By Lawrence G. McMillan

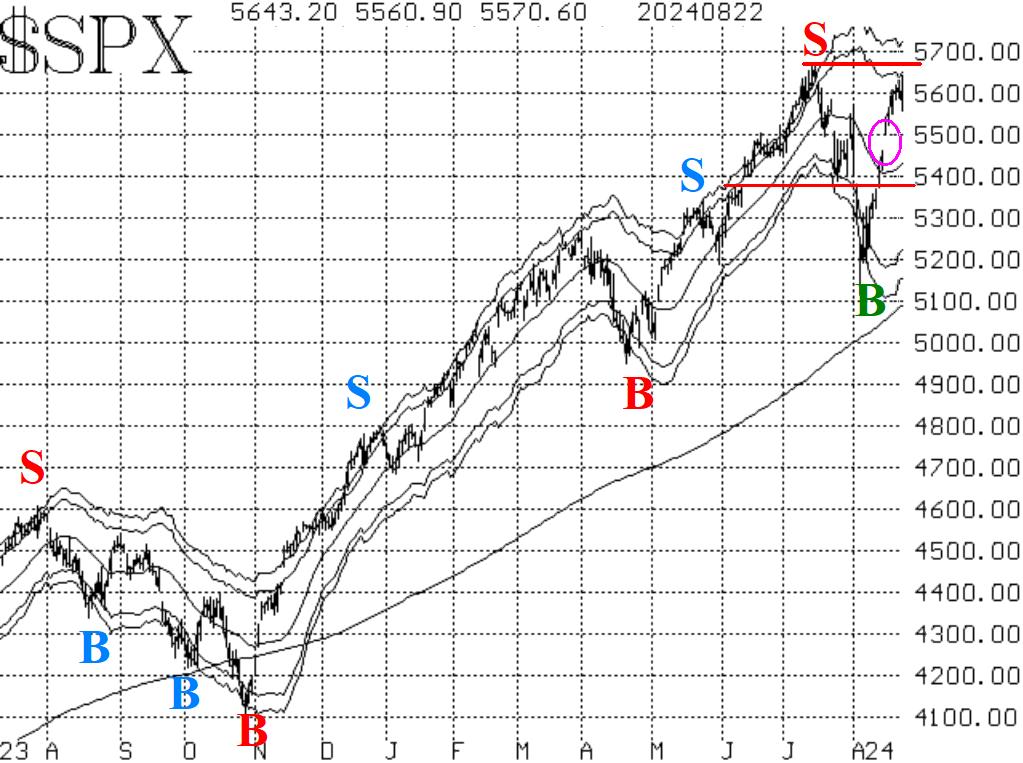

The rally that began with an upward intraday reversal on August 5th continues to plow ahead. It has now brought $SPX back to nearly its all-time highs. The pattern of lower highs has been broken, and all that remains for the bulls to re- establish complete control is for $SPX to trade above 5670. That is probably going to happen.

As for resistance, that only exists at the old highs near 5670. Given the speed of the advance, there has to be some leeway for a correction without calling for outright bearishness. There is a gap down to 5450. If that were filled, it would be in the normal course of activity. However, a decline below 5370 would be far more negative. So, any pullback that is limited to 5370 or higher is still within the realm of a new bullish leg in the market, but anything more raises the prospect of a deeper correction.

Equity-only put-call ratios have rolled over, but only now are the computer analysis programs finally agreeing that these could be back on buy signals. The standard ratio (Figure 2) buy signal has been confirmed. The weighted ratio (Figure 3) has not, but to the naked eye how could this NOT be a peak?

Breadth has been strong (see the Table on Page 1), although there have been a couple of pretty negative days this week. Regardless, the breadth oscillators remain on buy signals, and they remain in overbought territory. It is a positive thing when the breadth oscillators are overbought and the broad market is beginning a new leg upward as is the case now. From current levels, the breadth oscillators would still be able to withstand a couple of days of negative breadth and remain on those buy signals (as was the case this week).

$VIX continues to give mixed signals. First, the "spike peak" buy signal of August 5th remains in place. It will last for 22 trading days, or until September 5th. So, it still has more time. Conversely, the trend of $VIX sell signal remains in place, because $VIX has not closed below its 200-day Moving Average.

We continue to trade confirmed signals as they appear, and importantly we are rolling options when they become deeply in-the- money. This rolling action takes partial profits, and reduces the risk when a large reversal occurs, as has been the case recently regarding some of our sell signals.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation