By Lawrence G. McMillan

We have had some requests for more information on these types of ETFs, so here is the first attempt to answering those requests. In the last couple of years, several new ETFs have come to market that essentially write calls against a popular, volatile stock. The ETFs are not all constructed the same way, although there is a basic format to begin with. Sometimes, variations are made if the performance of the underlying stock is exceptional.

Many of these are issued by the company Yield Max ETFs. Their website has a plethora of information, including prospectuses (prospecti?), dividend history, holdings, etc. Their URL is:

https://www.yieldmaxetfs.com

There is a button on the main page of their website that says “Full ETF list.” You can click on that and get the information on the one you want. I have not done an exhaustive search of everything in that list, for – as you will see – it is quite long, with more that 40 such ETFs.

For the purposes of this article, we’re going to discuss the ETF that is a covered write on the stock Microstrategy (MSTR) – which is a volatile stock that basically just buys Bitcoin. The covered writing ETF is MSTY, and we have traded it several times in this newsletter. As I work my way through further research, if there is anything to report, I’ll put it in this newsletter.

Yieldmax is the creator of the ETF. The advisor and sub-advisor, who are doing the trades, are other companies. In the article below, when we say “they” it generally refers to the advisor.

Strategy

Initially, the strategy here was to sell slightly out-of-the-money options on MSTR, with expiration dates of a month or less. These are generally the options with the highest implied volatility on a volatile stock, so this part makes sense.

In addition, they do not buy the stock. Instead they use synthetic stock:

Synthetic stock: long call + short put at the same strike with the same expiration date.

The margin required for synthetic stock varies with the price of the underlying stock, but it is almost always less than the price of the stock itself. So, T-Bills are bought and they act as collateral for setting up the synthetic stock. Interest is earned on the T-Bills. The use of synthetic stocks means that the ETF does not earn any dividends from the underlying stock. That is a moot point, in terms of MSTR, because it doesn’t pay a dividend. But in some of the other 40 stocks in that list of ETFS, they might.

I’m not even 100% certain that the use of synthetic stock accomplishes much, because the prices of the options used to create the synthetic stock, plus any dividends, should be reflected as being about equal to what you could earn from the T-Bills, but let’s move on.

Dividend

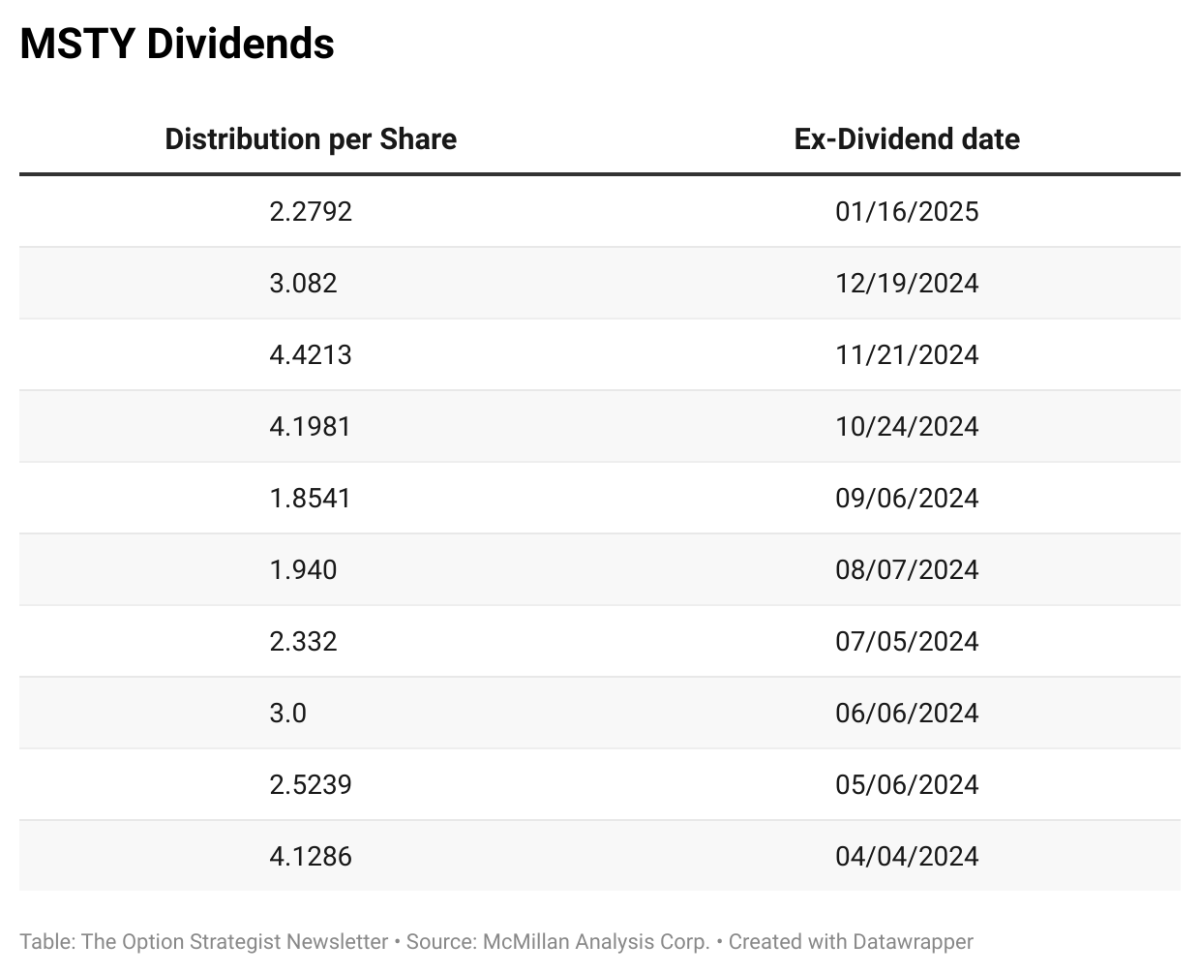

There is no formula for this payout that I could find, so it is up to the discretion of the fund managers, more or less. It appears, though, that they are paying out nearly the entire profit every month. This has resulted in a phenomenal string of high dividend payouts, reflecting not only the hefty call option premiums that are being sold, but the gain in the price of the (synthetic) stock as the underlying MSTR moves higher in price, plus one more nuance that we’ll get to in a minute. The table above shows the monthly dividend payouts for MSTY, which first began trading in February 2024, and the first dividend payout was on April 4th, 2024...

Read the full article by subscribing to The Option Strategist Newsletter now. Existing subscribers can access the article here.

© 2023 The Option Strategist | McMillan Analysis Corporation