By Lawrence G. McMillan

Over the years, I’ve written extensively about the $VIX/SPY hedged strategy, a position that allows traders to take advantage of the inverse relationship between volatility and the stock market. The strategy is designed to profit from large market moves in either direction, but its real power emerges when an “edge” appears—such as when $VIX futures trade at a sizable premium or discount to the $VIX index.

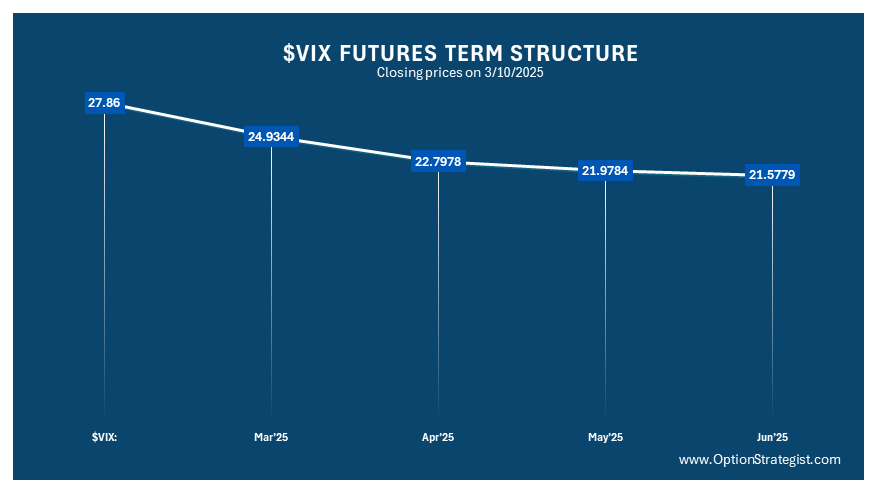

Right now, we are seeing precisely that kind of opportunity. The March VIX futures are trading at a substantial discount to the cash $VIX, creating a setup where the hedged strategy becomes particularly attractive. When this kind of mispricing occurs, a trader can buy calls on both SPY and $VIX, allowing them to benefit not only from a large directional move in the market but also from the natural narrowing of the discount in $VIX futures over time.

This approach has been a cornerstone of our volatility trading strategies for years, and as I discussed in my original article, Another View of the $VIX/SPY Hedged Strategy, the key to maximizing its potential is recognizing when these discounts or premiums arise.

With market volatility still elevated, now is an excellent time to revisit this strategy. The current pricing setup presents a strong case for employing it once again, as the edge created by the discount in $VIX futures provides a built-in advantage from the start.

Read the full article here to dive deeper into the mechanics and past performance of this strategy.

Subscribe to The Option Strategist Newsletter to follow this trade with us.

© 2023 The Option Strategist | McMillan Analysis Corporation