By Lawrence G. McMillan

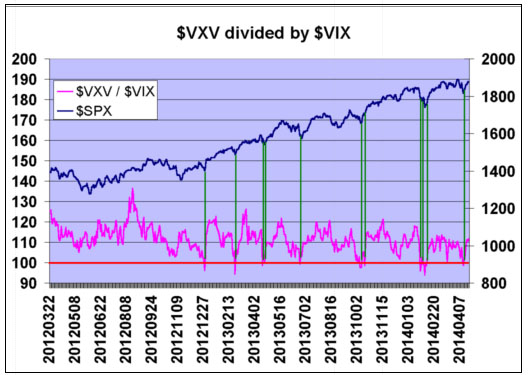

Recently, it came to light that some traders follow the 90-day $VIX (Symbol: $VXV) because when the “regular” $VIX exceeds the 90-day $VIX, worthy market signals are generated. Recently (Volume 23, No. 4), we discussed what happens when the Short-Term Volatility Index ($VXST) crosses above $VIX. There are some similarities in these two cases. In fact, one might be able to make some generalized statements about when a shorter-term volatility measure crosses above a longer-term volatility measure. Are these crossovers more significant when they occur in multitude instead of individually? Are the signals different in bull markets as opposed to bear markets? These are some of the items that are discussed in the following article...

Read the full article (published on 4/25/14) by subscribing to The Option Strategist Newsletter today. Introductory 3 month trial subscriptions are available for only $29.

© 2023 The Option Strategist | McMillan Analysis Corporation