By Lawrence G. McMillan

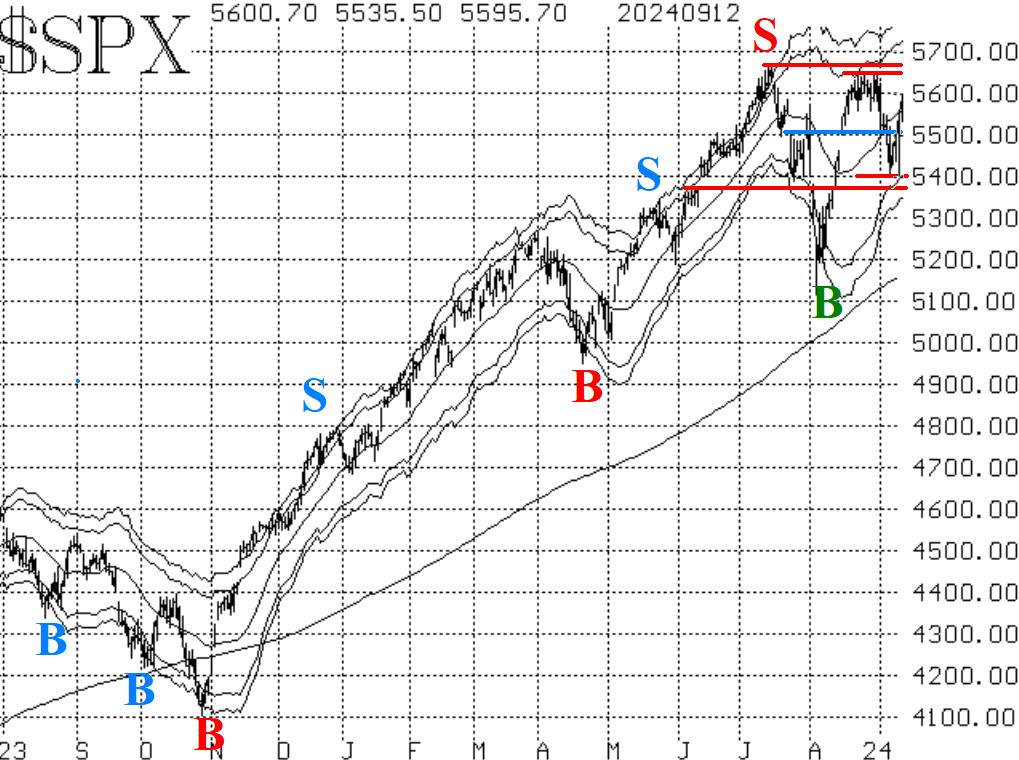

A week ago, things looked rather bearish, with $SPX having broken down from a 5560-5650 trading range, and plummeting quickly to 5400. An oversold rally ensued, but by Wednesday of this week, $SPX was plunging again and reached that 5400 level for a second time. For whatever reason, buyers emerged en masse at that point, and $SPX has rallied 230 points in about two trading days.

This brings the Index right back into that 5560-5650 trading range where it spent over two weeks in the latter half of August. So, there is resistance at the top of that range, 5650, and at the all- time highs, 5670. Meanwhile, there is very solid support at 5400, since the market bounced off of there twice. There is also support at 5370, which I continue to believe is quite crucial: a close below 5370 would be very negative for the market. In the final analysis, it appears that $SPX is still within a rather wide trading range, from 5400 to 5650.

Our indicators are mixed, which is somewhat typical with $SPX in a trading range. Even with the strong move upward over the past four days, some sell signals are still clinging to life.

Equity-only put-call ratios remain on buy signals, because they are continuing to decline. They declined right through the recent selling in stocks, mainly for two reasons: 1) there are relatively large numbers coming off the 21-day moving averages, and 2) put buying has just not been all that heavy during the recent market decline.

Breadth has gone from extremely negative to extremely positive in a very short period of time which has not only canceled out the sell signals, but has produced buy signals.

The two main $VIX indicators continue to be in opposition to each other. A new $VIX "spike peak" buy signal was issued on September 5th. Conversely, the trend of $VIX is still upwards and that is a sell signal for stocks. I suppose it is rather fitting that both $VIX signals are in place while $SPX is within a large trading range.

In summary, the indicators are mixed and the market is in a wide trading range. It looks great for a few days, and then looks terrible for a few days. We will continue to trade confirmed signals and will roll options that are deeply in-the-money.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation