By Lawrence G. McMillan

Other bear markets have shown similar behavior: realized volatility increases by a relatively small amount, and $VIX therefore does not accelerate to extreme highs. Often, late in the bear market – near its bottom – is when we see a sharper increase in volatility.

Before getting into the detail, I want to point out something that has occurred in several previous bear market and seems to be occurring in the bear market of 2022-20??: $VIX finds a floor that it doesn’t drop below, even though HV20 might be much lower. While there are many factors influencing the price of $VIX, one of the larger ones is the price of $SPX puts. $SPX options are mainly the bailiwick of “big money,” because they are so expensive. “Big money” is not necessarily “smart money,” but it often is. When these “big money” traders put a floor on $VIX (i.e., when they are willing to buy $SPX puts at a healthy premium), then they are worried about the market going forward. More often that not, their fears seem to play out as $SPX eventually falls and $VIX rises – not explodes, but rises.

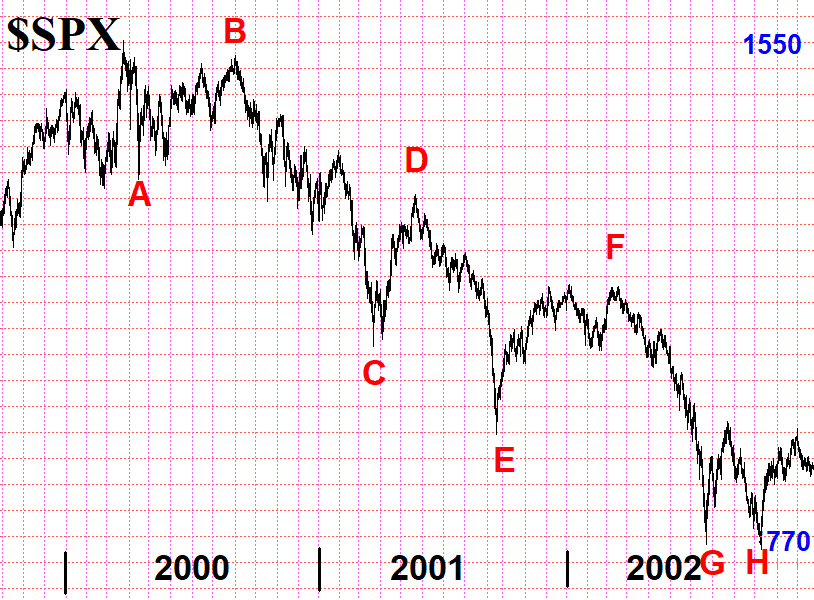

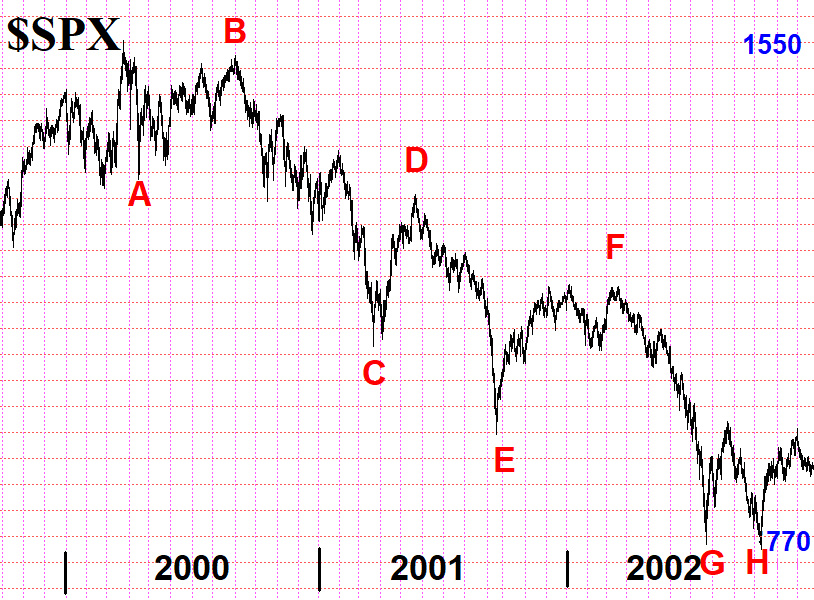

The Multi-legged Bear market of 2000-2002

The chart of the 2000–2002 bear market is in Figure 6. The huge tech-based rally in the “dot com” stocks probably peaked in 1998, but the major averages continued higher into March 2000. Shortly thereafter, the “Tech Stock Massacre” of April 14, 2000, occurred – when the market dropped almost 6% (point A on chart). Supposedly George Soros was selling out a major portion of his tech stocks, and the selling snowballed as others got word of that. There was a reflex rally back towards the highs in the summer of 2000, but internallythings were deteriorating, and a serious decline began in September 2000.

The ensuing bear market had three stages. In stage 1, $SPX declined from 1550 to 1100 (–29%) into February of 2001 (point B through Point C). A strong reflex rally carried into May 2001...

Read the full article, published on 4/14/2023, by subscribing to The Option Strategist Newsletter now. Existing subscribers can access the article here.

© 2023 The Option Strategist | McMillan Analysis Corporation