By Lawrence G. McMillan

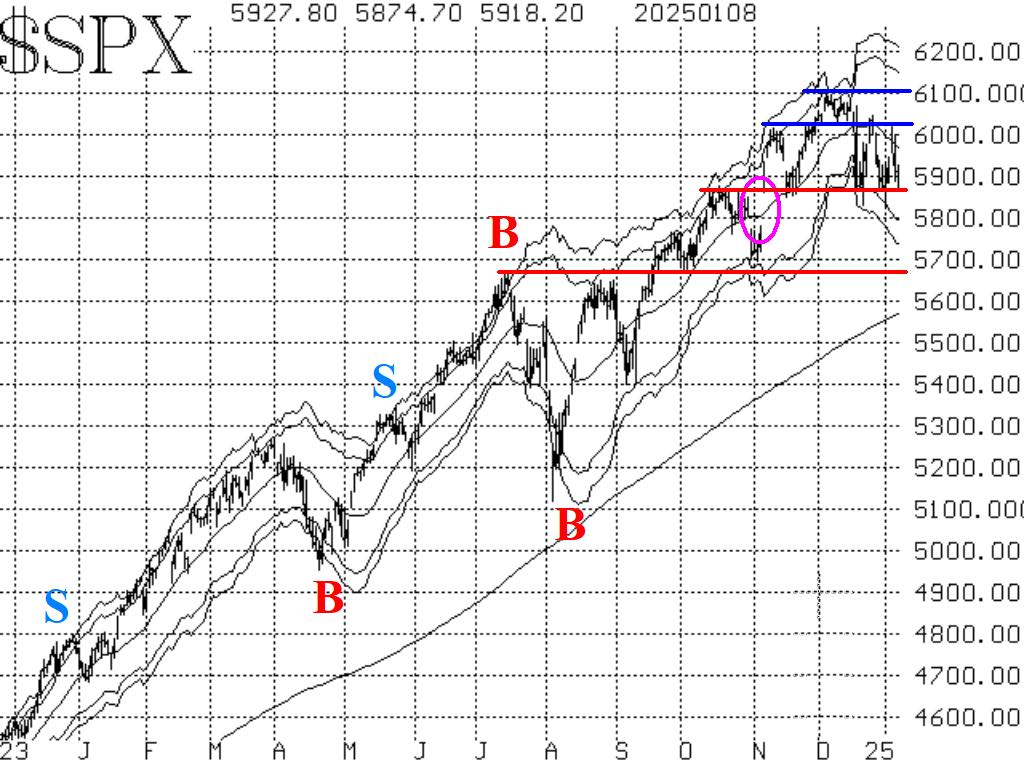

The stock market saw some seasonally unusual selling at the end of 2024, and now there has been some continuation in 2025. That's not to say there haven't been some strong rally days as well, but it does leave $SPX locked in the 5870-6100 trading range. A clear breakout of that range on a closing price basis should provide momentum for a further trade in the direction of that breakout.

Twice, $SPX has fallen below 5870, only to bounce off the 5830 level intraday and close back above that crucial number. $SPX is sitting just above 5870 as of Wednesday's close (January 8th). A two-day close below there would usher in a period of bearishness.

There is further support below 5870 at 5670 and 5780 but the chart would no longer be bullish if the Index fell that far.

Equity-only put-call ratios continue to rise, with the weighted (Figure 3) advancing more swiftly than the standard (Figure 2). As long as these ratios are rising, it is bearish for stocks.

Breadth has generally been poor since the election. It made an attempt to improve about a week ago, and in fact, the breadth oscillators rolled over to buy signals. But this is our shortest-term indicator and thus the most subject to whipsaws. In the last two days breadth has been poor again, and those new buy signals are in jeopardy.

$VIX has even tried to jump a little bit higher, but it's not up by much. The previous "spike peak" buy signal remains in place for now. But $VIX is trending higher, so a trend of $VIX SELL signal is now in place, too.

In summary we are maintaining a "core" bullish (out-of-the-money) position as long as $SPX closes above 5870. We will trade other confirmed signals around that, and we urge the taking of partial profits by rolling deeply in-the-money options.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation