By Lawrence G. McMillan

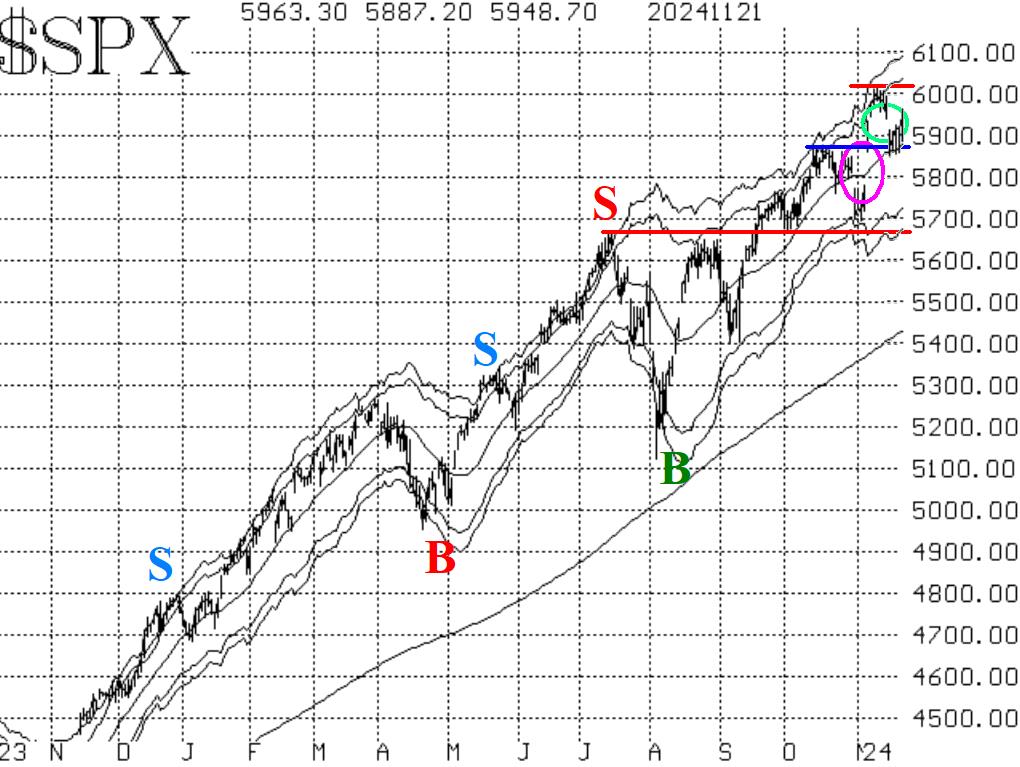

$SPX, stalled out at about 6020, and has seen a modest amount of selling since November 8th. But the damage has been limited, and there is now a more positive development taking place: the gap down and sharp selloff on November 15th left a bearish island reversal in place on the $SPX chart. That gap has now been closed, thereby erasing the negative effects of that chart formation (green circle on the chart in Figure 1).

The resistance near 6020 must be overcome in order for the $SPX chart to resume a full-blown bullish outlook, but the fact that the recent selling was not able to generate a close below 5870 is a bullish testament to that level as a strong support area. We are maintaining a "core" bullish position as long as $SPX remains above 5870.

Equity-only put-call ratios are crawling sideways near the bottom of their charts. Thus, they are indicating that stocks are in an overbought state but these ratios are not generating a tradeable signal at this time. Green horizontal lines on both charts indicate the range that they have been in for nearly a month now. If they were to rise above the November highs, that would be bearish for stocks, but if they were to fall below the October lows, that would be bullish. Meanwhile, they really aren't telling us much of anything at this time as far as stock market direction is concerned.

Breadth has improved greatly over the past four trading days, and the "stocks only" breadth oscillator has generated a buy signal after having previously fallen into oversold territory. The NYSE- based oscillator never quite made it down to oversold territory, so it is still on a sell signal at this time. That may end soon, though, since breadth is strong again today. In essence, breadth has returned to a positive state.

$VIX has shown a little more worry over the past week, as it has edged up from 14 to 18. However, it has not re-entered "spiking" mode (a rise of 3.00 or more points over any 3-day or shorter time frame, using closing prices). Thus the previous "spike peak" buy signal is still in place.

A positive seasonality is about to set in after Thanksgiving. December is normally a positive time for stocks (although 2018 was a nasty exception).

In summary, we are maintaining a "core" bullish position as long as $SPX continues to close above 5870. We will be trading any new confirmed signals as they occur. In addition, we continue to take partial profits on options that become deeply in-the-money generally by rolling them.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation