By Lawrence G. McMillan

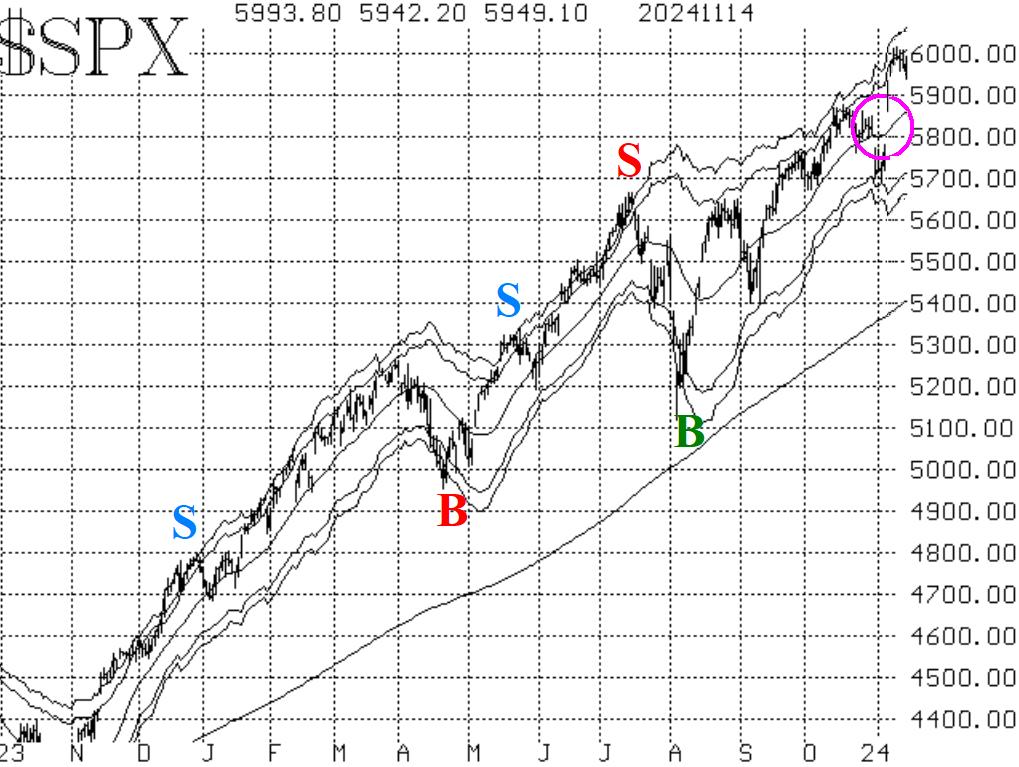

Stocks have struggled a little this week, after roaring higher post- election. On the $SPX chart, there is resistance in the 6010- 6020 area, where prices peaked on four separate days in the past week. That is minor resistance. The upside target for this move still remains as the +4å "modified Bollinger Band" (Mbb), which is now nearing 6070 and still rising.

There is support at 5870, the previous highs, and as long as that holds, the bulls will remain in charge. A two-day close below 5870 would cause us to abandon our "core" bullish position, but the market could still recover from that fairly easily. However a close below 5670 would be a major problem, for it would not only negate the positive "island reversal" pattern on the $SPX chart (circled in Figure 1) but would be a decline below several important support areas.

Equity-only put-call ratios are moving sideways near the lower regions of their charts. This is not giving us much of a directional signal at all. A move to new lows would be bullish for stocks, while a move back above the November highs on these put-call ratio charts would be bearish for stocks. In between is telling us nothing.

Breadth was positive, but not particularly strong, after the election. But now, in the past three days, breadth has been terrible, and the breadth oscillators have rolled back over to sell signals. Those signals have been confirmed with a two-day close. The last such sell signal was briefly correct, but then was quickly whipsawed as the market rose with strong breadth. Even so, one should probably take at least a small position based on this sell signal.

$VIX has declined to roughly the 15 area and seems to be settling in there. The "spike peak" buy signal is still in place. It would be stopped out if $VIX were to return to "spiking" mode.

We continue to maintain a "core" bullish position as long as $SPX closes above 5870. We will add new positions around that when signals are confirmed. Moreover, we continue to roll options that are deeply in-the-money.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation