By Lawrence G. McMillan

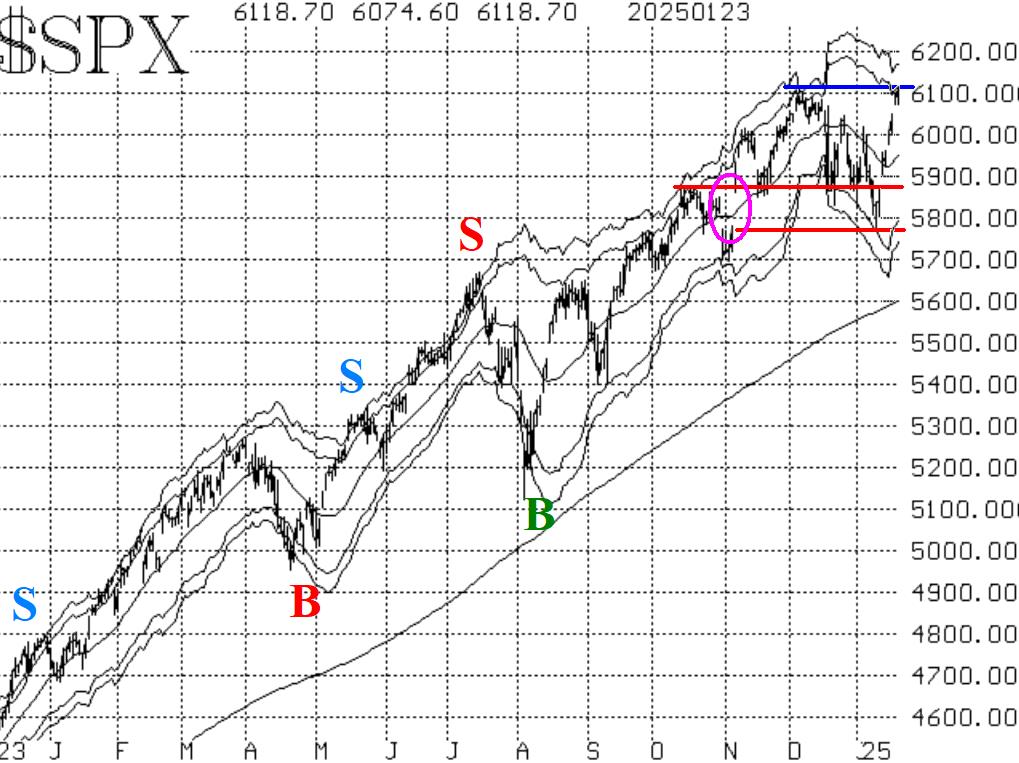

The inauguration of President Trump seemed to spur the market this week, after a strong rally the previous week. $SPX has now advanced well over 300 points since its upward reversal on Monday, January 13th. In doing so, it has left three gaps on its chart. Short- term gaps like that are often closed fairly quickly, but the momentum is strong now. Another close above 6100 today would be a two-day confirmation of the new upside breakout.

Since the advance has been so swift, there really is no traditional support along the way, but there is support in the 5760- 5870 area, marked as the two red horizontal lines on the $SPX chart in Figure 1. If the upside breakout can continue, then the old highs at 6100 would be a support area as well.

When this current rally was getting underway, equity-only put- call ratios kept rising. It seemed that buyers of stock were also buying some protective puts. In the last couple of days, however, when $SPX pushed up to and above 6100, the put-call ratios have fallen back. The computer analysis programs are still saying that these ratios are on sell signals, though.

Breadth has been very strong during this rally, and both breadth oscillators remain on buy signals. They are also in overbought territory, but that is a good thing when $SPX is breaking out to new all-time highs.

Implied volatility ($VIX) has pulled back sharply. The "spike peak" buy signal from December 19th is expiring today, and the trend of $VIX sell signal was stopped out earlier this week.

One of the stronger bullish seasonal patterns takes place at the end of January. And that is set to begin this coming week.

In summary, with $SPX breaking out to new all-time highs, a "core" bullish position would be warranted once again. Meanwhile, most of the other indicators are bullish, but a couple remain somewhat doubtful In any event, continue to roll options that have become deeply in-the-money.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation