Lawrence G. McMillanBears are having trouble understanding why the stock market continues to rise, but in reality it’s due in part to the fact that there are still too many bears. Many of...

Aug, 07, 2012

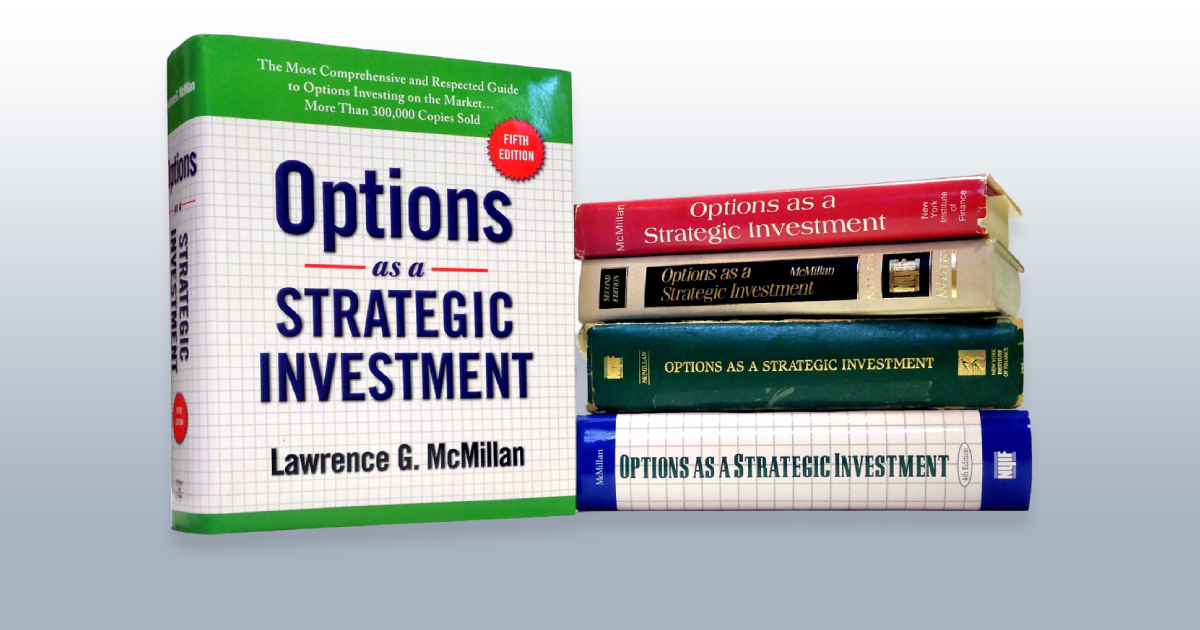

By Lawrence G. McMillanThe fifth edition of the best-selling book, Options As A Strategic Investment was released today, August 7th. An updated version of the Study Guide has also been...

Pages

© 2023 The Option Strategist | McMillan Analysis Corporation