By Lawrence G. McMillan

The stock market has continued to make new all-time highs, accompanied by strong internal indicators. Eventually, overbought conditions may become confirmed sell signals, but so far that x hasn't been the case.

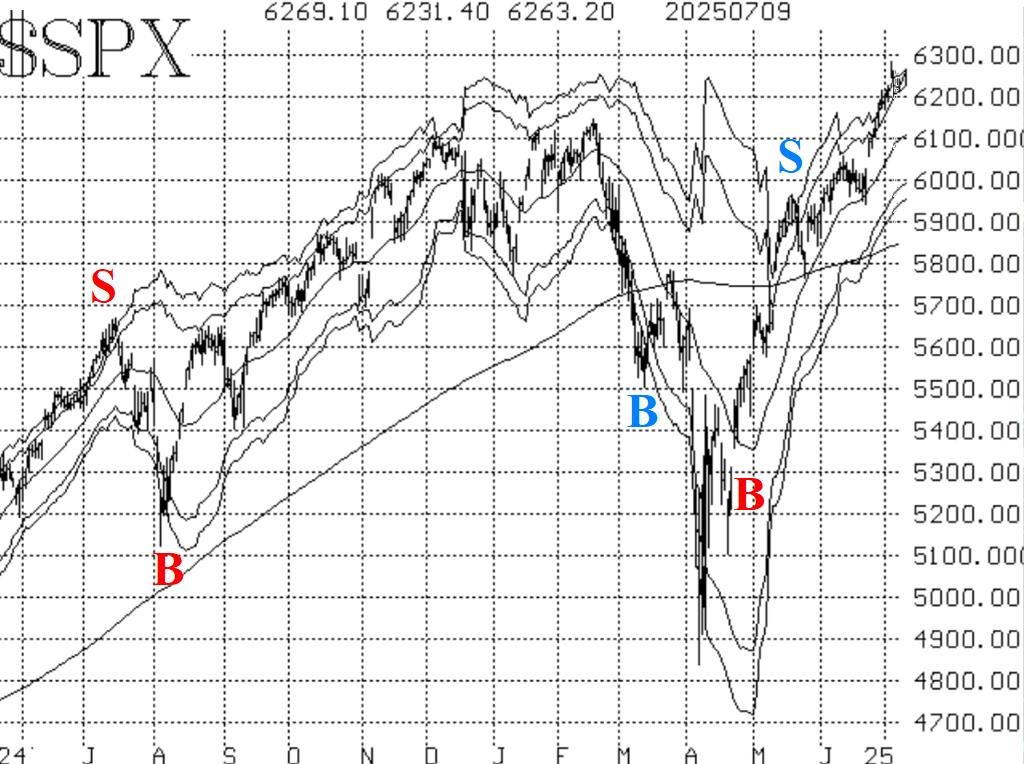

$SPX has support at 6150 (the previous highs), 6020-6060 (the highest open gap on the chart), and 5920. If it were to fall below 5920 then the $SPX chart would no longer be bullish, but we are not looking for that to happen.

Equity-only put-call ratios continue to fall. They are making new relative lows almost every day. This movement canceled out a previous sell signal and returned these indicators to a bullish status for stocks. As long as the ratios are declining, stocks can rally.

The breadth oscillators are strongly on buy signals and are in overbought territory. As we've often pointed out, it is a good thing for these oscillators to be overbought when $SPX is making new all-time highs, for that shows that participation is widespread.

Implied volatility ($VIX) remains low, as $VIX has drifted below 17. None of the turmoil in the political scene nor the world seems to have aroused $VIX yet. The two $VIX-related buy signals remain in place: the "spike peak" buy signal (which was confirmed on June 24th and runs for 22 trading days), and the trend of $VIX buy signal (which was confirmed on June 4th and will remain in effect as long as $VIX is below its 200-day MA).

Overall, the picture is about as bullish as it gets: the $SPX chart is strong, and the internal indicators are almost uniformly on buy signals. However, we will keep our eye on those overbought conditions and, if any roll over to confirmed sell signals, will act on them. Meanwhile, continue to roll deeply in-the-money calls up to higher strikes.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation