By Lawrence G. McMillan

The post-Thanksgiving series of three seasonal trading periods has ended, and we are nearing the beginning of what is called the “January Defect,” when the market – and NASDAQ-100 ($NDX) stocks in particular, sell off. Following that, there is a strong seasonally bullish period at the end of January.

Recap of the Post-Thanksgiving Seasonals

The results were mixed for this year. On the day before Thanksgiving, November 26th 2025, these were the closing prices:

$SPX: 6812.61

$RUT: 2486.12

The three consecutive seasonal periods were 1) the post-Thanksgiving Day rally, 2) the January Effect (which now takes place in December), and finally the Santa Claus Rally, which terminates on the second trading day of the new year – January 5th, this year. On that latter date, the indices closed at the following prices, for the indicated gains:

$SPX: 6902.05, +89.44 (1.3%)

$RUT: 2547.92, +51.80 (2.5%)

It should be noted that both indices were higher than that in early December, but the market stumbled into year-end. The above results were very close to the long-term averages, with $RUT outperforming $SPX. Over the past 34 years (including this year), $SPX gained on average 1.6%, while RUT gained on average, 2.4%.

As for our position, on November 26th (the day before Thanksgiving), we bought 3 Russell 2000 ETF (IWM) call bull spreads to begin with. The spreads expired on Jan 9th, and used the 247-257 strikes. They were rolled up when IWM traded at 257 in early December. From there, though, IWM declined before making a bit of a late run, but still not back to the highs. The overall position made $735, on an investment of $1167, which is a good return. Of course, the original spreads made more than that. The subsequent pullback after those early December highs cost the position some money.

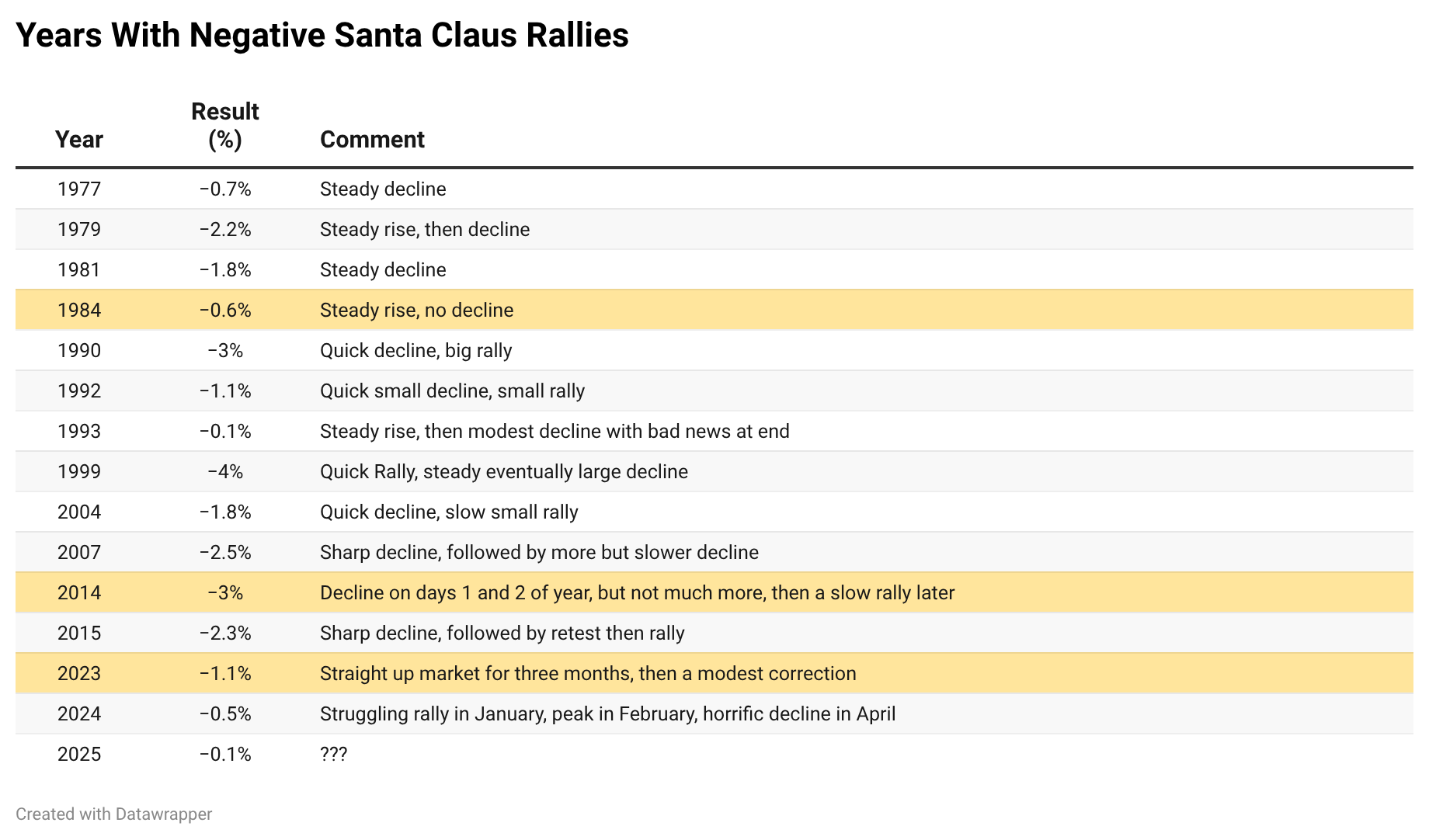

The Santa Claus Rally

This year, the Santa Claus Rally didn’t happen. The seasonal period produced a tiny loss. The following closing prices show the results in terms of $SPX...

Read the full article by subscribing to The Option Strategist Newsletter now. Existing subscribers can access the article here.

© 2023 The Option Strategist | McMillan Analysis Corporation