By Lawrence G. McMillan

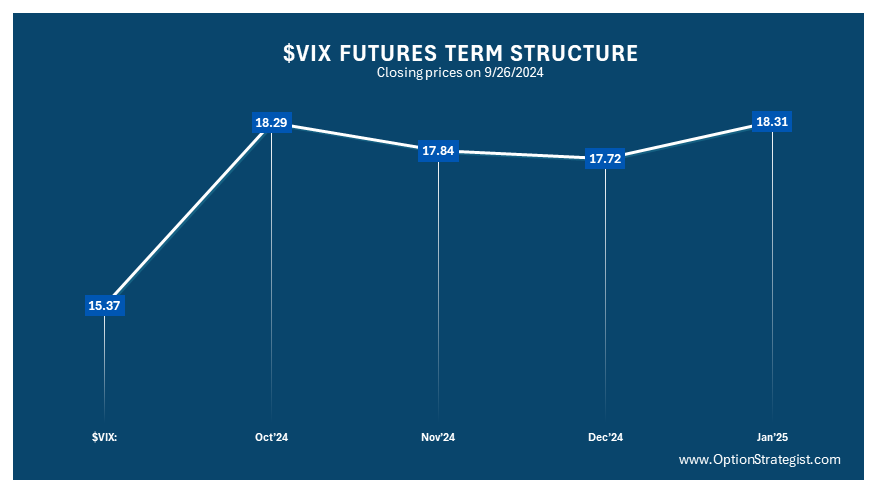

The “election bump” is the term that I have given to the distortion in the term structure of the $VIX futures prices. Specifically the October $VIX futures continue to trade above the prices of the Nov and Dec futures. The following article adds some insight to this condition.

The reason that October $VIX futures are so elevated is that they are based on the prices of the $SPX options that expire on November 15th, 2024 – just after the election. As with any event that is perceived to be a generator of volatile price action – earnings, legal verdicts, and FDA PDUFA hearings are examples of others – the options that expire just after the event will be high-priced in terms of implied volatility, and the other option series that follow out in time after that will also be trading with a somewhat elevated volatility, but not as large as the near-term one.

Personally, I don’t see why the election would necessarily cause a volatile stock market move (it normally does not), but that is the perception that is in the marketplace at this time, and my opinion does not and should not matter.

The “election bump” won’t affect the price of $VIX itself until the election is 30 days or less in the future. At that point, the $VIX calculation will begin...

Read the full article by subscribing to The Option Strategist Newsletter now. Existing subscribers can access the article here.

© 2023 The Option Strategist | McMillan Analysis Corporation