By Lawrence G. McMillan

Last October, the CBOE changed the way it calculated $VIX – or, as the CBOE put it, the methodology was “enhanced.” The change was a logical and necessary one, in that weekly options were used in the calculation, where applicable. $VIX is a 30-day volatility estimate, and it had always used the two nearest series of $SPX monthly options. They were then weighted to produce a 30-day volatility measure.

The new methodology used weekly, monthly, or end-of-the-month, or end-of-the-quarter options – whichever most closely surround a 30-day expiration window.

The new methodology used weekly, monthly, or end-of-the-month, or end-of-the-quarter options – whichever most closely surround a 30-day expiration window.

The calculations and the options used for the $VIX futures did not change (they still use the single strip of $SPX options that expire 30 days after the $VIX derivatives’ expiration date).

A $VIX calculated the “old” way is still being disseminated. It trades with the symbol “$VIXMO.”

At the time of the change, we wrote – in Volume 23, No. 17 – that we expected the futures discount to be smaller with the new $VIX as opposed to the old ($VIXMO). Transposed, that’s another way of saying that the new methodology $VIX would not spike as high as $VIXMO did.

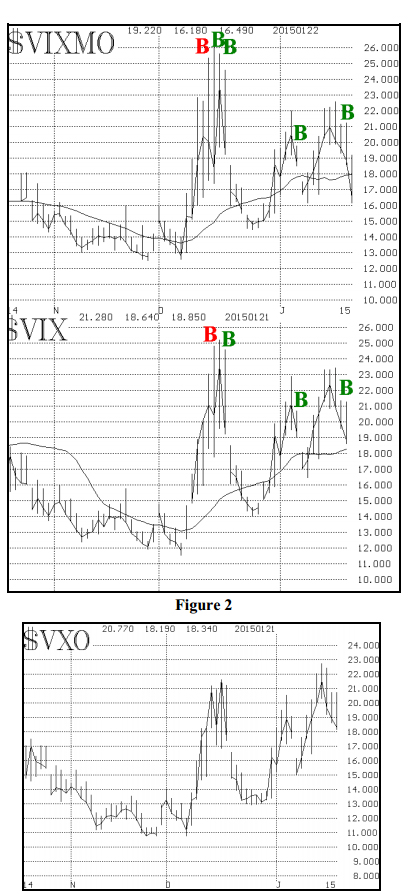

Figure 2 shows the comparison of the new $VIX and $VIXMO over the entire (short) trading history of $VIXMO. You can see that, in December, $VIXMO did spike to a higher level. It rose above 25 on three separate days, reaching 26.31 on December 15th. $VIX, however, was about a point lower on each of those days.

The same pattern was not upheld in January though. When the market sold off in the first week of the new year, $VIX rose to 23, but $VIXMO only got to 22. The same can be said of the mid-January selloff as well. Apparently the weighting of the longer-term February $SPX options in the $VIXMO calculation depressed it.

The various $VIX (and $VIXMO) spike peak buy signals are marked on the charts in Figure 2. You can seen that they line up quite well, but are not identical. In any case, we are not planning on paying much attention to $VIXMO signals.■

This article was published in the 1/23/15 edition of The Option Strategist Newsletter. Read all the articles. and get all of the trading recommendations by subscribing today. Introductory 3 month trial subscriptions are available for only $29.

© 2023 The Option Strategist | McMillan Analysis Corporation