By Lawrence G. McMillan

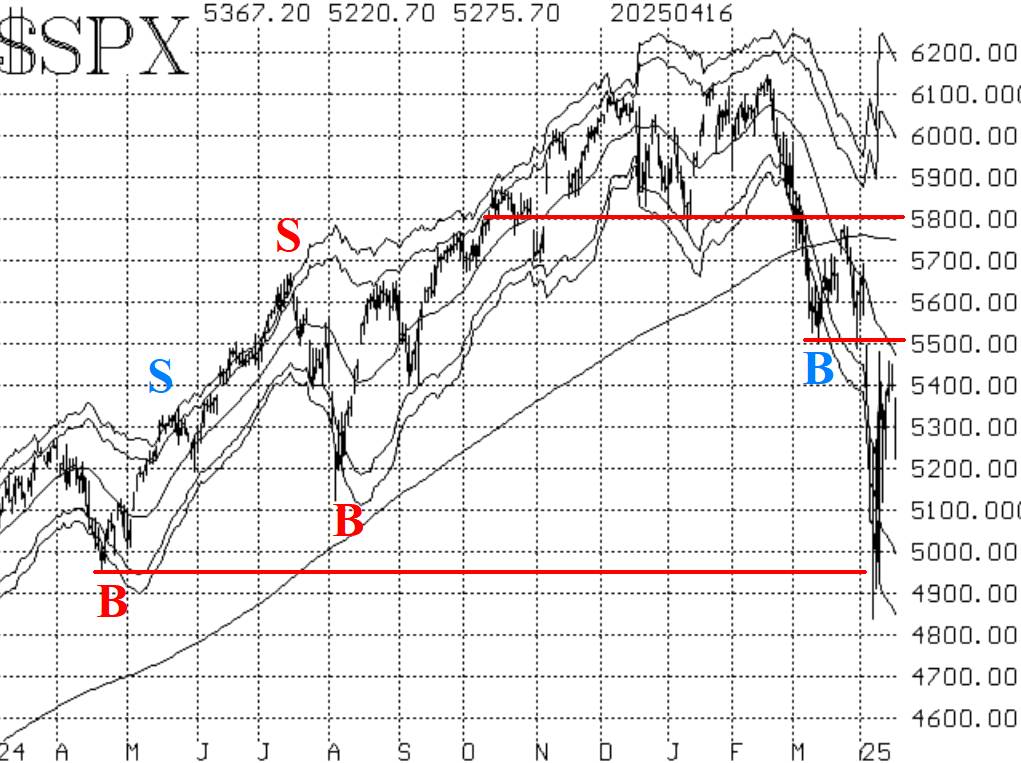

Stocks are trying to rally but so far, rallies have merely been of the oversold variety short-term affairs which only carry back to about the declining 20-day moving average. That was the case in late March when a rally stalled out just below 5800, and that is the case currently. After bottoming in the 4850-4950 area last week, $SPX rallied strongly one day and has been trying to find its direction ever since. There have been several days this month where the daily high has been in the 5450-5500 area. The declining moving average is in that range as well. That represents resistance, and $SPX has not been able to overcome it. So, the $SPX chart remains negative in that lower highs and lower lows are in evidence, while rallies have been limited.

If $SPX were to rise above 5800, that would be a bullish game-changer, but it would have to overcome the now-declining 200-day moving average in order to do that.

Equity-only put-call ratios remain split. The standard ratio continues to rise and thus remains bearish for stocks. Meanwhile, the weighted put-call ratio peaked last week, and that peak is still in place despite the ratio climbing higher this week. That is technically a buy signal, but we won't rate this overall indicator as bullish until both ratios have peaked and are moving lower.

Breadth was strong enough on Thursday so push the "stocks only" breadth oscillator to the brink of a buy signal. If breadth is positive again on Monday, that will be a 2-day confirmation for this oscillators's buy signal.

$VIX has remained relatively high (near 30) but is well off its most recent highs at 60. The "spike peak" buy signal remains in effect but so does the trend of $VIX sell signal. The buy signal will "expire' after 22 trading days and would be stopped out if $VIX were to rise back above 60.13 (the most recent peak). Positions in line with the trend of $VIX sell signal which was generated in late February were rolled down to lower strikes when the market was falling.

In summary, we are retaining a "core" bearish position, because of the negativity of the $SPX chart. We will trade confirmed signals around that position. Most importantly, continue to roll deeply in-the-money options to take partial profits and generate credits along the way.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation