By Lawrence G. McMillan

A monster oversold rally -- or perhaps something more -- has arisen in the wake of a rather benign CPI report. There is now renewed hope for several rate cuts this year (several being two, according to the predictions of the Fed futures markets). The reversal began as an oversold rally last Monday, January 13th after $SPX had broken down below support and traded down to 5730. From there, the market gapped up 90 points on Wednesday and just kept going.

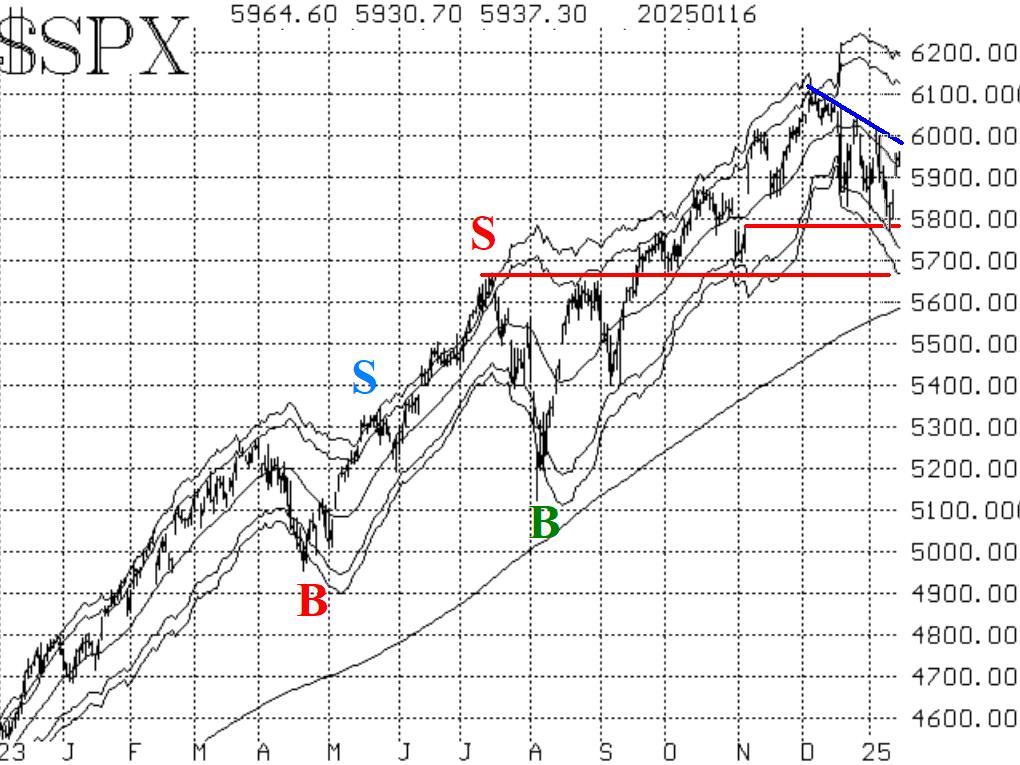

From the $SPX chart in Figure 1, one can see that there is a small downtrend in place on the $SPX chart (blue line). This rally has now exceeded the declining 20-day Moving Average and is challenging that downtrend line today. Even so, there is a lot of resistance between current levels and resistance at 6010. Finally, the heaviest resistance will be at the all-time highs of 6100. A breakout over that level would be a renewed bullish scenario.

Market internals had begun to deteriorate in mid-December and continued to do so through January 10th or so. However, there has been a large improvement in some of them this week, as you will see when we discuss them below.

However, equity-only put-call ratios are not one of the areas of improvement. They continue to remain on sell signals, as they are rising and rising even more quickly now.

Breadth has been an area of great improvement, though. T rue buy signals have been generated by both breadth oscillators. This is our shortest-term indicator and is thus subject to whipsaws, but this is now a confirmed buy signal.

Implied volatility, however, is painting a somewhat bullish picture. $VIX has declined again, thus generating the third "spike peak" buy signal since December 19th.

In summary, if this is an oversold rally (which it may well be), it is stronger than the typical oversold rally. If $SPX breaks the recent downtrend and moves back above 6010, that would be bullish, but it would take a close at new highs above 6100 in order to confirm a truly bullish outlook.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation