By Lawrence G. McMillan

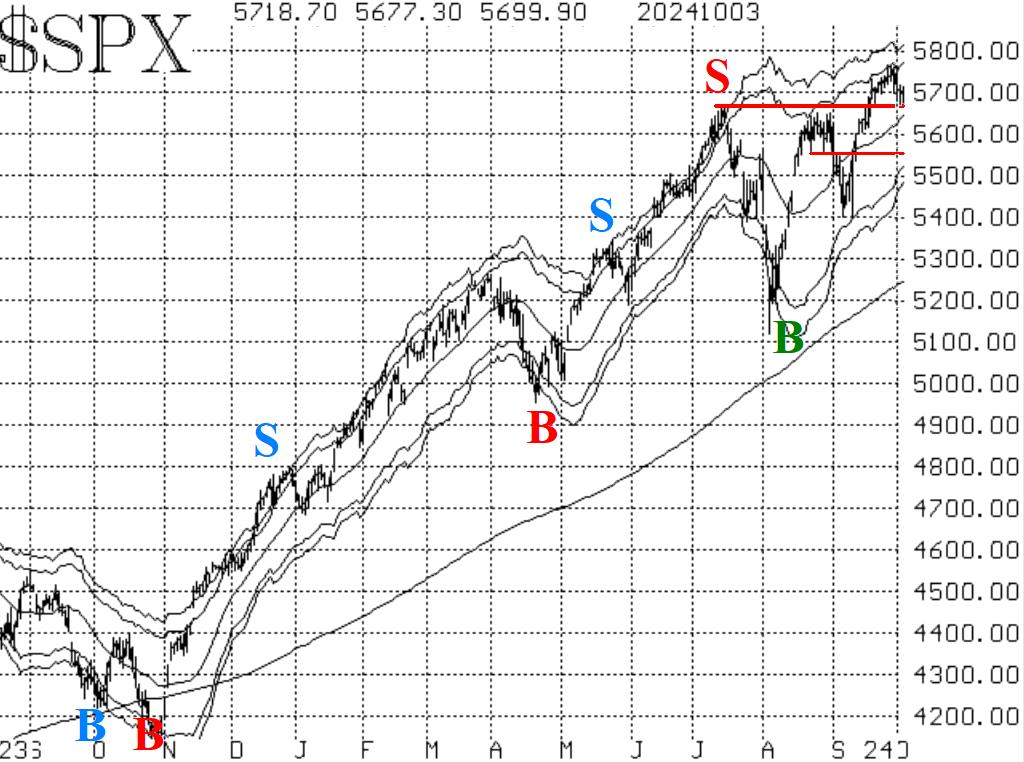

The bull market was plodding along quite nicely, making new all- time highs almost every day through the end of September. But then some bellicose actions in the Middle East caused the market to pull back. So far, the retreat has been mild, holding above support at 5670. The daily lows on each of the last three trading days have been just above that level. I suppose one could make a case for support all throughout the 5560-5670 zone, but it seems to me that a close below 5670 for two days would be a negative factor that would have to be dealt with. So, it is imperative that $SPX continue to close above 5670. If not, we would relinquish our "core" bullish stance.

Equity-only put-call ratios have returned to a solidly bullish position. They toyed with the idea of turning upward, but that did not persist. Now, they are making new relative lows. As long as they are declining, that is bullish for stocks.

Breadth has deteriorated quite a bit in the last week. The "stocks only" breadth oscillator has now generated a new sell signal, and that has been confirmed with a two-day close. The NYSE breadth oscillator also has rolled over to a sell signal, but it needs to hold that level again today in order for a sell signal to be confirmed.

Cumulative Volume Breadth (CVB) made new all-time highs along with $SPX, through September 30th, so there is not a negative divergence in place at this time.

$VIX has -- for the time being -- relieved itself of the dual signals that were in place. The trend of $VIX sell signal is still intact, since $VIX has not been able to close below its 200-day Moving Average. In fact, with the developments in Middle East, $VIX has risen above 20 this week, and is well above that 200-day MA, which is just below 15 and rising slowly.

Meanwhile, the previous $VIX "spike peak" buy signal was stopped out when $VIX returned to "spiking" mode at the close of trading on October 1st. A new "spike peak" buy signal will occur when $VIX closes at least 3.00 points below the high price that it reaches while in this current "spiking" mode.

In summary, we are maintaining a "core" bullish position for now. It would be stopped out if $SPX were to close below 5670 for two consecutive days. Meanwhile, we will trade any new confirmed signals, and we will continue to take partial profits by rolling deeply in-the-money options.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation