By Lawrence G. McMillan

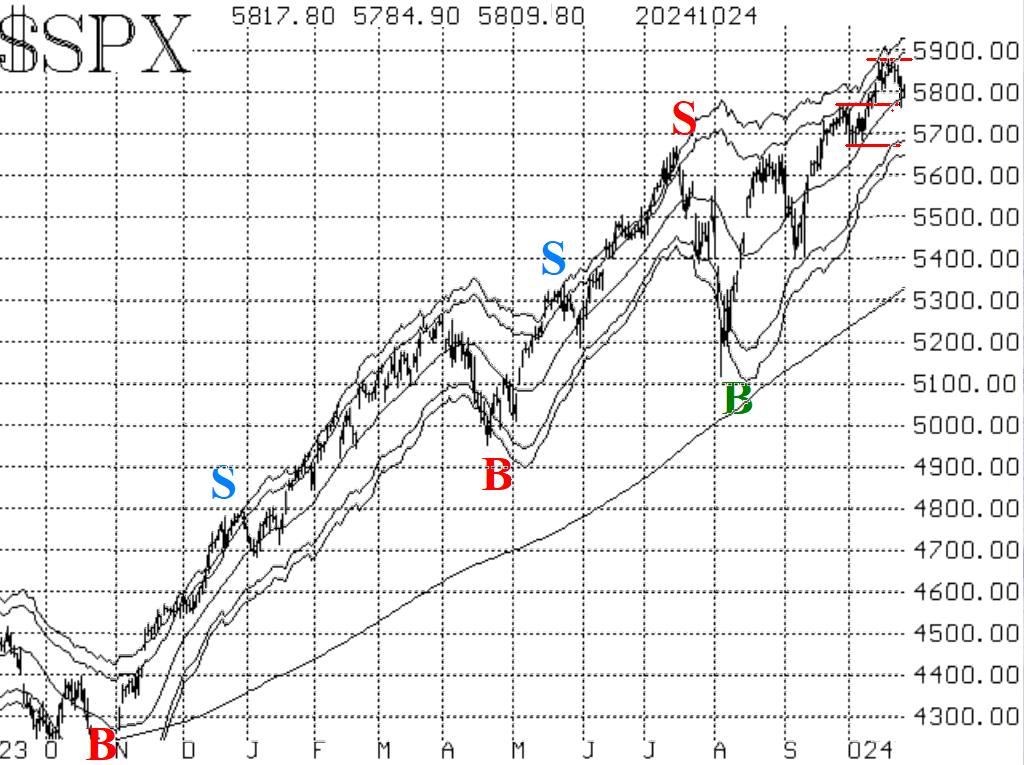

The market has stalled out. For several days (and today is included as well), it has tried to forge through 5860 but has been unable to do so. There was a minor pullback this week, to 5760, but so far it has not been much of a problem except for the deterioration it caused in some of the market internals (more about that later). The support zone of 5670-5770 remains intact, and this week's pullback penetrated just the top of that zone, and then the market bounced higher.

So, none of this is a game-changer, and we thus continue to maintain a "core" bullish position. A close below 5670 would change that.

Equity-only put-call ratios are now rolling over to sell signals. The negative action this week finally caused an increase in put buying. Both ratios (Figures 2 and 3) have curled upward, and the computer analysis programs are saying that sell signals are in place.

Breadth has deteriorated badly. As a result, both breadth oscillators are now on sell signals. We require a two-day confirmation of any breadth signals, and that confirmation was attained at the close of trading on October 22nd.

$VIX continues to display a mixed picture. On the one hand, there is a "spike peak" buy signal in place. That will remain in place unless $VIX closes above 23.14. On the other hand, there is a trend of $VIX sell signal in place. That would be terminated if $VIX were to close below its rising 200-day moving average, which is currently just about 15.50. So, currently $VIX is near 19 relatively centered between those two significant points.

In summary, we are maintaining a "core" bullish position as long as $SPX continues to close above 5670. That "core" position would be terminated on a two-day close below 5670. Regardless, we will take new positions as signals are confirmed. Continue to roll deeply in-the-money positions to take partial profits and reduce risk.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation